By Maugie Solana-Drops: De9Qh9UVzzNj7aiE5tjMqSZfscb1aMa1JizP3RhMSGfD 💖

–> Maugie on Twitter

Click for Audio Read!

Weekly Metals Market Analysis: A Deep Dive into Precious Metals Trends

Date: March 27, 2024

The precious metals market has seen its fair share of fluctuations this past week, with each metal showcasing unique trends. Our detailed analysis dives into the movements of gold, silver, platinum, and palladium, providing insights into their current valuations and week-on-week changes.

Gold Spot Price Analysis

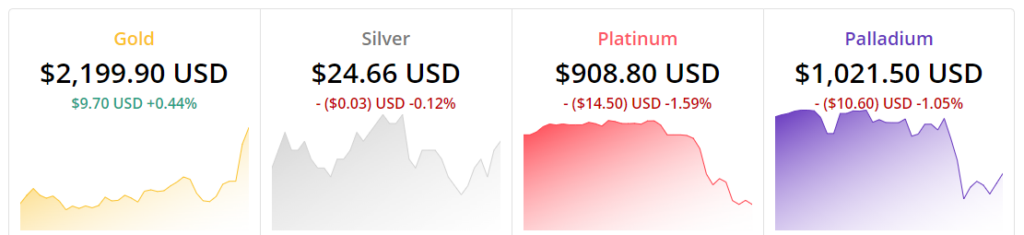

As of the latest update, the gold spot price stands at $2,201.30 USD per ounce, marking a positive change of $11.10 USD or 0.5% within the last 24 hours. When we zoom out to the weekly view, gold has seen an uptick of $35.00 USD or 1.62%, showcasing a bullish trend in the short term.

- Current Price: $2,201.30 USD/oz

- Weekly Change: +1.62%

- Analysis: The increase in gold prices can be attributed to a variety of factors, including market uncertainty and a stronger demand for safe-haven assets. Technical indicators suggest a continued positive momentum, with resistance observed at $2,220 USD and support around $2,180 USD.

Silver Spot Price Analysis

Silver, while more volatile, presents a modest increase in the spot price to $24.69 USD per ounce, a slight change of $0.01 USD or 0.04% in the last 24 hours. Over the week, however, silver faced a downturn of $0.35 USD or -1.4%, indicating a bearish sentiment among investors.

- Current Price: $24.69 USD/oz

- Weekly Change: -1.4%

- Analysis: Silver’s market dynamics often follow gold, yet its industrial demand introduces higher volatility. The current resistance is pegged at $25.00 USD, with support levels near $24.40 USD, suggesting a potential for rebound if industrial demand picks up.

Platinum Spot Price Analysis

The platinum market has experienced a decrease, with the current spot price at $910.00 USD per ounce, down by $13.30 USD or -1.46% from yesterday. The weekly perspective shows a marginal increase of $0.30 USD or 0.03%, indicating a stable market with slight bearish pressure.

- Current Price: $910.00 USD/oz

- Weekly Change: +0.03%

- Analysis: Platinum’s price movement has been relatively stable, with short-term pressures from both supply constraints and fluctuating industrial demand. Technical analysis indicates a tight trading range, with $925.00 USD as the next resistance and $900.00 USD as a crucial support level.

Palladium Spot Price Analysis

Palladium spot price is currently at $1,021.00 USD per ounce, showing a decrease of $11.10 USD or -1.1% over the last day. Conversely, the week has seen an increase of $5.50 USD or 0.54%, reflecting a cautiously optimistic outlook among investors.

- Current Price: $1,021.00 USD/oz

- Weekly Change: +0.54%

- Analysis: Palladium’s market is notably influenced by the automotive industry’s demand for catalytic converters. Despite the recent drop, the medium-term outlook remains positive, with resistance seen at $1,040.00 USD and support at $1,000.00 USD.

Conclusion

This week’s precious metals market shows a mixed bag of trends, with gold and palladium posting weekly gains, while silver and platinum experienced slight decreases. Investors are advised to keep a close eye on geopolitical developments, currency fluctuations, and industry demand shifts, as these factors could significantly impact future prices.

Disclaimer: The content of this article is provided for informational and entertainment purposes only and is not meant as investment advice or a recommendation for trading strategies. The opinions expressed herein belong solely to the author, and do not represent the views or policies of any company or institution. Investments in precious metals can be volatile and carry a degree of risk. Prices for metals can fluctuate widely and may be influenced by numerous factors outside the control of the investor. As such, potential investors should not invest funds they cannot afford to lose. Prior to making any investment decisions, it is advised to consult with a financial advisor or other qualified financial professional to assess the risks and suitability based on individual circumstances.