Crypto & Economic Calendar

The events below inform governments, corporations, traders and investors on the health of the economy. I only list events noted as “high volatility expected” in related markets.

- Monday

- All Day: Holiday – Lunar New Year for some Asian Countries incl. China, Japan, S. Korea

- All Day: Holiday – Brazil – Carnival

- Tuesday

- All Day: Holiday – Lunar New Year for some Asian Countries incl. China

- 0830 ET: [USD] Consumer Price Index (CPI)

- Forecast: 2.9% (YoY), 0.2% (MoM)

- Previous: 3.4% (YoY), 0.3% (MoM)

- Wednesday

- All Day: Holiday – Lunar New Year for some Asian Countries incl. China

- 0200 ET: [GBP] CPI (YoY)

- Forecast: 4.1%

- Previous: 4.0%

- 1850 ET: [JPY] Gross Domestic Product (GDP) (QoQ)

- Forecast: 0.3%

- Previous: -0.7%

- Thursday

- All Day: Holiday – Lunar New Year for some Asian Countries incl. China

- 0200 ET: [GBP] GDP

- Forecast: -0.2% (MoM)

- Previous: 0.3% (MoM), 0.3% (YoY)

- 0830 ET: [USD] Initial Jobless Claims

- Forecast: 217k

- Previous: 218k

- 0830 ET: [USD] Philadelphia Fed Manufacturing Index

- Forecast: -8.9

- Previous: -10.6

- Friday

- All Day: Holiday – Lunar New Year for some Asian Countries incl. China

- 0830 ET: [USD] Producer Price Index (PPI) (MoM)

- Forecast: 0.1%

- Previous: -0.1%

Bitcoin – Welcome to the Post-ETF World

Summary: In recent weeks we consolidated within the value range of $38k to $48k. Our premise was simple: price over $35k is high-timeframe (HTF) bullish, and over $32k is healthy- keep stacking. This week started spicy for one reason – this morning price broke January’s highs, and is currently (at the time of writing) at nearly $49,000, the highest we’ve seen since late 2021.

Semantics: Sentiment cooled off over the past month, but remained overall positive. The Bitcoin ETFs provided a boost to the perception of Bitcoin and crypto markets, and Bitcoin ETFs are now the SECOND LARGEST ETF commodity in the US after Gold. Its probably safe to say that with these developments, the number of long term holders with conviction in Bitcoin and crypto is rising. Additionally, with Grayscale selling waning, this removes a significant pressure to upward movement, which will further boost sentiment.

- Immediate resistance: ~$49,800 to $50,000

- Immediate support: ~$47,700

- Current value range: $48,900 to $51,700

- Local support levels:

- $48,200

- $47,183

- $45,961

- $44,692

- $42,069

- $41,800

- $40,360

- $40,000 psychological & correlates with 2021 & 2017 levels

- $38,482

- $37,142

- $36,800 (21w EMA)

- $36,043

- $35,700

- $35,000

- $34,271

- $33,000

- Local resistance levels:

- $48,991

- $50,781

- $51,768

- $52,619

Bull Perspective: The success of the ETFs, compounded with relaxing macroeconomic conditions and the Bitcoin’s halving on the horizon – we have the right conditions for an increasingly bullish market in 2024 into 2025. Factor in the reduction in selling pressure due to investors exiting Grayscale, potentially sets up the market for another rally into the next higher value range over $50,000.

Bear Perspective: While economic circumstances appear to be improving, there are still stressors and risks to monitor. If macroeconomic data comes back as weaker than expected, the US Fed can reconsider their retreat from peak rates, and even raise them further. Senator Warren and other leading politicians appear poised to continue an anti-crypto narrative into the next election cycle, potentially stifling investor appetite and bringing more divisive politics to the crypto markets.

Bottom line: Should you buy? Bitcoin remains under it’s previous high, historically that means you have time to stack crypto. Don’t wait, develop a dollar cost average (DCA) strategy you are comfortable with, and begin to buy now before institutions buy more.

