Crypto & Economic Calendar

The events below inform governments, corporations, traders and investors on the health of the economy. I only list events noted as “high volatility expected” in related markets.

| Time (ET) | Cur. | Event | Forecast | Previous |

| Monday, February 26, 2024 | ||||

| 10:00 | USD | New Home Sales (Jan) | 680K | 651K |

| Tuesday, February 27, 2024 | ||||

| 8:30 | USD | Core Durable Goods Orders (MoM) (Jan) | 0.2% | 0.6% |

| 10:00 | USD | CB Consumer Confidence (Feb) | 114.8 | 114.8 |

| 20:00 | NZD | RBNZ Interest Rate Decision | 5.5% | 5.5% |

| Wednesday, February 28, 2024 | ||||

| 8:30 | USD | GDP (QoQ) (Q4) | 3.3% | 4.9% |

| 10:30 | USD | Crude Oil Inventories | 3.514M | |

| Thursday, February 29, 2024 | ||||

| 8:00 | EUR | German CPI (MoM) (Feb) | 0.5% | 0.2% |

| 8:30 | USD | Core PCE Price Index (YoY) (Jan) | 2.8% | 2.9% |

| 8:30 | USD | Core PCE Price Index (MoM) (Jan) | 0.4% | 0.2% |

| 8:30 | USD | Initial Jobless Claims | 209K | 201K |

| 9:45 | USD | Chicago PMI (Feb) | 47.9 | 46 |

| 20:30 | CNY | Manufacturing PMI (Feb) | 49.1 | 49.2 |

| Friday, March 1, 2024 | ||||

| All Day | South Korea – Independence Day | |||

| 5:00 | EUR | CPI (YoY) (Feb) | 2.5% | 2.8% |

| 9:45 | USD | S&P Global US Manufacturing PMI (Feb) | 51.5 | 50.7 |

| 10:00 | USD | ISM Manufacturing PMI (Feb) | 49.5 | 49.1 |

| 10:00 | USD | ISM Manufacturing Prices (Feb) | 54.6 | 52 |

Bitcoin – Welcome to the Post-ETF World

Summary: Our premise remains simple: price over $32k is healthy- and under previous highs, keep stacking. Bitcoin is flirting with previous highs, and this writer will stop buying at that point, and begin implementing an exit strategy (over time, not immediately). I’ll discuss this more in a future post.

Looking at long term cycles, I suspect a top around Q1 2025, but thats subject to change. Its admittedly more of an art than science, with everything from Pi Cycle to Coinbase popularity coming into play.

Also recent cycles have been a little different, but a few patterns remain consistent- they take longer, and log smaller growth than their predecessor. With institutional money here and interest in crypto rising, drawdowns should also be less pronounced in the future.

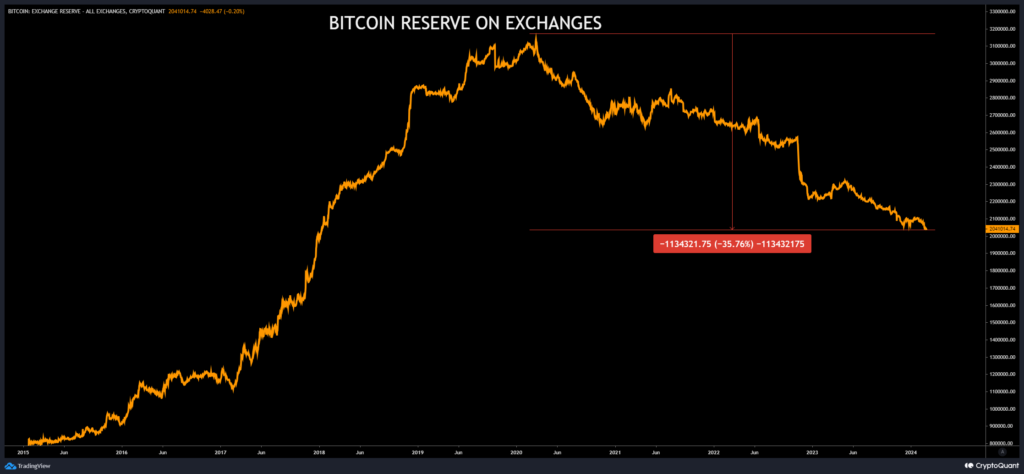

This means that long term forecasts will begin evaluating other types of data. One of my favorites is supply available on exchanges. With increased investment in Bitcoin, thanks to the ETFs, we are seeing an acceleration of the Bitcoin supply drain. This means more Bitcoin is being bought and HODL’d than is being mined. And as we know with commodities, scarcity boosts percieved value. With a 36% drain on supply since 2020, we are in a very clear downtrend.

