Crypto & Economic Calendar

The events below inform governments, corporations, traders and investors on the health of the economy. I only list events noted as “high volatility expected” in related markets.

- Monday

- Nothing to report

- Tuesday

- 0500 ET: [EUR] Consumer Price Index (CPI) YoY

- Forecast: 2.4%

- Previous: 2.9%

- 0500 ET: [EUR] Consumer Price Index (CPI) YoY

- Wednesday

- 0200 ET: [GBP] CPI YoY

- Forecast: 4.3%

- Previous: 4.6%

- 0200 ET: [GBP] CPI YoY

- Thursday

- 0830 ET: [USD] Gross Domestic Product (GDP) Q3

- Forecast: 5.2%

- Previous: 2.1%

- 0830 ET: [USD] Initial Jobless Claims

- Forecast: 218k

- Previous: 202k

- 0830 ET: [USD] Gross Domestic Product (GDP) Q3

- Friday

- Half Day: Holiday in UK and New Zealand

- 0200 ET: [GBP] GDP Q3

- 0830 ET: [USD] Personal Consumption Expenditure (PCE) Index

Bitcoin – End of Year Indecision

Summary: Last week’s call was spot on (again), as we called for the first red week in two months. As we approach the final weeks of 2023, its likely to be remembered as as a positive year for crypto and most speculative markets, thanks to Q4 front-running the peak Fed hiking cycle. Bitcoin is approaching 2024 with a measured indecision along the $44k resistance; and that indecision extends to analysts. Some doubt this Q4 rally, and others are ready with the $1 million Bitcoin projections. In more practical terms – price over $35k is bullish and over $32k is healthy. Don’t overthink it, as long as we are under previous highs and ETFs are on the horizon, we are in a good place to stack and wait.

Semantics: Last week the hot news story was Senator Warren’s anti-crypto stance, and proposed legislation. That fear has retreated somewhat, as we approach the holiday seasons, but expect it to resurface in early 2024. Still, sentiment remains overall positive, and the Bitcoin ETFs appear on their route to approval, suggesting the crypto lobby is offering a strong counterpoint to the banking and anti-crypto lobby. While there is always that existential risk of oppressive crypto regulation, I’m comfortable betting it won’t happen and continue to double-down on red days.

Bitcoin Levels: After tapping the mid $40 resistance two weeks ago, we called for a retracement predicted the first red week in two months. Now that we got it, its a question of whether bulls have it in them, on a major holiday week, to push towards $50k, or whether markets will take a breather. Some analysts are concerned about a repeat of 2019, where the start of a bull market collapsed into the March 2020 crash, but I suspect those are irrational fears, as (most) economic indicators are quite strong at the moment.

Looking at momentum, I suspect a most likely scenario is a shakeout this week (ie. a volatile event with some downside move) to test demand, we begin a rally towards $50k. If the bulls fail to show up, we retrace to somewhere between $39k and $36k.

- Immediate resistance: $42,032

- Immediate support: $41,905

- Current value range: $40,000 to $48,600

- Local support levels:

- $41,362

- $40,501

- $40,000

- $38,482

- $37,142

- $36,043

- $35,700

- $35,000

- $34,271 (21w EMA)

- $33,000

- Local resistance levels:

- $42,038

- $42,143

- $42,354

- $42,691

- $43,100

Bull Perspective: Bitcoin used last week as a break, from the longest run of green weekly closes in 5 years, dropping 7.6% at peak. We had a positive FOMC meeting, where the US Fed announced it would likely reduce rates 3 times in 2023- very good news for crypto, equities and other speculative markets. Its difficult to always maintain a longer term outlook, but for the first time in crypto history, we see legitimacy on the horizon, if the ETFs are approved. Compound that with the relaxing macroeconomic conditions, and a bullish storm is brewing for 2024 into 2025.

Bear Perspective: FOMC was a bullish event, but markets may be prematurely pricing in the reduction in rates that are expected in 2024. If any macroeconomic data comes back as less healthy than expected, its still not too late for the Fed to retreat from their idea of peak rates, and even raise it further. And while a continued upside move is possible for Bitcoin in coming weeks, its unlikely we see institutional money enters the market in size before the SEC issues a Bitcoin ETF. With the new Senator Warren bill up for debate, the discussion around crypto again grows negative, potentially stifling investor appetite. With that in mind, any moves beyond $40,000 could reverse if the ETFs are rejected or delayed, or the macro unexpectedly degrades and Bitcoin is impacted.

