In this post we’ll cover the top 12 reasons why people lose money trading and dig into the psychology behind these errors.

Have you fallen victim to any of these mistakes?

Share your experience with these errors! Comment on our Twitter thread.

- Lack of discipline: The number one reason many traders lose money trading is because they claim that they lack discipline in their approach to trading. They may not stick to their trading plan, take excessive risks or trade on emotion, all of which can lead to losses… But real trading discipline is not about willpower. Being disciplined in your trading is effortless when you believe in your methods.

- Overconfidence: Some traders may become overconfident in their abilities and take on more risk than they should. Overconfidence is often a result of past successes and can lead to a false sense of ability to predict the next moves and a blindness to contrarian views.

When someone has experienced success in the past, it can create a sense of confidence and belief in their abilities that may not necessarily be warranted. For example, a trader may have experienced a string of successful trades, which can lead them to believe that they have a deep understanding of the markets and that their predictive abilities are highly accurate.

Social recognition can play a role in reinforcing overconfidence in trading. When a trader experiences success, they may receive positive feedback from others, which can reinforce their beliefs about their abilities and contribute to a sense of overconfidence. This social recognition can come in many forms, such as praise from colleagues, media coverage, or social media validation.

For example, a trader may experience a significant win and share the news with their social media followers. The response may be overwhelmingly positive, with many people congratulating them and praising their abilities. This can create a sense of validation and reinforce the trader’s belief that they are highly skilled and capable.

Similarly, a trader may receive positive feedback from colleagues or mentors, who may praise their approach or suggest that they have a natural talent for trading. This can create a sense of pride and reinforce the trader’s belief in their abilities, which can contribute to overconfidence.

They may begin to believe that they can predict the next move with a high degree of accuracy, this can cause them to become overconfident in their approach and to take on more risk – that is, they take on a position size that is too large for the equity in their account or they take a position with larger leverage than they should – leaving themselves open to large losses from unexpected moves against their positions.

Overconfident traders may ignore or dismiss contrarian views that suggest a different outcome. When a trader is blind to contrarian views and believes that their own predictions are logical, they may be unwilling to adjust their approach when the market moves against them. This can lead to a reluctance to cut losses or to take profits when they should, and large losses pile on from poor trading decisions.

- Fear of missing out (FOMO): The fear of missing out on potential profits can cause traders to enter trades impulsively, with too large of a position size, at too high of leverage… without proper analysis or risk management, these people are most likely to lose money trading. This is often a result of a desire to be proven right and to gain recognition from others.

The fear of missing out can alter the emotional state of a trader by creating a sense of urgency and anxiety about potential missed opportunities.

Research has shown that FOMO can activate the same brain regions that are associated with stress and anxiety. When someone experiences FOMO, the amygdala, which is a part of the brain associated with emotional processing, becomes activated. This can trigger the release of stress hormones such as cortisol, which can affect cognitive thinking and decision making.

Studies using brain scan technology have shown that stress can alter cognitive thinking in several ways. For example, stress can impair working memory, which is the ability to hold and manipulate information in the mind over short periods of time. Stress can also interfere with attention and cognitive flexibility, which are both important for making complex decisions.

In other words, as a trader, we must be aware that our emotional state has a significant impact on the decision making in our trades. When we experience FOMO, we are more prone to making impulsive decisions rather than thinking through all stages of our trade planning.

- Chasing losses: Traders who have experienced losses may feel the need to recoup those losses quickly, leading them to take on more risk than they should. This is often a result of a feeling of lack, a feeling of being behind financially – and feeling like a fast fix will change your money problems.

When traders experience losses, they may feel a sense of scarcity or lack of resources, which can trigger a desire to recoup those losses quickly in order to regain a sense of control and security.

This feeling of lack can be compounded if the trader behind financially, or feeling like one is not making enough money to meet their financial goals. This can create an acute sense of urgency and pressure – which can often result in taking higher risks in the hope of generate the ‘needed’ funds.

It is very likely that most people #lostmoney trading #cryptos because of the way we learned our trading skills. (10 min soundcloud podcast)

— DigitalCurrencyTraders (@introtocryptos) February 28, 2023

How We Learn Crypto Trading And Why We Failhttps://t.co/buaodehjng#altseason2023

- Confirmation bias: Traders may hold onto a position even when the evidence suggests they should exit, due to a bias towards confirming their pre-existing beliefs. This is often a result of a need for ego recognition as being smarter than the average and a fear of being seen as wrong.

