Crypto & Economic Calendar

Be advised that events listed below inform corporations, traders and investors on the health of the economy, which leads to volatility in markets. Only experienced traders should trade around these events.

- Wednesday

- Ethereum “Shanghai” Hard Fork / Upgrade

- 830 ET: US Consumer Price Index (CPI) Data

- 1400 ET: US Federal Open Market Committee (FOMC) Meeting Minutes Release

- Thursday

- 830 ET: US Producer Price Index (PPI) Data

- 830 ET: Jobless Claims Data

- Friday

- 830 ET: Retail Sales Data

- 1000 ET: Consumer Sentiment

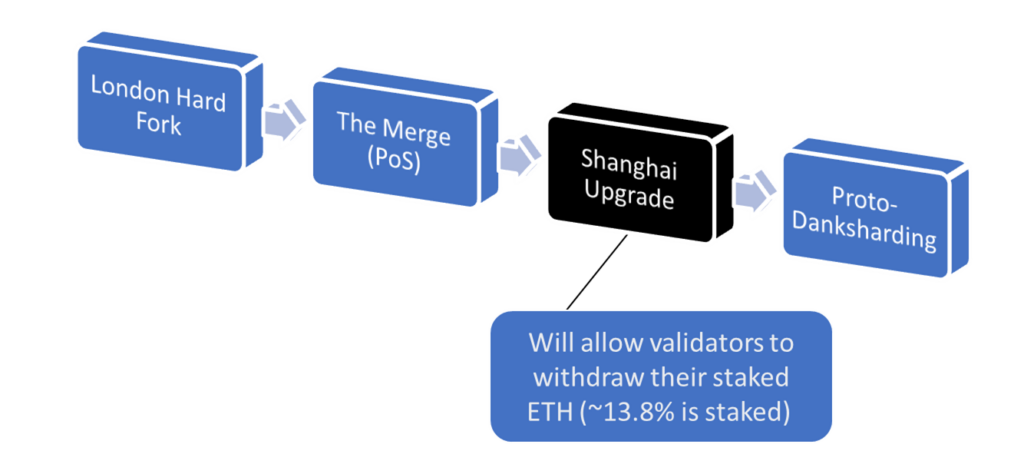

Ethereum “Shanghai” Hard Fork – What You Need to Know

The Shanghai Hard Fork’s will enable the withdrawal of staked / delegated ETH. Currently around 13% of ETH is staked on various platforms. While I don’t have the exact number, the majority of ETH appears to be invested into “liquid staking” solutions, like LIDO. Liquid Staking allows you to trade your ETH, even if it’s locked into a staking protocol.

While many are predicting a massive selloff into the Shanghai Upgrade, this writer expects minimal impact due to the prevalence of liquid staking. Most staked ETH can be traded already, so this event isn’t a significant game changer.

Note that volatility is still likely, both due to a busy economic calendar this week and some stakers may look to log a tax loss event (wash trade) or trade into Bitcoin due to rising Bitcoin Dominance early in the new cycle.

Bitcoin Indecision

Bitcoin closed weekly in the same 1.2% range for nearly a month, since the mid March rally and the 30% green candle. It is testing resistance at one of the most significant levels from Bitcoin’s previous cycle, along $30,000.

During this time, volume was dropping; and the tight trading range combined with lower volume indicates an impending breakout. With several high profile events on the economic calendar, the breakout is likely to occur this week. While my personal bias is for more upside, we need to build a forecast based on the primary theme of this week – the economy.

What to watch for? We aren’t fortune tellers, but one method for assessing breakout direction based on economic data is to watch the US Dollar Index (DXY).

- When the DXY drops, this typically sends crypto higher, as it usually indicates the market is hungrier for risk assets like crypto.

- The opposite is true if economic data indicates additional tightening or higher rates are coming, as it indicates an appetite for safe havens like the US Dollar.

Based on the pattern alone, if we see a long extension followed by a consolidation in a tight range (ie. a triangle), that generally signals a continuation (in this case to the upside). But economic data can trump that.

- If we break into the next higher value range (>$30,000), $35,000 is an intermediate target.

- Downside target no lower than ~$25,000, any lower leads to potential invalidation of Q1 uptrend.

If you enjoyed this article and want more hot takes and interesting posts about the economy, web3, crypto, decentralized finance, NFTS and more – you can follow Papi on Twitter at https://twitter.com/1MrPapi.

Disclaimer: Nothing found on this website, or any sources linked to this website includes financial advice of any sort. We are not certified financial advisors, use our content at your discretion as entertainment, and as an educational resource. Do your own research.