Crypto & Economic Calendar

The events below inform governments, corporations, traders and investors on the health of the economy. I only list events noted as “high volatility expected” in related markets.

- Monday

- Nothing

- Tuesday

- 1000 ET: [USD] Existing Home Sales

- Wednesday

- 0800 ET: [USD] Building Permits

- 0945 ET: [USD] U.S. Services Purchasing Managers Index (PMI)

- 1000 ET: [USD] New Home Sales

- Thursday

- 0830 ET: [USD] Initial Jobless Claims

- Friday

- 0200 ET: [EUR] German Gross Domestic Product (GDP)

- 1005 ET: [USD] Fed Chair Powell Speaks

Bitcoin Consolidation Along $25k

Summary: Last week we prefaced a potential bullish scenario with this: “This is potentially the bull’s third attempt. Another rejection could get messy and lead to more pronounced downside.” As it turns out, bull could not overcome $30k and we dropped to the next major value range, along $25k. If this holds, look for a consolidation before the next rally.

Alternatively, additional downside could lead Bitcoin to around $20k or the pocket between the 50% and 62% fibonnaci retracement, which is still considered a healthy retracement in an uptrend, although less bullish than if it were higher than 50%.

Bitcoin Levels: $30k marked the most important support level in 2021’s bull market, and is the most important resistance to overcome in 2023.

- Immediate resistance: between $26,100 to $26,200

- Immediate support: ~$25,900

- Current value range: $25,600 to $26,100

- Support levels:

- $25,800

- $25,500

- $25,248

- $24,450

- Resistance levels:

- $26,300

- $27,600 (21w EMA)

- $29,044

- $30,600

- $31,300-$32,000

- $34,000-$36,500

- $37,500

- $40,000

Bull Perspective: While macroeconomic factors are improving, a bad month or confirmation of a recession will stifle upward momentum, as we saw recently. Hawkish comments by the Fed, in their FOMC meeting minutes last week, was partially responsible for the breakdown to ~$25,000.

This breakdown is an opportunity for momentum reset, and it liquidated a lot of leveraged traders, who were in long positions at a scale not seen since the bull market. This typically signals more potential upside than downside, but the safest strategy is to continue dollar-cost-averaging into spot, if you are bullish on Bitcoin.

Bear Perspective: Despite some clarity from Ripple’s win, there is no clear playbook for crypto in the U.S. The much touted ETF requests, such as BlackRock’s, are not guaranteed and if they are rejected, may drive a selloff in crypto markets. Additionally, big players entering an emerging market isn’t always good news – many have a reputation for manipulating markets.

Last week we said “If price rejects from that level [$30k range] for a third time in four months, we might see a more pronounced selloff going into Q4, leading to retests of mid or even lower $20k range.” It appears we did precisely that, and now we are looking at consolidation around $25k, or lacking suitable demand, a potential drop as low as $20,000.

US Dollar Index (DXY)

Little is changed from last week. Since last year we’ve been waiting for the US Dollar Index (DXY) to lose support between 101 and 102 on the monthly. Historically that led to prolonged (multi-year) downtrends at least 5 times.

Intramonth, the DXY touched it’s lowest level since April 2022. If you observe the red horizontal level at 101.6, at least 5 times in the past 50 years, losing that led to several years of the US Dollar trending down. While July saw the DXY barely recover to close just over 102, the trend and sentiment favors more downside over the next quarter.

Why do we care about the DXY?

The Dollar Index is a complex financial data point, a lot of external factors impact its value. But in the simplest terms, you can look at the relationship between DXY and risk assets like Bitcoin simply – they usually move inverse to each other. When DXY is up, BTC is down; and the opposite is true.

DXY’s bearish sentiment, coupled with a hawkish outlook for the Euro (a key economic competitor), Bitcoin’s rising sentiment on the back of ETF news and Ripples win, and next year’s Bitcoin halving – things are shaping up for a potentially bullish 2024/2025.

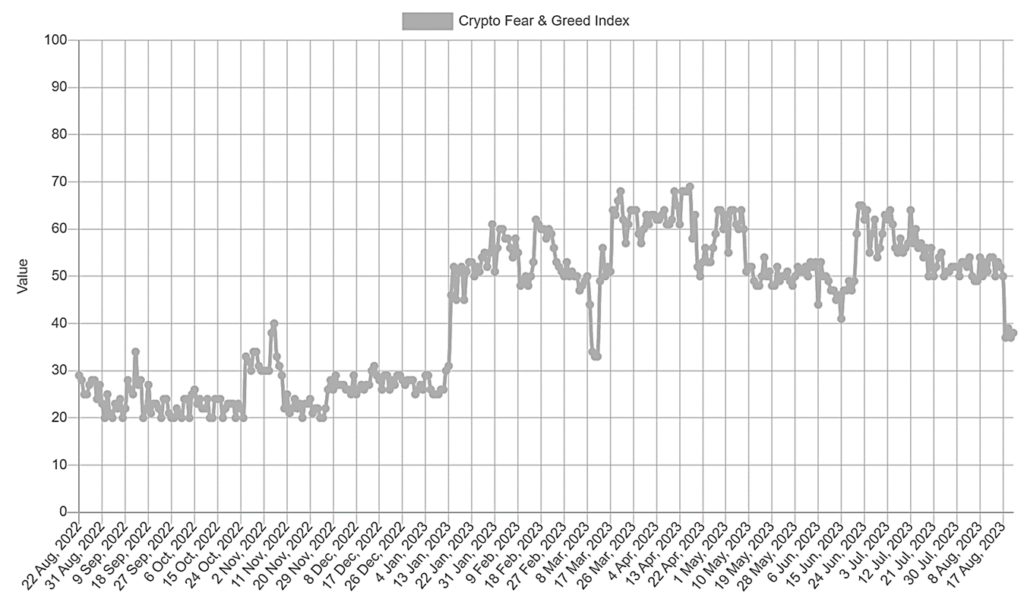

Market Sentiment

Along with price, sentiment finally broke from the indecision around 50, with a drop to the mid 30s. While things look up from late last year, there remains a pronounced uncertainty in the macroeconmic forecast, and regulatory approvals.

An ETF approval likely leading to a strong increase in greed across Bitcoin and crypto markets. Further boosts to market sentiment will follow if the US Fed declares a pause on rates, peak rates, or if a recession is confirmed avoided.

Trading Tips

This is a general piece of advice – don’t flex, flaunt or make references to how much crypto you have, unless someone needs to know. Consider this – once your crypto is on a hardware wallet, the easiest way to access it is through you.

That makes you a target, for spoofing, spam, hacks, or threat of physical harm. People have been attacked or even killed for their crypto, so you may think this won’t happen to you, but its important to take adequate precautions in protecting your investment – most people do not need to know about it, including most relatives or family members.

——————————————————————————-

If you enjoyed this article and want more hot takes and interesting posts about the economy, web3, crypto, decentralized finance, NFTS and more – you can follow Papi on Twitter/X at https://twitter.com/1MrPapi.

Disclaimer: Nothing found on this website, or any sources linked to this website includes financial advice of any sort. We are not certified financial advisors, use our content at your discretion as entertainment, and as an educational resource. Do your own research.