Confirmation bias is the tendency to seek out and interpret information in a way that confirms pre-existing beliefs or hypotheses, while disregarding or minimizing contradictory evidence.

For example, a trader may become attached to a particular asset and develop a strong belief that it will perform well. As a result, they may discount or ignore negative news or market signals that suggest it is likely to decline in value.

Another example of confirmation bias in trading is when a trader is reluctant to sell a losing position because they hope that the price will rebound and they can avoid the pain of financial loss and avoid the embarrassment of being ‘wrong’. They may seek out information that supports this hope, such as news or reports from analysts, while downplaying negative signals that suggest the asset is not likely to recover.

“A few years ago I wrote a detailed journal entry when I was trading a particular cryptocurrency… (MAID/BTC). I was convinced it would be the next big thing and it was about to take off any time soon. I had read all the whitepapers and followed the project closely, so I felt confident that its value would skyrocket.

At first, everything seemed to be going according to the trading plan that had been working so well for me. The price of MAID started to rise from the 1-2-3 bottom formation, the EMA’s crossed over to confirm… I was feeling a rush of excitement and anticipation. I started to imagine all the profits I would make and all the things I could do with the money.

But very quickly after the breakout, things started to go wrong. The price of the cryptocurrency began to fluctuate and it pulled back just below my entry. I found myself constantly checking price charts to see how it was doing. I became increasingly anxious and irritable, frustrated and impatient with every day things that I normally would enjoy.

Despite the small loss and emotional warning signs, I held onto the cryptocurrency, convinced that it would soon rebound. I started to ignore negative news and the overall bearish market signals from the Crypto Smartwatch spreadsheet, telling myself that MAID was just experiencing a temporary dip and market would consolidate soon bounce back.

Days turned into a week, and my initial excitement was turning into dread. I watched in horror as the price of the cryptocurrency continued fade slowly only to plummet sharply, erasing more than half of my investment. I felt a knot in my stomach as I realized how much money I had lost. For days, no… months… well, ok.. I berated myself on how foolish I had been.

Now that massive loss is one of my favorite trading stories!

Looking back, I can see that I was suffering from confirmation bias. I had become so attached to the idea that this cryptocurrency would be a surefire winner that I couldn’t see the warning signs that it was headed for disaster. The experience was painful and humbling, and it taught me important lessons on how fast I could lose money trading. As a result of this trading error, I ended up creating a profoundly important respect for my two simple risk control rules.”

- Herd mentality: Traders may follow the crowd and make decisions based on what others are doing, rather than their own analysis. This is often a result of a belief that someone else may know something that you don’t know – but highlights the traders lack of understanding of a sound system they believe in.

We are social creatures, and we have been taught look to others for guidance when making decisions. When traders see that others are buying or selling a particular asset, they may assume that those people have more knowledge or expertise and follow their lead.

When the herd or the social influencer’s prediction turns out to be incorrect, we may experience a range of emotions and thoughts.

We may feel disappointed or frustrated that the prediction did not come true. They may have been hopeful or even confident that the influencer’s prediction was accurate, and the failure of the prediction can cause frustration and sometimes rage.

We are going to feel doubt, confusion and a loss of trust in the only source that was ‘reliable’… and how can we trust our own decision-making abilities?

It is natural to find explanations or justifications for the ‘fake price move’, such as external factors that were unforeseeable or the idea that the prediction was still a good one, but whales, regulation changes, news releases, or manipulation ruined the trade. We create our own cognitive dissonance trying to reconcile their beliefs and separate ourselves from responsibility for the reality of the situation.

It’s crucial for traders to develop confidence in their own analysis and decision-making abilities. By doing so, traders can avoid being swept up in the emotions and biases of the crowd and make more informed and objective decisions. This can lead to more successful trading outcomes and a greater sense of self-efficacy and control over their financial future.

- Lack of patience: Traders may enter and exit trades too quickly, without giving them time to play out. This often results in whipsaw and additional losses. The need for immediate gratification often leads a trader to high leverage trades on small timeframe charts – magnifying the risks and increasing the odds of failure.