Bottom line: Should you buy? Bitcoin remains under it’s previous high, historically that means you have time to stack crypto. Don’t wait, develop a dollar cost average (DCA) strategy you are comfortable with, and begin to buy now before institutions do.

Note: why do I rarely cover other coins and tokens on this weekly newsletter? As a cycle trader, I look at Bitcoin as a proxy for the larger crypto market. It drives the cycles that everything else follows, so by understanding Bitcoin, I understand the cycle at large.

US Dollar Index (DXY)

In the past two years I’ve often discussed the inverse relationship between the strength of the US Dollar (DXY) and speculative markets like crypto and equities. Of particular importance, we often discussed the very important ~101 level, arguably the most significant for the DXY. Several times in the past 50 years, when DXY rejected from, or closed under that level, it led to at least a prolonged period of weakening dollar.

Once again we find the DXY on the cusp of losing 101, and if the Fed reduces rates several times in the coming year, that will send the DXY even lower. An intermediate target for such a breakdown is around 96. After years of watching the DXY, this man will throw a party when it finally loses 101.

Why do we care about the DXY?

The Dollar Index is a complex financial data point, a lot of external factors impact its value. But in the simplest terms, you can look at the relationship between DXY and risk assets like Bitcoin simply – they usually move inverse to each other. When DXY is up, BTC is down; and the opposite is true.

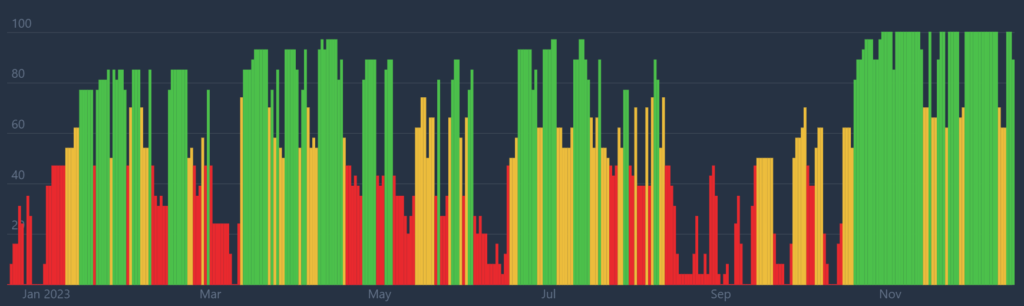

Market Sentiment

While things look up from late last year, and the Fed is starting to take a more dovish tone, there remains a measure of uncertainty in the macroeconomic forecast, and regulatory climate. That said, it is clear the market sentiment is shifting, with growing confidence in the economic recovery, Bitcoin ETF approvals, and Ethereum following it in 2024, and with the worst of the bad news behind us in terms of bad players like FTX and the SBF trial.

Senator Warren’s anti-crypto bill has a chance to shift the crypto narrative to a more negative tone into early 2024, but it’s unlikely to stick and once the bill is defeated, and once the ETFs are live.

We are currently oscillating around neutral with a bullish bias (current score is 66, only down 4 points from last week).

An ETF approval will likely lead to improved sentiment and greed across Bitcoin and crypto markets. Further boosts to market sentiment will follow if the US Fed declares a pause on rates, peak rates, or if a recession is confirmed avoided.

Miscellaneous

New SEC rules go into effect in January 2024 that address short selling manipulation in markets:

- Require institutional investors to report gross short positions monthly & activity by date

- Require parties in stock lending to report info about the loans.

This coincides with Department of Justice (DoJ) and SEC investigation into market manipulation by short sellers and hedge funds. It will be interesting to see how funds react, and how the meme traders respond in turn. With markets likely recovering, there may be an opportunity for a repeat of the 2021 meme stock mania like we saw with GME or AMC.

——————————————————————————-

If you enjoyed this article and want more hot takes and interesting posts about the economy, web3, crypto, decentralized finance, NFTS and more – you can follow Papi on Twitter/X at https://twitter.com/1MrPapi.

Disclaimer: Nothing found on this website, or any sources linked to this website includes financial advice of any sort. We are not certified financial advisors, use our content at your discretion as entertainment, and as an educational resource. Do your own research.