First, here’s the goods. Two Must-See Charts for AltSeason 2023. Top recommended altcoins to trade with the greatest potential and highest probability of delivering.

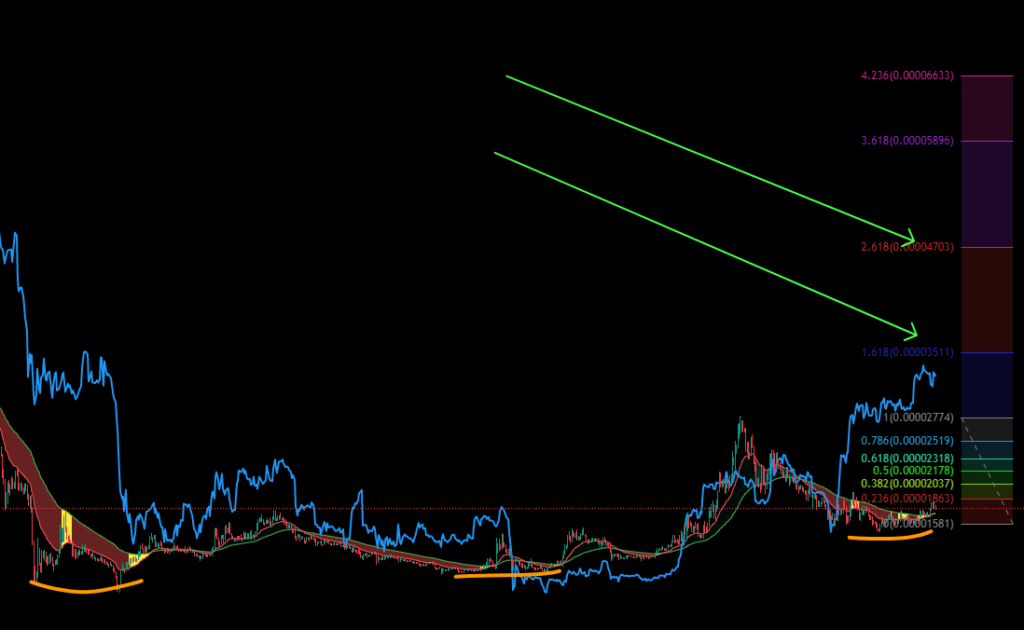

FTM/BTC and LTC/BTC

Then the charts, then the technical analysis – and

…how YOU can find TWENTY super hot charts!

Why Are These The Best Cryptos for 2023?

A very common question is ‘Based on your analysis, which altcoins do you think have the greatest potential for significant price movements in the near future?‘

Currently my bias is favoring the ALT/BTC pairs that are showing higher lows from May 2022, November 2022 and higher again for the low in March 2023.

The example charts above for FTM/BTC and LTC/BTC are just two of about 30 coins.

To me, these few markets are showing investor interest that is stronger.

However, I don’t even try to guess which will be the best gainers. I trade with risk management technical analysis, and not with price prediction technical analysis.

So I’ll also be trading the entry signals in the alt/btc pairs that have created lower lows from May, November and March… if they are creating a valid 1-2-3 bottom in April, I’ll watch that formation for our entry signal and after the trade is entered it is my job to manage risk!

Find More Than TWENTY MONSTER CHARTS!

- What are your top recommended altcoins to trade currently, based on your analysis?

Those that match our requirement must pass the following three conditions become our top recommendations. We rebalance our portfolio every day. And within that group of the best coins for altcoinseason 2023, we can narrow the list further by limiting to only those alt/btc pairs showing higher lows from May, November and March – as we see in the two chart examples above.

- Moving averages, trend lines, and chart patterns are the three tools that you can use to identify potential trend changes. For instance, moving averages or exponential moving averages can be used to identify the direction of a trend by plotting the average price of a security over a specified period. By analyzing the relationship between the 60-period moving average and the 20-period moving average, traders can better identify upward or downward trends.

- Similarly, trend lines can be used to identify key support and resistance levels that can help identify early signs of the trend changes.

- Chart patterns, such as head and shoulders or cup and handle, can also be identified with the 1-2-3 pattern. This may indicate a change in the direction of the trend and also provides technical levels for setting risk control.

In order to sort out the top coins to invest in today, we must evaluate our portfolio of coins against out trading plan each day, and keep an organized list that is easy to follow with a simple routine.

- Based on your analysis, which altcoins do you think have the greatest potential for significant price movements in the near future?

Altcoins that exhibit strong trends and have broken through key support or resistance levels may have the greatest potential for significant price movements in the near future. Tools such as bitcoin dominance and stable coin dominance are helpful, but in order to have an objective approach to trading altcoin seasons, it is important to review each coin chart individually and diversify into all of those that pass the entry signal. We can never know the future. That’s up to the market. But we CAN identify opportunity, manage risk and surrender the results to the unknown future.

- What are the key factors you consider when selecting altcoins for your trading shortlist?

The most important factor in my approach is that my money must work for me while I do other things. In other words, I must plan out my trades to that I do not have to watch the markets… I task my money with that dreary, endless 24×7 job – and I’m working to build new income streams!

When selecting altcoins for a trading shortlist, we are strictly using technical price levels. First we review the altcoin/btc price chart. This reveals the spread between the the ALT/USD price vs the BTC/USD price. The direction of that price spread helps us pinpoint the cryptocurrencies that are outperforming bitcoin.

- Could you provide me with a list of the altcoins you believe have the highest probability of delivering significant gains, based on your research and analysis?

Yes. And No. There are a list of coins that are nearing our trade entry levels. Each day we update that list as different cryptocurrencies are passing our entry or our exit signals. In addition, we also have a shortlist of coins that performed well in recent pumps… yet our trading plan is centered around the fact that we do not know the future, and that our job as traders – is to manage risk as crypto season heats up.

The Trouble With Price Prediction Technical Analysis

Would you agree that most people start a trade because they believe they are correct, and they only exit the trade when the market proves them wrong?

This is completely backwards! If you are making this error, this will hold you back from greater trading success! But that is for another day…

I’ll write more about how Fear and Greed work against us when we hold a desire to be correct about out opinions about market direction.

About the author

Doug is a full time crypto trader and the creator of the Altseason CoPilot. He is a strong believer in the small trader. He shares his biggest trading mistakes so you might avoid them, and evangelizes the strategy of making your money work for you while you do other things!

Follow Doug on Twitter. Connect on Linkedin. Watch on YouTube.