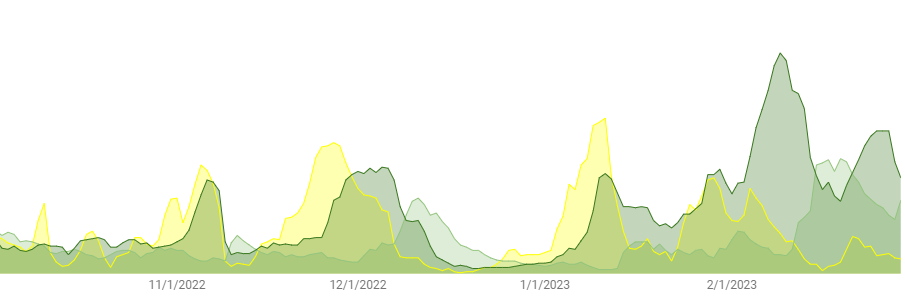

Traders who are new to crypto markets may not fully understand the cyclical nature of altcoin seasons and the different factors that influence the rise and fall of altcoin prices.

It is easy to become impatient when a trade isn’t immediately profitable, leading new traders to exit the trade prematurely or to take on more risk than they should in order to try to make up for the perceived loss. This can lead to overtrading, where a trader makes too many trades in a short period of time, often resulting in losses due to impulsive decision-making.

Without understanding how to identify the start of the next altcoin season, new traders can quickly lose patience in waiting for the right opportunities to present themselves. Traders who are unfamiliar with bitcoin dominance and altcoin season, may not realize that certain market conditions are more favorable for certain types of altcoins, and may try to force trades when conditions are not optimal. This can lead to frustration and impatience, as well as a greater likelihood of making unwise trading decisions.

Overall, it’s important for traders to take the time to educate themselves about the altcoin season and the different factors that can influence altcoin trends and fluctuations. By doing so, they can develop a greater sense of patience and discipline, which can help them make more informed and successful trading decisions.

- Emotional trading: Traders may make decisions based on their emotions, rather than analysis. This may be a result of a lack of emotional control that you learned from your parents when you were a child. This can be overcome with yoga, meditation and mindfulness drills intended to calm and still the thinking mind.

Emotional trading and gambling share some similarities in terms of the emotional and cognitive processes that underlie them. Both activities involve risk-taking, uncertainty, and the potential for reward. In both cases, individuals may experience a rush of excitement or anticipation when they place a trade or make a bet, and may feel a sense of disappointment or frustration when they lose.

Emotional trading can also lead to behaviors that are similar to those associated with gambling addiction. For example, traders may experience a compulsion to continue trading even when they know that it is not in their best interest. Compulsive trading is a behavioral addiction that can be difficult to recognize because trading is a legitimate activity that can generate income.

- Ignoring risk management: Traders may take on excessive risk without considering the potential downsides. This is often a result of a desire for potential rewards without taking the time to do the mathematics that will highlight the potential losses.

When traders are focused solely on profits, they may be more likely to overlook the risks associated with their trading decisions and this dramatically increases the odds they will lose money trading. This can be especially true in situations where profits seem particularly lucrative or when the trader is experiencing a winning streak.

They may believe that their analysis is correct and the direction of the market has a high degree of certainty, therefore a trader reasons that it is time to take on a larger position because they believe that they can realize profits quickly.

By overlooking the potential magnitude of the risks associated with the over-sided, over-leveraged trade, we underestimate the potential for losses and ignore the possibility of unforeseen events that could impact price in unexpected ways.

- Failure to adapt: Traders may continue to use a strategy that is no longer effective, due to a reluctance to change their approach. This is often a result of a desire to be proven right.

Desiring to be proven correct in situations where the outcome is unpredictable can create a number of difficulties, particularly when it comes to trading volatile crypto markets.

When we are invested in being right, we may be more likely to ignore or downplay information that contradicts our beliefs or predictions, instead we seek out and interpret information in ways that confirm our pre-existing beliefs.

Traders who are overly invested in being proven correct may be more likely to hold onto positions that are no longer profitable. It becomes difficult for us to change course or to adapt our strategies in response to changing market conditions.

- Lack of knowledge: Traders may enter into trades without fully understanding the underlying asset or market conditions are also very likely to lose money trading. This is often a result of a lack of research and a tendency to act impulsively.

If you were to learn to fly a plane the way most people try to learn how to trade crypto, it would likely lead to disastrous consequences.

Learning to fly a plane requires a significant amount of study, training, and practice, with a focus on safety and risk management. It is a highly regulated and structured field, with clear standards and protocols that must be followed in order to ensure the safety of both the pilot and the passengers.

