Crypto & Economic Calendar

The events below inform governments, corporations, traders and investors on the health of the economy. I only list events noted as “high volatility expected” in related markets.

- Monday

- Nothing to report

- Tuesday

- 0830 ET: [USD] Consumer Price Index (CPI)

- Forecast: 0.3%

- Previous: 0.2%

- 0830 ET: [USD] Consumer Price Index (CPI)

- Wednesday

- 0830 ET: [USD] Producer Price Index (PPI)

- Forecast: 0.1%

- Previous: -0.5%

- 1400 ET: [USD] Federal Open Market Committee (FOMC) Rate Decision

- Forecast: 5.5%

- Previous: 5.5%

- 14030 ET: [USD] FOMC Press Conference

- 0830 ET: [USD] Producer Price Index (PPI)

- Thursday

- 0700 ET: [GBP] BoE Interest Rate Decision

- Forecast: 5.25%

- Previous: 5.25%

- 0830 ET: [USD] Initial Jobless Claims

- Forecast: 221k

- Previous: 220k

- 0830 ET: [USD] Retail Sales

- 0700 ET: [GBP] BoE Interest Rate Decision

- Friday

- Global Services Purchasing Managers Index (PMI)

- Forecast: 50.8

- Previous: 50.6

- Global Services Purchasing Managers Index (PMI)

Bitcoin – Healthy Flush of Leverage

Summary: Last week we ended our summary with “… in the near term, pullbacks will happen, and we want to see bulls defend $40k into the weekly close.” That is precisely what we got, so congrats to those who follow along. Short but steep retracements are not only healthy, but required for price to continue to the upside. It flushes the greed and excess leverage in markets. So far this is a shallow, bullish retracement but anything over $35k is bullish, over $32k is healthy. That said, this is on-track to potentially be the first red week after 8 green weeks. For those who follow me on Twitter, you’ll recall we discussed this- we haven’t seen 8 green weeks since 2017 and a red week felt overdue.

Semantics: The new narrative is Senator Warren’s anti-crypto bill. This will be a popular fud in the near term, but unlikely to become law. Its clear she is doing this at the behest of TradFi/banking lobby, like Jamie Dimon, Chief of JP Morgan. But BlackRock has deeper pockets and a better track record, plus there is support enough for crypto in the US Congress to challenge this bill. This is a record year for crypto lobby (paying for the sins of FTX). While there is always that existential risk of oppressive crypto regulation, I’m comfortable betting it won’t happen and continue to double-down on red days.

Bitcoin Levels: After breaching the $40k resistance and entering a new value range, we saw bulls return to, and defend, $40k as support. But the week is not over and a deeper retracement is possible. An intraweek wick to the upper $30s (>$37k) is a likely scenario, as is sideways chop, courtesy of leveraged players. Remaining over $40k through the week is a very clear sign of strength in the meantime.

- Immediate resistance: $42,130

- Immediate support: $40,900

- Current value range: $40,000 to $48,600

- Local support levels:

- $40,000

- $39,980

- $38,482

- $37,142

- $35,700

- $35,000

- $33,654 (21w EMA)

- $33,000

- $31,778 (20w SMA)

- $30,000

- Local resistance levels:

- $42,143

- $42,354

- $42,691

- $43,100

Bull Perspective: I’ll keep this section simple. Bulls have been in the driver seat over the past 8 weeks. While the intermediate target for bulls is $47k, Bitcoin needs a break after, the longest run of green weekly closes in 5 years. Sideways chop along the upper $30s to lower $40s would be the ideal scenario. The FOMC is this week and depending on what Jerome Powell says at the FOMC press conference, markets could rally. Even with positive FOMC news, I suspect crypto will be muted, Bitcoin potentially peaking around mid $40s in a best-case scenario. I am using this week to do a little more accumulation via my dollar cost average (DCA) strategy, and will be grateful for any red weeks when we get them.

