Crypto & Economic Calendar

The events below inform governments, corporations, traders and investors on the health of the economy. I only list events noted as “high volatility expected” in related markets.

- Monday

- 1950 ET: [JPY] Gross Domestic Product (GDP)

- Tuesday

- All Day: Holidays in Italy, India, South Korea

- Wednesday

- 0200 ET: [GBP] Consumer Price Index (CPI)

- 1400 ET: [USD] Federal Open Market Committee (FOMC) Meeting Minutes

- Thursday

- 0830 ET: [USD] Initial Jobless Claims

- Friday

- 0500 ET: [EUR] Consumer Price Index (CPI)

Bitcoin Indecision Continues

Summary: Bitcoin continues sideways, in a 5% range between $28k and $30k. In a positive sign, price moved up marginally from the first half of August, re-entering the value range over $29.2k (green box), after a clean bounce from the 20w SMA “bull market support.”

[So far] this is repeating a pattern observed several times since December 2022- bullish retracements to between the 38% and 50% fib levels, before rallying.

Since April 2023, price rejected from $30,600 to $30,700 twice. This is potentially the bull’s third attempt. Another rejection could get messy and lead to more pronounced downside. More information below-

Bitcoin Levels: $30k marked the most important support level in 2021’s bull market, and is the most important resistance to overcome in 2023.

- Immediate resistance: between $30,200 to $30,300

- Immediate support: $29,300

- Current value range: $29,300 to $30,700

- Support levels:

- $29,044

- $28,700 (20w SMA)

- $28,100 (50 fib level and 21w EMA)

- $26,300

- $25,500

- Resistance levels:

- $30,000 (psychological)

- $30,100

- $30,600

- $31,300-$32,000

- $34,000-$36,500

- $37,500

- $40,000

Bull Perspective: BlackRock’s ETF request and Ripple’s XRP victory against the SEC were the catalyst for increased bullish sentiment, but additional clarity is needed before a definitive trend emerges. While macroeconomic factors are improving, a bad month or confirmation of a recession will stifle upward momentum.

With such low volume and volatility on Bitcoin, it appears poised for a breakout – a case could be made for upside continuation after the successful retest of the bull market support band and 38 fib level.

Bear Perspective: Despite some clarity from Ripple’s win, there is no clear playbook for crypto in the U.S. The much touted ETF requests are not guaranteed and if they are rejected, may drive a selloff in crypto markets. Additionally, big players like BlackRock isn’t all good news – many have a reputation for manipulating markets.

Looking at price action, the diagonal support extending from mid 2022 appears to be the trend mean, with price oscillating around it since after the Luna meltdown. As of yet, price is unable to escape this value range, and key resistance around $30,700. If price rejects from that level for a third time in four months, we might see a more pronounced selloff going into Q4, leading to retests of mid or even lower $20k range.

US Dollar Index (DXY)

Little is changed from last week. Since last year we’ve been waiting for the US Dollar Index (DXY) to lose support between 101 and 102 on the monthly. Historically that led to prolonged (multi-year) downtrends at least 5 times.

Intramonth, the DXY touched it’s lowest level since April 2022. If you observe the red horizontal level at 101.6, at least 5 times in the past 50 years, losing that led to several years of the US Dollar trending down. While July saw the DXY barely recover to close just over 102, the trend and sentiment favors more downside over the next quarter.

Why do we care about the DXY?

The Dollar Index is a complex financial data point, a lot of external factors impact its value. But in the simplest terms, you can look at the relationship between DXY and risk assets like Bitcoin simply – they usually move inverse to each other. When DXY is up, BTC is down; and the opposite is true.

DXY’s bearish sentiment, coupled with a hawkish outlook for the Euro (a key economic competitor), Bitcoin’s rising sentiment on the back of ETF news and Ripples win, and next year’s Bitcoin halving – things are shaping up for a potentially bullish 2024/2025.

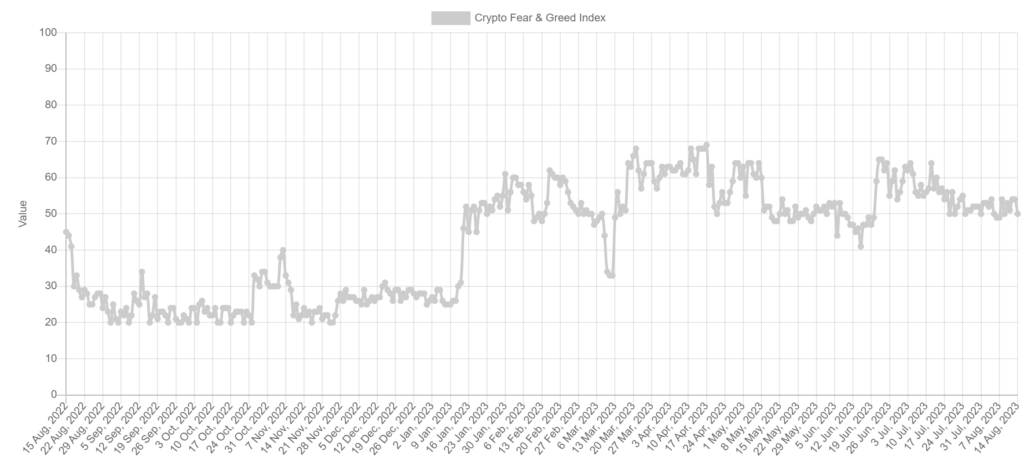

Market Sentiment

Little is changed from last week. Sentiment continues to range around 50, represents indecision in a market awaiting news on BlackRock’s or other ETF requests; and uncertainty in the macroeconmic outlook.

An ETF approval likely leading to a strong increase in greed across Bitcoin and crypto markets. Further boosts to market sentiment will follow if the US Fed declares a pause on rates, peak rates, or if a recession is confirmed avoided.

Trading Tips

Many of you may have heard of “decentralized finance,” or DeFi, but never tried it. Did you know there is an excellent data aggregator that pulls together a ton of information on DeFi protocols across every chain, and its free to use?

I am not affiliated with or paid by them to say this – but DeFi Llama (defillama.com) is one of my favorite resources when deciding which protocols to trust, or to find the best rates.

For example, the term TVL stands for Total Value Locked (total amount of value stored on a protocol). Its a great data point to start with, because it tells you who the larger market trusts the most. The top 3 largest DeFi protocols by TVL are:

- Lido (liquid staking platform)

- MakerDAO (the DAO that has oversight of DAI stablecoin)

- AAVE (a popular lending platform)

Or you can use it to research yields/rates for various tokens and services. For example, I can filter and sort by say BTC or ETH and look for the best rates on lending or liquidity pools. They also provide data on NFTs, and log known hacks, going as far back as 2016.

——————————————————————————-

If you enjoyed this article and want more hot takes and interesting posts about the economy, web3, crypto, decentralized finance, NFTS and more – you can follow Papi on Twitter/X at https://twitter.com/1MrPapi.

Disclaimer: Nothing found on this website, or any sources linked to this website includes financial advice of any sort. We are not certified financial advisors, use our content at your discretion as entertainment, and as an educational resource. Do your own research.