Crypto & Economic Calendar

The events below inform governments, corporations, traders and investors on the health of the economy. I only list events noted as “high volatility expected” in related markets.

- Monday

- 2230 ET: [AUD] RBA Interest Rate Decision

- Forecast: 4.35%

- 2230 ET: [AUD] RBA Interest Rate Decision

- Tuesday

- 0945 ET: [USD] Services Purchasing Managers Index (PMI)

- 1000 ET: [USD] Non-Manufacturing PMI

- 1000 ET: [USD] Job Openings

- Wednesday

- 0815 ET: [USD] Nonfarm Employment Change

- Forecast: 128k

- Previous: 113k

- 1000 ET: [CAD] BoC Interest Rate Decision

- Forecast: 5%

- 1030 ET: [USD] Crude Oil Inventories

- 0815 ET: [USD] Nonfarm Employment Change

- Thursday

- 0830: [USD] Initial Jobless Claims

- Forecast: 223k

- Previous: 218k

- 1850: [JPY] Gross Domestic Product (GDP)

- 0830: [USD] Initial Jobless Claims

- Friday

- 0200 ET: [EUR] German Consumer Price Index (CPI)

- Forecast: -0.4%

- Previous: 0.0%

- 1100 ET: [USD] Unemployment Rate

- Forecast: 3.9%

- Previous: 3.9%

- 0200 ET: [EUR] German Consumer Price Index (CPI)

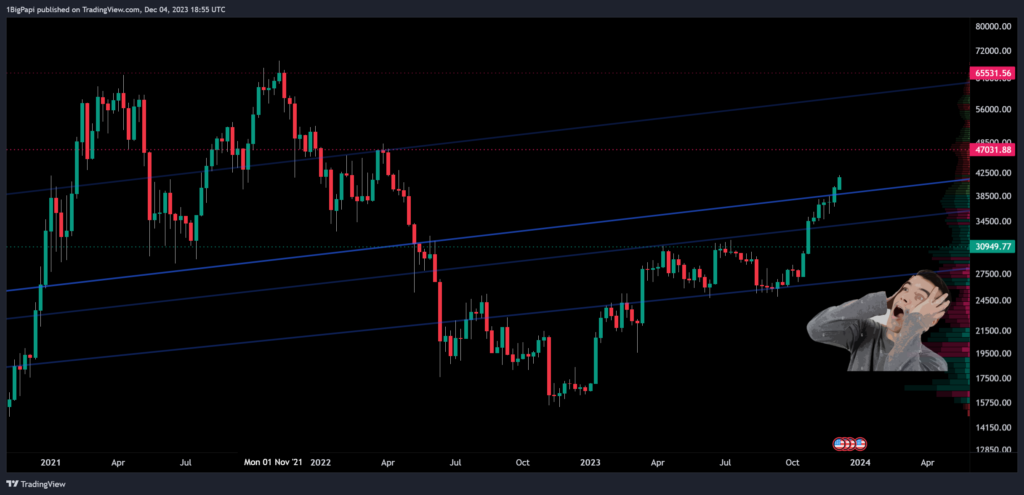

Bitcoin Spice – Getting Spicier!

Summary: We spoke last week about price compression under a key resistance and on the back of 7 weekly green candles – it was a clear sign of strength. Looks like the bulls finally breached $40k – congratulations to everyone who invested over the past year as we suggested. The good news? We aren’t even at previous highs – this has a lot more room to run, and 2024 will be spicy. But in the near term, pullbacks will happen, and we want to see bulls defend $40k into the weekly close.

Bitcoin Levels: Price finally reached the next value range, this one between $40k and $48.6k. Historically a predominantly red value range

- Immediate resistance: $42,130

- Immediate support: $40,900

- Current value range: $40,000 to $48,600

- Support levels:

- $40,000

- $39,980

- $38,482

- $37,142

- $35,700

- $35,000

- ~$34,800

- $33,000

- 30,170

- $29,379

- $26,145

- $25,100

- $22,240

- $20,981

- Resistance levels:

- $37,592

- $37,993

- $38,094

- $40,400

- $42,354

- $46,967

Bull Perspective: I’ll keep this section simple. Bulls have been in the driver seat over the past ~8 weeks. We need to see bulls defend the $40k or higher support levels into the weekly close. Assuming that we continue to the upside in the coming week(s), ~$47k is most likely the next range of resistance. This could lead some some consolidation in the mid to upper $40k range.