Bear Perspective: We have the FOMC this week, which will offer short-lived volatility but unlikely to change the course of the macro narrative, which is that peak rates are behind us. While a continued upside move is possible for Bitcoin in coming weeks, its unlikely we see institutional money enters the market in size before the SEC issues a Bitcoin ETF. With the new Senator Warren bill up for debate, the discussion around crypto again grows negative, potentially stifling investor appetite. With that in mind, any moves beyond $40,000 could reverse if the ETFs are rejected or delayed, or the macro unexpectedly degrades and Bitcoin is impacted.

Bottom line: Should you buy? Bitcoin remains under it’s previous high, historically that means you have time to stack crypto. Don’t wait, develop a dollar cost average (DCA) strategy you are comfortable with, and begin to buy now before institutions do.

US Dollar Index (DXY)

The Dollar Index showed some short term strength through September, due to an indecisive but decidedly more hawkish US Fed, but that rally faded in October as market sentiment pivoted and through November into December it’s clear that markets are forward looking to 2024, with the expectation of a reduction in rate hikes during H1 2024.

November closed under 106.6, meaning a lower high was set adding confirmation of a downtrend, with a downside target of upper 90s possible in 2024. The DXY saw a little bounce from the 102 range, and I suspect it could rally as high as 105 before continuing to trend down. With the FOMC news this week, we have a chance to confirm the weakening DXY (most likely), or economic numbers justify additional rate hikes and we see the DXY recover ground, climbing back over 105.

Why do we care about the DXY?

The Dollar Index is a complex financial data point, a lot of external factors impact its value. But in the simplest terms, you can look at the relationship between DXY and risk assets like Bitcoin simply – they usually move inverse to each other. When DXY is up, BTC is down; and the opposite is true.

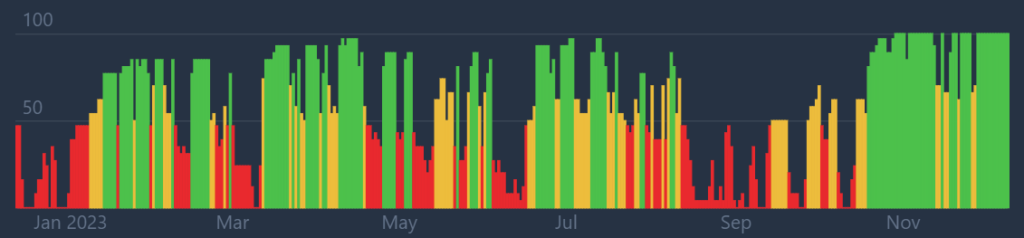

Market Sentiment

While things look up from late last year, there remains a measure of uncertainty in the macroeconomic forecast, and regulatory climate. That said, it is clear the market sentiment is shifting, with growing confidence in the economic recovery, Bitcoin ETF approvals, and Ethereum following it in 2024, and with the worst of the bad news behind us in terms of bad players like FTX and the SBF trial.

Senator Warren’s anti-crypto bill has a chance to shift the crypto narrative to a more negative tone in the coming weeks, but it’s unlikely to stick and once the bill is defeated, we’ll move on.

We are currently oscillating around neutral with a bullish bias (current score is 70).

An ETF approval will likely lead to improved sentiment and greed across Bitcoin and crypto markets. Further boosts to market sentiment will follow if the US Fed declares a pause on rates, peak rates, or if a recession is confirmed avoided.

Miscellaneous

New SEC rules go into effect in January 2024 that address short selling manipulation in markets:

- Require institutional investors to report gross short positions monthly & activity by date

- Require parties in stock lending to report info about the loans.

This coincides with Department of Justice (DoJ) and SEC investigation into market manipulation by short sellers and hedge funds. It will be interesting to see how funds react, and how the meme traders respond in turn. With markets likely recovering, there may be an opportunity for a repeat of the 2021 meme stock mania like we saw with GME or AMC.

——————————————————————————-

If you enjoyed this article and want more hot takes and interesting posts about the economy, web3, crypto, decentralized finance, NFTS and more – you can follow Papi on Twitter/X at https://twitter.com/1MrPapi.

Disclaimer: Nothing found on this website, or any sources linked to this website includes financial advice of any sort. We are not certified financial advisors, use our content at your discretion as entertainment, and as an educational resource. Do your own research.