To start off, I believe there are a few misconceptions around this topic, so I want to address them as best as I can. I’ll talk about what funding represents, how it’s really calculated and about how to (not) trade it.

Introduction

To understand funding, we need to first make a difference between traditional futures and perpetual futures. While the former have an expiry date, the latter don’t.

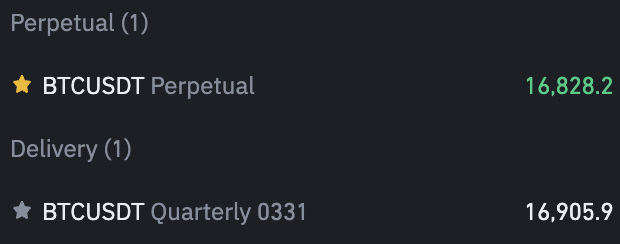

You could ask, why is this important? Well, because traditional futures contracts have their own supply and demand balance, thus price usually differs from spot. Here is an example comparing BTCUSD with expiry and without: see different price.

Traditional futures don’t need funding rates because, well, they have an expiry date. But perps *need* to represent the spot price, although supply and demand of the contract is still different. This is why funding rates exist.

When funding is negative, shorts pay longs — there’s a supply excess.

When funding is positive, longs pay shorts — there’s a demand excess.

Calculation

I believe some may think it’s *just* the difference between futures price and spot price, but it’s a bit more complex. Introducing here 3 concepts, Last Price, Index Price, and Mark Price:

- Last Price: represents the last trade that was executed, hence its name “last price”.

- Index Price: average of spot prices across big exchanges. Represents the best the cost of the asset.

- Mark Price: average between Index Price and Last Price. Again, it’s more complicated than that, but it goes outside the scope of this thread. You can find a fully detailed calculation of Mark Price on Binance’s FAQ.

Back to the calculation itself, it’s important to note there are two main components: –

- Interest rate (I): this is a fixed 0.1% every 8 hours on most exchanges.

- Premium (P): difference between Mark Price and Index Price.

That being said, the formula is the following: F = P-Clamp(I-P, 0.5%/-0.5%).

You may not know what a clamp function is, but it’s quite simple:

- If (I-P) is in the range of 0.5% and -0.5%, nothing happens

- If (I-P) is higher than 0.5%, then I-P = 0.5%

- If (I-P) is lower than -0.5%, then I-P = -0.5%

So in this case, if (I-P) is between 0.5% and -0.5%, the formula will be the one stated before. F = P-(I-P) = I. Since I is 0.1%, this is what we call ‘neutral funding’.

Trading funding rates

I’ve seen people long because funding is negative, or short because it’s higher than neutral. But that’s quite a big no for me. Why?

Since funding rates are a calculation based on price movements, they effectively don’t cause market to continue a trend or anything by themselves. Instead, these funding inefficiencies cause supply and demand of the futures contract to balance out.

Important point, not the asset but the futures contract. These inefficiencies are usually corrected by delta neutral strategies, or arbitrage. So if funding is positive, you can hedge yourself by buying spot and shorting futures. Now you fixed supply and demand without moving price.

This doesn’t happen 100% of the time, especially with high volatility alts — cases in which time is valuable. In these situations, you can trade them, but always used with other technical or fundamental confluence. Feel free to try, but the more people use an edge or meta, the more diluted it becomes (less effective)

Final thoughts

Funding rates are a tool to fix supply and demand inefficiencies in perpetual futures contracts. Their calculation is more complex than just “spot and futures price difference”

You can trade funding rates, but I personally don’t recommend it nor do it myself.