Crypto & Economic Calendar

The events below inform governments, corporations, traders and investors on the health of the economy. I only list events noted as “high volatility expected” in related markets.

- Monday

- All Day: Canada Bank Holiday

- Tuesday

- 0200 ET: [EUR] German Consumer Price Index (CPI)

- Wednesday

- 0815 ET: [USD] ADP Non-Farm Employment Change

- 1030 ET: [USD] Crude Oil Inventories

- Thursday

- 0830 ET: [USD] CPI (Core, MoM, YoY)

- Friday

- 0200 ET: [GBP] Gross Domestic Product (GDP)

- 0830 ET: [USD] Producer Price Index (PPI)

Bitcoin Indecision Continues

Summary: Bitcoin continues with a measure of uncertainty, ranging tightly between $28k and $30k, with a recent low around $28.6 where it bounced off the 20w SMA support. From a Fibonacci perspective, this is the same pattern observed several times since December with a retracement between the 38% and 50% fib before climbing higher.

Macroeconomic events remain significant but the narrative is starting to shift from macro to regulatory concerns; and with the US Dollar Index (DXY) appearing poised to possibly lose 101 this quarter, money may return to risk assets, and crypto specifically, if the US avoids a recession.

Bitcoin Levels: $30k marked the most important support level in 2021’s bull market. $30k withstood several retests, until the Luna meltdown in mid 2022. Afterwards, Bitcoin didn’t touch $30k again until April 2023. Since April Bitcoin has ranged between $25k and $31k.

- Immediate resistance: $29,200

- Immediate support: $28,900 (the 38 fib level)

- Current value range: $28,800-$30,600 [historically bearish range due to the massive distribution during the Luna meltdown; optimistically flipping to accumulation range now]

- Support levels: $28,900-$29,000; $28,600 (20w SMA), $28,000 (50 fib level), $27,900 (21w EMA); $26,300, $25,500

- Resistance levels: $29,200; $30,100; $30,600; $31,300-$32,000; $34,000-$36,500; $37,500; $40,000

Bull Perspective: BlackRock’s request for a Bitcoin Spot ETF and Ripple’s victory in the XRP suit remain the catalyst for increased bullish sentiment through Q2, but macroeconomic factors still matter While they are marginally improving, a bad month or confirmation of a recession will stifle upward momentum.

- 23.6% fibonacci retracement at $30,061

- 38.2% retracement at $28,900

- 50% at $28,000

- 62% at $27,200

- The “bull market support” moving averages (20w & 21w) are between $27.9k and $28.6k

Bear Perspective: Despite the implied clarity from Ripple’s win, there is no clear playbook for crypto in the U.S. The much touted ETF requests are not guaranteed and if they are rejected, may drive a selloff in crypto markets. Additionally, big players like BlackRock isn’t all good news – many have a reputation for manipulating markets.

Looking at price action, the diagonal support extending from mid 2022 appears to be the trend mean, with price oscillating around it since after the Luna meltdown. As noted last month – bulls couldn’t escape the sell pressure over $31k, another swing low into the upper $20s was inevitable. Now it becomes a test of support, and demand, in this range.

One might suspect that industry players are forcing price into a range so they can accumulate ahead of regulatory approvals.

US Dollar Index (DXY)

Note: The DXY chart above is set to 12 month candles, to present the general decline of the US Dollar over the past 50 years +.

Since last year we’ve been waiting for the US Dollar Index (DXY) to lose support between 101 and 102 on the monthly. Historically that led to prolonged (multi-year) downtrends at least 5 times.

Intramonth, the DXY touched it’s lowest level since April 2022. If you observe the red horizontal level at 101.6, at least 5 times in the past 50 years, losing that led to several years of the US Dollar trending down. While July saw the DXY barely recover to close just over 102, the trend and sentiment favors more downside over the next quarter.

Why do we care about the DXY?

The Dollar Index is a complex financial data point, a lot of external factors impact its value. But in the simplest terms, you can look at the relationship between DXY and risk assets like Bitcoin simply – they usually move inverse to each other. When DXY is up, BTC is down; and the opposite is true.

DXY’s bearish sentiment, coupled with a hawkish outlook for the Euro (a key economic competitor), Bitcoin’s rising sentiment on the back of ETF news and Ripples win, and next year’s Bitcoin halving – things are shaping up for a potentially bullish 2024/2025.

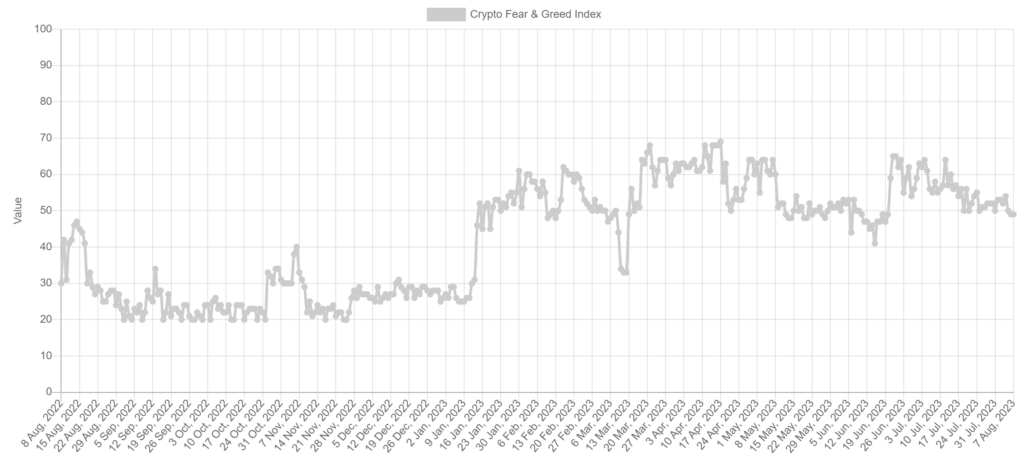

Market Sentiment

With the narrative shifting from macro to regulatory concerns in the crypto space, we see some indecision. Ranging around 50, this represents a market awaiting news on BlackRock’s ETF, with an approval likely leading to a strong increase in greed across Bitcoin and crypto markets. Further boosts to market sentiment will follow if the US Fed declares a pause on rates, peak rates, or if a recession is confirmed avoided.

Trading Tips

Like many of you, I invest in more than just Bitcoin; but every crypto investor should have exposure to Bitcoin, understand it, and respect what Satoshi created – Bitcoin revolutionized the concept of financial and individual sovereignty, and spawn a trillion dollar digital currency market.

Here are three reasons why you should have Bitcoin in your portfolio:

- Digital Gold and Store of Value: Bitcoin has a fixed supply of 21 million, unlike fiat currencies which can be printed freely, devaluing them. This scarcity positions Bitcoin as a potential hedge against inflation over longer timeframes.

- Decentralization and Censorship Resistance: Bitcoin runs on a decentralized network free from central control, ensuring transactions are resistant to censorship, appealing to those prioritizing financial sovereignty or who live in an oppressive environment.

- Potential for Appreciation & Adoption: Despite intracycle volatility, Bitcoin has trended up-only since it’s inception. As it gains mainstream acceptance and institutional interest, its value and adoption could further rise.

If you enjoyed this article and want more hot takes and interesting posts about the economy, web3, crypto, decentralized finance, NFTS and more – you can follow Papi on Twitter/X at https://twitter.com/1MrPapi.

Disclaimer: Nothing found on this website, or any sources linked to this website includes financial advice of any sort. We are not certified financial advisors, use our content at your discretion as entertainment, and as an educational resource. Do your own research.