Note: why do I rarely cover other coins and tokens on this weekly newsletter? As a cycle trader, I look at Bitcoin as a proxy for the larger crypto market. It drives the cycles that everything else follows, so by understanding Bitcoin, I understand the cycle at large. I do buy and hold altcoins, with my largest allocations in Ethereum and Bitcoin Layer-2 like Stacks.

US Dollar Index (DXY)

Change typically comes slow to the US Dollar. In this case it appears to have peaked in January 2022, and is trending down in accordance with a multi-decade downtrend and inflation/devaluation of the USD.

Over the past two years I discussed the inverse relationship between the strength of the US Dollar (DXY) and speculative markets like crypto and equities. Of particular importance, the ~101 level, arguably the most significant for the DXY. Almost every time in the past 50 years, when DXY rejected from, or closed under the 101 range, it led to a prolonged period of weakening dollar.

If the Fed reduces rates several times in 2024, that will be the catalyst to send it lower. An intermediate target for such a breakdown is around 96. After years of watching the DXY, this writer will throw a party when it finally loses 101.

Why do we care about the DXY?

The Dollar Index is a complex financial data point, a lot of external factors impact its value. But in the simplest terms, you can look at the relationship between DXY and risk assets like Bitcoin simply – they usually move inverse to each other. When DXY is up, BTC is down; and the opposite is true.

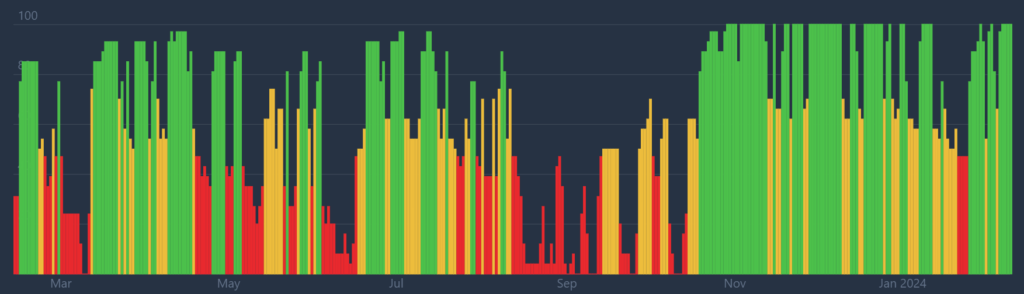

Market Sentiment

While sentiment saw a moderate cooling off in late January into early February, its still significantly elevated from a year ago and remains in a firmly bullish trajectory. Some cooling off was due to the ETFs finally going live, and a small selloff (in part due to Grayscale unwinding a large portion of their massive Bitcoin holdings).

In my opinion, this was a very healthy and overdue retracement in terms of sentiment. Too much bullish sentiment over a sustained period leads unhealthy market conditions, like overleveraged traders; a retrace in sentiment and price provides longevity to any bull market. Also Grayscale distributing their supply of Bitcoin is a positive for the space.

We are kicking off this week back to peak bullish sentiment, corresponding likely the result of Bitcoin rallying to it’s highest level since 2021.

Senator Warren’s anti-crypto bill, and [some] Democrat posturing around crypto, could shift the narrative to a negative tone as the election cycle ramps up. It’s unlikely to stick but introducing political bias to cryptocurrency could lead to other unforeseen issues.

Note: Remember Bitcoin, Ethereum, cryptocurrency is apolitical; its designed by and for the people. Governments, banks, funds, they are tourists here.

——————————————————————————-

If you enjoyed this article and want more hot takes and interesting posts about the economy, web3, crypto, decentralized finance, NFTS and more – you can follow Papi on Twitter/X at https://twitter.com/1MrPapi.

Disclaimer: Nothing found on this website, or any sources linked to this website includes financial advice of any sort. We are not certified financial advisors, use our content at your discretion as entertainment, and as an educational resource. Do your own research.