In contrast, many people who try to learn how to trade crypto do so without a clear understanding of the risks involved or the proper strategies and techniques for managing those risks. They may rely on tips and advice from social media influencers or online forums, without fully understanding the implications of their decisions. They may also engage in risky trading practices, such as using leverage or trading on margin, without fully understanding the potential consequences.

If you approach trading without a clear understanding of the risks involved and a well-defined strategy for managing those risks, you are likely to suffer significant losses. This may result in emotional stress and anxiety, as well as financial losses. To avoid these consequences, traders should study market trends and analyze data, as well as develop a sound risk management plan that includes measures such as stop-loss orders and diversification.

- Unrealistic expectations: Traders may have unrealistic expectations for the amount of money they can make in a given period. This is often a result of a desire for quick and easy profits, without considering the amount of work and risk involved.

Earning a 20% profit in a year would be considered very successful, yet if a new trader starts with $500, they would be disappointed with only a $100 gain after a year of trading.

This is a cause of failure in new traders because it demonstrates a lack of understanding of realistic expectations. Many new traders enter the market after seeing some quick and large profits, often fueled by the hype and excitement of the market or by social media influencers touting get-rich-quick schemes. When they don’t achieve their expectations fast enough, they become disappointed, frustrated, and may even engage in risky trading behaviors to try and make the profits they were expecting.

This mindset reveals a lack of appreciation for the power of compounding returns over time.

A 20% return on investment may not seem like much in the short term, but over the course of several years, it can lead to significant gains. By focusing on short-term gains and immediate gratification, new traders may miss out on the long-term benefits of a disciplined, patient, and well-structured approach to trading.

Will More Money Solve Your Money Problems?

Many people believe that a fast fix will solve their money problems. Traders may rationalize that if they can just make a few quick and successful trades, they will be able to recoup their losses and achieve financial stability.

However, the question of whether more money solves money problems is a complex one. While having more money can certainly alleviate financial stress and provide more opportunities and choices, it does not necessarily solve underlying psychological or emotional issues related to money.

For example, someone who has the habit of overspending or engage in impulsive behaviors with money is very likely to continue doing so, especially if they have more money!

Ultimately, the key to managing money problems and achieving financial stability is to address underlying psychological and emotional issues related to money. The book, Money Is My Friend, is a great place to begin addressing these underlying issues with money and begin building a healthy and wealthy future.

Naturally develop the ability to delay gratification

The 12 reasons people lose money trading can be attributed to a variety of psychological factors, such as overconfidence, fear of missing out, and a bias towards confirming pre-existing beliefs.

As the adoption of cryptocurrencies continues to grow, the future growth potential of crypto appears to be vast, leaving investors with a feeling of eager anticipation for the Cryptocurrency investment potential to come!

The famous marshmallow experiment

However, one key trait that can help overcome these challenges is the ability to delay gratification. This is exemplified in the famous marshmallow experiment, a well-known psychological study on delayed gratification conducted by Walter Mischel in the late 1960s and early 1970s.

The experiment involved placing young children in a room with a marshmallow and giving them the option to either eat the marshmallow immediately or wait for 15 minutes and receive a second marshmallow as a reward.

The study found that the children who were able to delay gratification and wait for the second marshmallow tended to have better life outcomes later in life, including higher academic achievement, better social skills, and lower rates of substance abuse and obesity.

The marshmallow experiment is often cited as an example of the importance of self-control and delayed gratification, particularly in the context of personal finance and investing. It suggests that individuals who are able to resist the temptation of short-term rewards and delay gratification in favor of long-term goals are more likely to achieve success and financial security over time.

By understanding The Five Stage Of The Trade, individuals can naturally develop the ability to delay gratification. With perspective on Altcoin Season cycles, traders can avoid impulsive and emotional decision-making and instead focus on long-term strategies that prioritize risk management and patience.

This can help overcome common mistakes such as overtrading, following the crowd, and ignoring contrary evidence. By recognizing the importance of delayed gratification in trading and investing, individuals can cultivate the self-control and discipline needed to achieve success in the markets.

Doug is a full time crypto trader and the creator of the Crypto SmartWatch Altseason Model Portfolio. He is a strong believer in the small trader. He shares his biggest trading mistakes so you might avoid them, and evangelizes the strategy of making your money work for you while you do other things!

Follow Doug on Twitter. Connect on Linkedin. Watch on YouTube.