Bear Perspective: The chart looks bullish, sentiment is rising – all positives. However, while a continued upside move is possible, its unlikely we see institutional money enters the market in size before the SEC issues a Bitcoin ETF. With that in mind, any moves beyond $40,000 could reverse if the ETFs are rejected or delayed, or the macro degrades further and Bitcoin is impacted.

Bottom line: Should you buy? Bitcoin remains under it’s previous high, historically that means you have plenty of time to stack crypto. Don’t wait, develop a dollar cost average (DCA) strategy you are comfortable with, and begin to buy now before institutions do.

US Dollar Index (DXY)

The Dollar Index showed some short term strength through September, due to an indecisive but decidedly more hawkish US Fed, but that rally faded in October as market sentiment pivoted and through November it’s clear that markets are forward looking to 2024, with the expectation of a reduction in rate hikes during H1 2024.

November closed under 106.6, meaning a lower high was set adding confirmation of a downtrend, with a downside target of upper 90s possible in 2024. The DXY saw a little bounce from the 102 range, and I suspect it could rally as high as 105 before continuing to trend down.

Why do we care about the DXY?

The Dollar Index is a complex financial data point, a lot of external factors impact its value. But in the simplest terms, you can look at the relationship between DXY and risk assets like Bitcoin simply – they usually move inverse to each other. When DXY is up, BTC is down; and the opposite is true.

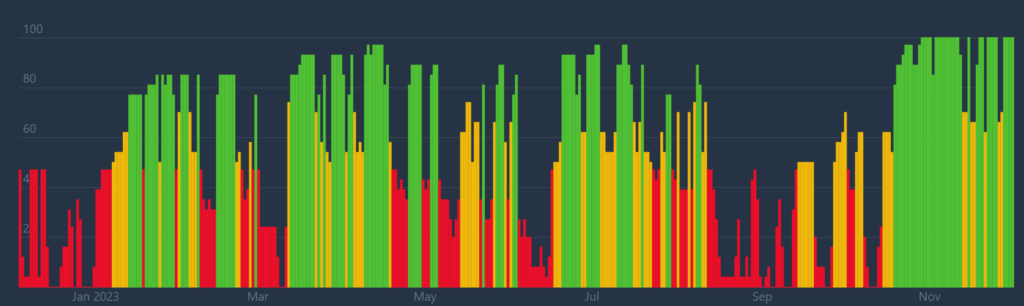

Market Sentiment

While things look up from late last year, there remains a measure of uncertainty in the macroeconomic forecast, and regulatory climate. That said, it is clear the market sentiment is shifting, with growing confidence in the economic recovery, Bitcoin ETF approvals, and Ethereum following it in 2024, and with the worst of the bad news behind us in terms of bad players like FTX and the SBF trial.

We are currently oscillating around mid to upper 100 (extreme greed), up from 47 (bearish) a year ago – this is the highest sentiment has been since Q4 of 2021, nearly two years ago.

An ETF approval will likely lead to improved sentiment and greed across Bitcoin and crypto markets. Further boosts to market sentiment will follow if the US Fed declares a pause on rates, peak rates, or if a recession is confirmed avoided.

——————————————————————————-

If you enjoyed this article and want more hot takes and interesting posts about the economy, web3, crypto, decentralized finance, NFTS and more – you can follow Papi on Twitter/X at https://twitter.com/1MrPapi.

Disclaimer: Nothing found on this website, or any sources linked to this website includes financial advice of any sort. We are not certified financial advisors, use our content at your discretion as entertainment, and as an educational resource. Do your own research.