All of this to say – while you may be interested in the short to mid-term outlook for Bitcoin and crypto markets, its also a good time to consider your longer term position over the next decade, especially for leading cryptocurrencies like Bitcoin and Ethereum.

- Immediate resistance: ~$53,600

- Immediate support: ~$51,700

- Current value range: $47,063 to $53,300

- Local support levels:

- $52,230

- $51,740

- $50,700

- $50,000

- $48,200

- $47,183

- $45,961

- $44,692

- $42,200 (20w SMA and 21w EMA, aka Bull Market Support)

- $41,800

- $40,360

- $40,000 psychological & correlates with 2021 & 2017 levels

- Local resistance levels (we are lighter on historic levels here):

- $53,360

- $55,000

- $56,200

- $60,000

Bull Perspective: The success of the ETFs, compounded with relaxing macroeconomic conditions and the Bitcoin’s halving on the horizon – we have the right conditions for an increasingly bullish market in 2024 into 2025.

Bear Perspective: While economic circumstances appear to be improving, there are still stressors and risks to monitor. If macroeconomic data comes back as weaker than expected, the US Fed can reconsider their retreat from peak rates, and even raise them further. Senator Warren and other leading politicians appear poised to continue an anti-crypto narrative into the next election cycle, potentially stifling investor appetite and bringing more divisive politics to the crypto markets.

Bottom line: Should you buy? Bitcoin and most crypto remain under previous highs, historically that means the risk/reward is still solid here, but not for much longer.

US Dollar Index (DXY)

Change typically comes slow to the US Dollar. In this case it appears to have peaked in January 2022, and is trending down in accordance with a multi-decade downtrend and inflation/devaluation of the USD.

Over the past two years I discussed the inverse relationship between the strength of the US Dollar (DXY) and speculative markets like crypto and equities. Of particular importance, the ~101 level, arguably the most significant for the DXY. Almost every time in the past 50 years, when DXY rejected from, or closed under the 101 range, it led to a prolonged period of weakening dollar.

If the Fed reduces rates in 2024, that will be the catalyst to send it lower. An intermediate target for such a breakdown is as low as 96.

Why do we care about the DXY?

The Dollar Index is a complex financial data point, a lot of external factors impact its value. But in the simplest terms, you can look at the relationship between DXY and risk assets like Bitcoin simply – they usually move inverse to each other. When DXY is up, BTC is down; and the opposite is true.

Market Sentiment

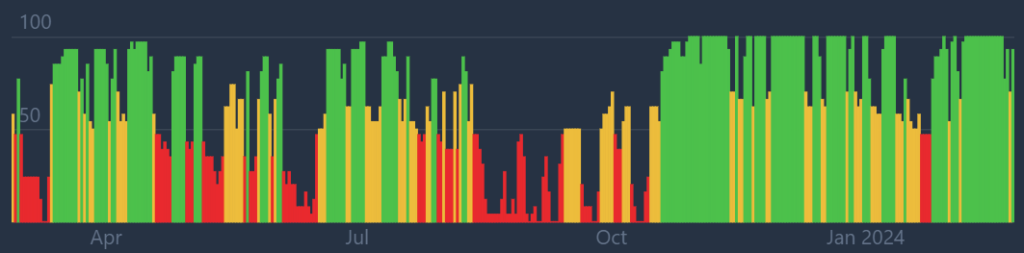

Summary: There isn’t much to say – among this block of green across 2024 to-date is confirmation that sentiment is increasingly positive around cryptocurrencies.

While sentiment saw a moderate cooling in late January into early February, its still significantly elevated from a year ago and remains in a firmly bullish trajectory. Some cooling off was due to the ETFs finally going live, and a small selloff (in part due to Grayscale unwinding a large portion of their massive Bitcoin holdings).

Grayscale distributing their Bitcoin is actually a very positive development, and we need occasional retracements in sentiment, if we want to go higher.

Note: Remember Bitcoin, Ethereum, cryptocurrency is apolitical; its designed by and for the people. Governments, banks, funds, they are tourists here.

——————————————————————————-

If you enjoyed this article and want more hot takes and interesting posts about the economy, web3, crypto, decentralized finance, NFTS and more – you can follow Papi on Twitter/X at https://twitter.com/1MrPapi.

Disclaimer: Nothing found on this website, or any sources linked to this website includes financial advice of any sort. We are not certified financial advisors, use our content at your discretion as entertainment, and as an educational resource. Do your own research.