Crypto & Economic Calendar

The events listed below inform governments, corporations, traders and investors on the health of the economy, which can lead to volatility in markets and currencies.

- Monday

- After Close: Oracle earnings

- Tuesday

- 0200 ET: [EUR] German Consumer Price Index (CPI)

- 0830 ET: [USD] Consumer Price Index

- CPI Core Forecast: 0.4%

- CPI Core MoM Forecast: 0.2%

- CPI YoY Forecast: 4.1%

- Wednesday

- 0200 ET: [GBP] Gross Domestic Product (GDP)

- 0830 ET: [USD] Producer Price Index (PPI)

- 1030 ET: [USD] Crude Oil Inventories

- 1400 ET: [USD] Federal Open Market Committee (FOMC) – Forecast: 5.25% (sustain current rate)

- 1430 ET: [USD] FOMC Press Conference

- 1845 ET: [NZD] GDP

- 2200 ET: [CNY] Industrial Product (YoY)

- Thursday

- Before Open: Kroger earnings

- 0815 ET: [EUR] European Central Bank (ECB) Interest Rate – Forecast: up 0.25% to 4%

- 0830 ET: [USD] Initial Jobless Claims – Forecast: down 11k to 250k

- 0830 ET: [USD] Core Retail Sales – Forecast: down 0.3% to 0.1%

- 0830 ET: [USD] Philadelphia Fed Manufacturing Index – Forecast: down 3.1 points to -13.5

- After Close: Adobe earnings

- Friday

- 0500 ET: [EUR] Consumer Price Index (YoY) – Forecast: down 0.9% to 6.1%

Bitcoin Indecision Continues

Bitcoin continues a sideways indecision between two key levels. Despite the tremendous uncertainty and recent actions by US regulators, Bitcoin remains in a healthy pattern. Note: the brunt of the US regulatory actions recently is being felt by the altcoin market (except for Ethereum).

Caution: This is a very big week. Crypto markets are already on-edge due to the past week’s regulatory news. Next up- the infamous Federal Open Market Committee (FOMC) on Wednesday will set the tone for markets over the next month. Trade safely or avoid trading this week; between the CPI and PPI data, markets will try to front-run the FOMC news and we will see volatility.

Bitcoin Levels

Overhead is Bitcoin’s critical resistance, around $30,000. Through the 2020-2021 bull cycle, this served as the key horizontal support. Recovering it will likely spur a larger rally.

Price is currently trading within the value gap ($25,000 to $26,400), which is a historical range with little trading volume. Algos and professional traders typically avoid these areas due to lack of data or key levels to trade against.

Closing below the value gap on the weekly is bearish, but intraweek wicks lower are okay and sometimes expected, as the market and bears force retests of support. Consolidation within the value gap is a positive, as it can result in a stronger support for future uptrends.

We also have the horizontal support between the 38.2 and 50 fibonacci retracement levels. In an uptrend or bullish market, these are the fib levels most often acting as support.

And lastly the diagonal support level extending from the end of March 2023, which the weekly continues to respect; that is currently sitting at $25,000.

Bull Perspective: For now the uptrend remains intact, but the bulls are at-risk, being at the lower range of the current trend. They don’t want to lose the 50% fib retracement support level ($24,500); or the diagonal support ($25,000). Closing below those on the weekly means a lower high and lower low, likely leading to a more pronounced downside. On the other hand, a breakout above $30,000 will bode very well for bulls.

Bear Perspective: Indecision in crypto markets is partially due to regulatory uncertainty and the ongoing discussion economic issues like inflation, interest rates and potential recessions. While bears feel more confident given the current macro narrative and rejection from $30,000, they need to see a close under $24,000 to invalidate the higher-timeframe uptrend. If we lose $24,000, look for support around $23,000 (and the 62% fib retracement), and $21,600. This week all eyes are on the FOMC meeting, and PPI and CPI data from the US and Europe.

Special Note: Traders need to continue monitoring the regulatory landscape, as the Securities and Exchange Commission upped the ante over the past week with actions against major exchanges Coinbase and Binance.

This predominantly impacts the altcoin market, but is highly likely to impact the entire market, and in a worst-case scenario can remove access to services. We recommend you move your crypto to self-custody wallets like Ledger or Trezor as soon as possible. There is a chance that US exchanges will restrict access or services in the coming weeks and months, particularly Binance.

