By Maugie

–> Maugie on Twitter

–> Hire for Freelance!

Click for Audio Read!

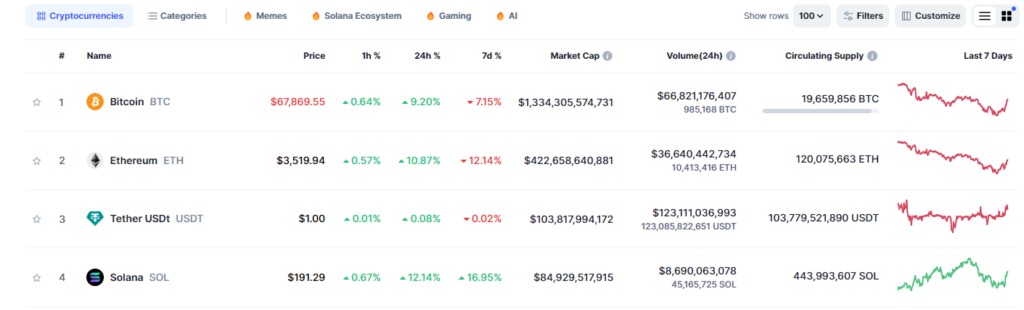

In the dynamic world of cryptocurrencies, staying informed about the top traded tokens is crucial for investors and enthusiasts alike. Today, we’re diving deep into the analysis of the top 4 traded crypto tokens on Binance, focusing on their recent performance, technical analysis (TA), and the latest news affecting their market movement.

1. Bitcoin (BTC)

Bitcoin, the original cryptocurrency, has seen a notable recovery in its market performance, with the price reaching $67,871.10. This 9.41% increase over the last 24 hours is attributed to a broader market recovery, where Bitcoin has found strong buying interest around the $67,700 mark. The global market cap for BTC stands at $1,334,336,087,766, emphasizing its dominance.

Technical Analysis:

- RSI (Relative Strength Index): At 79.92, indicating overbought conditions but reflecting strong buying interest.

- MFI (Money Flow Index): Also in the overbought territory at 91.05, suggesting high investor interest.

- MACD (Moving Average Convergence Divergence): Shows a bullish crossover, signaling potential for further price increase.

Recent news highlights Bitcoin’s resilience, with potential for further growth post-Federal Reserve’s interest rate decisions, and the renewed investor interest in Bitcoin ETFs as market confidence grows.

2. Ethereum (ETH)

Ethereum follows closely behind Bitcoin, with its price at $3,512.08 and a 10.91% increase in the last day. The platform’s shift towards asset tokenization, especially with BlackRock’s new fund on the Ethereum network, highlights Ethereum’s growing appeal beyond its foundational use cases.

Technical Analysis:

- RSI: At 66.7, indicating strong buying momentum.

- MFI: Suggesting significant buying pressure with a reading of 83.71.

- MACD: Exhibits a bullish trend, supporting the strong buy sentiment.

The broadening of Ethereum’s applications, from decentralized finance (DeFi) to tokenized assets, is setting a solid foundation for its market position and investor interest.

3. Tether (USDT)

Tether, the largest stablecoin by market cap, has maintained its peg at $1.00, with minor fluctuations in its trading volume. USDT serves as a cornerstone of the crypto trading ecosystem, providing liquidity and a safe haven during market volatility.

Technical Analysis:

- Being a stablecoin, USDT’s price analysis revolves more around its market cap and volume than technical indicators. The recent trading volume of $123,066,442,409 underscores its pivotal role.

The introduction of new assets like Raffle Coin (RAFF) and DeeStream (DST) to Tether holders highlights the ongoing diversification within the crypto space.

4. Solana (SOL)

Solana has emerged as a formidable competitor in the blockchain space, with its price at $191.03 and an impressive 11.99% increase in the last 24 hours. Its high throughput and low transaction costs continue to attract developers and investors alike.

Technical Analysis:

- RSI: Reflects strong buying activity at 80.37.

- MFI: Confirms the bullish sentiment with a value of 76.11.

- MACD: Indicates a bullish trend, further solidified by a bullish crossover in the STOCH.

The surge in Solana’s value can be partly attributed to the anticipation around new DeFi projects and NFT launches on its platform, enhancing its ecosystem’s vibrancy and appeal.

Conclusion

The crypto market is witnessing a remarkable recovery, led by major players like Bitcoin and Ethereum, alongside rising stars like Solana. The intersection of positive technical indicators, increasing institutional interest, and innovative developments across the blockchain technology spectrum is fueling optimism for future growth.

Disclaimer: This analysis is for informational and entertainment purposes only. It is not intended to be financial advice. The views expressed are those of the author and do not necessarily reflect the official policy or position of any agency or company. Cryptocurrency investments are volatile and high risk in nature. Don’t invest more than what you can afford to lose. Before making any financial decisions, consult with a qualified professional.