From a price perspective, Bitcoin and Ethereum remain mostly resilient, but other altcoins logged double-digit losses in the past week. While Bitcoin and Ethereum aren’t immune to price impacts from regulators or the news, they are likely to outperform most altcoins in that regard.

Market Sentiment

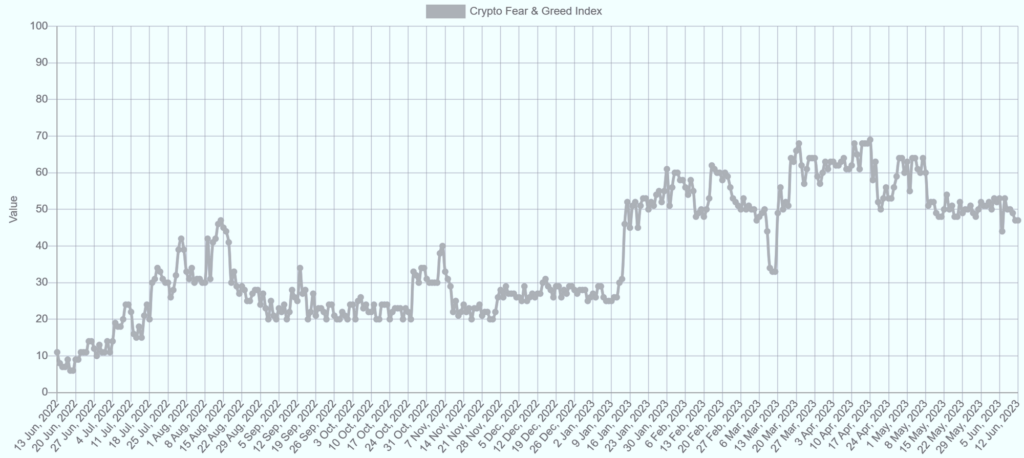

The Cryptocurrency Fear and Greed Index peaked at 69 in April, before consolidating into a range around 50, with neutral sentiment. Recently the regulatory actions taken by the SEC in the US pushed the sentiment down a few points to 47. This still remains within a neutral range, and suggests the market is largely priced in to the current regulatory climate.

Still, a neutral reading isn’t bullish, and it reflects the current indecision in markets, as recessionary worries and regulatory issues worry some investors; others are cautiously optimistic that peak rates are here or close, and that the US Government can navigate a “soft landing” and avoid a pronounced recession.

The overall risk appetite, including that of crypto markets, appears to be growing. But continued appetite will be dictated by the macroeconomic climate, so monitoring of the US Fed and European Central Bank (ECB) as leading sentiment indicators is important.

Trading Tips

Think about self-custody of your crypto, using technology like Ledger or Trezor. Storing your crypto on exchanges leaves it vulnerable to loss, if the company goes out of business. It also is used by exchanges to offer derivative services, which isn’t always beneficial to traders. Here are five reasons to consider hardware wallets:

- Control and Security: Hardware wallets are offline wallets that provide users with full control over their cryptocurrency assets, reducing reliance on third-party services which can be vulnerable to hacks or service disruptions.

- Privacy: With self-custody, users maintain their financial privacy. In traditional banking and some cryptocurrency exchanges, transactions and account details are known to the institution, which allows them to do things like sell their order book info to whales and institutions, or like FTX – they traded against their own customers.

- Direct Ownership: Self-custody of cryptocurrency means direct ownership. It represents the core principle of cryptocurrency – the idea of decentralization and eliminating the middleman in financial transactions. The user owns the keys and therefore owns the coins.

- Less Trust Dependence: With hardware wallets and self-custody, the security of your crypto assets doesn’t depend on the promises or competence of a third party. This becomes particularly important considering the history of security breaches on major crypto exchanges where users have lost their holdings. The author can speak to that one personally – I lost a lot of my portfolio when a third party who had custody of my coins was hacked

- Recovery and Redundancy: Hardware wallets often support recovery phrases to restore wallet data, allowing users to recover their assets in case the device gets lost, stolen, or damaged. This feature provides an extra layer of security and comfort for the user, knowing that their assets can be recovered and aren’t tied to a single piece of hardware.

If you enjoyed this article and want more hot takes and interesting posts about the economy, web3, crypto, decentralized finance, NFTS and more – you can follow Papi on Twitter at https://twitter.com/1MrPapi.

Disclaimer: Nothing found on this website, or any sources linked to this website includes financial advice of any sort. We are not certified financial advisors, use our content at your discretion as entertainment, and as an educational resource. Do your own research.