We have curated a list of ten of the most promising altcoin charts I am not going to miss. In this blog post, we will examine each chart in detail and discuss link to our risk control strategies for some exciting potentials. Our trading plan is an objective and methodical filter that reveals the most promising cryptocurrencies to watch. Today our system published a few new signals – let’s look at the charts!

Before we get into the most promising altcoin charts with our trading pattern,

Our main focus is to put $20 a week aside and double that money every year to become a crypto millionaire in 7 years.

But the trick is we must set it up so that our money works for us while we’re doing other things.

DCA is Bullshit.

Dollar cost averaging involves investing a fixed amount of money at regular intervals regardless of the asset’s price trend.

Investing with the trend refers to the strategy of buying financial assets that are showing an upward price trend and selling assets that are showing a downward trend.

One benefit of investing with the trend is that it can lead to higher returns. By only buying assets that are showing an upward price trend is about to begin, an investor is more likely to experience price appreciation, which can translate into higher returns. On the other hand, dollar cost averaging into an investment without regard to the price trend means that an investor may continue to add to losing investments, leading to lower returns.

Another benefit of investing with the trend is that it can reduce risk. By adding to your cash stack weekly, but only holding assets that are showing an upward price trend, an investor is less exposed to downward price movements. This can potentially lead to growing a stable cash portfolio in bear markets and lower risk of loss.

PRO Traders Know DCA Is Hogwash!

The internet has stripped away the curtain between the bank representative and the privileged portfolio investment manager – and poof – once you look over their shoulder you begin to see promising altcoin charts yourself… this is so simple that YOU CAN DO IT TOO!

- Can we actually identify the start and end of Altcoin Season?

- Is it really possible to identify when the average of a group cryptocurrencies are changing price direction from bearish to bullish?

Yes. It’s actually quite simple.

There are three technical indicators that our experienced analysts and full time traders use to identify promising altcoin charts at the start and at the end of Altcoin Season:

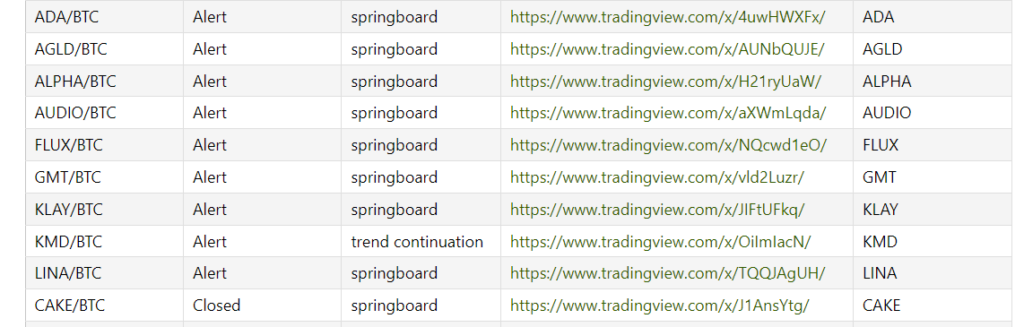

We use moving averages, trend lines, and chart patterns. Below are some realtime examples from Alerts generated by our Crypto Signal Provider Service – and I’m exited to share these charts with you today.

The charts below are from Today’s @bitcointrading livestream on YouTube –

packed with valuable insights on BTC, BTC.D,

ADA, AGLD, ALPHA,

AUDIO, FLUX, GMT,

KLAY, KMD, LINA, and CAKE.

ADA (Cardano): ADA is a decentralized Layer 1 blockchain platform that aims to provide a more secure and sustainable infrastructure for the development and execution of smart contracts and decentralized applications.

AGLD (Adventure Gold): AGLD is a decentralized gaming platform that uses blockchain technology to create in-game economies and allow players to earn cryptocurrency rewards for their in-game achievements.

ALPHA (Alpha Metacity): a decentralized finance (DeFi) project that aims to create a metaverse of interconnected virtual worlds on the blockchain. The project’s main goal is to enable users to own and monetize their virtual assets while providing a seamless gaming and social experience. Alpha Metacity uses its native ALPHA token to facilitate transactions within the ecosystem, and also offers staking and liquidity mining programs for token holders.

AUDIO (Audius): AUDIO is a decentralized music streaming platform that allows artists to distribute their content directly to their fans, bypassing traditional intermediaries such as record labels.

FLUX (Flux Cloud): Flux Cloud also includes Flux Drive, which offers the next generation of decentralized storage. With these features, RunOnFlux.io aims to break down the barriers of Web 3.0 and provide a seamless experience for developers looking to build on the Flux network.

GMT (STEPN): GMT is a self-styled “Web3 lifestyle app” with GameFi elements on the Solana blockchain. It combines aspects of a play-to-earn game with a fitness app to create a new category coined “move-to-earn.” Users buy NFT sneakers, which they can use to earn in-game currency while walking, running, or jogging.

KLAY (Klaytn): KLAY is a blockchain platform that aims to enable the development and deployment of enterprise-level decentralized applications.

KMD (Komodo AtomicDEX): KMD is a non-custodial cryptocurrency exchange developed by Komodo Platform. It is built on a decentralized architecture and utilizes atomic swap technology to enable peer-to-peer trading of cryptocurrencies without the need for intermediaries. AtomicDEX allows users to trade cryptocurrencies directly from their own wallets, giving them complete control over their funds.

LINA (Linear Finance): LINA is a decentralized synthetic asset platform that allows users to create and trade a variety of financial instruments, such as commodities and forex.

CAKE (PancakeSwap): CAKE is a decentralized exchange (DEX) built on the Binance Smart Chain, which allows users to trade various cryptocurrencies in a fast and low-cost manner.

Get Prepared For MORE Promising Altcoin Charts

Speculating and Investing vs Gambling

It is important to make a distinction between speculating and gambling. Our focus is to stay away from the gambling mindset and to start off a long term, careful and considered mindset of an investor.

Remember the chant ‘Money works for me’,

and not ‘I’ll be lucky with money’.

All of us are emotionally connected to money because it is part of survival, security, comfort and freedom. When you have lots of money everything’s a lot easier – when you don’t have money… not only are circumstances more difficult, but if you also make these 12 common trading mistakes, you may even begin to doubt yourself.

The emotions you feel while you are trading are much more important than many people acknowledge. The negative emotions created by the addiction-style compulsive need-to-watch-the-markets can begin to affect all relationships in all areas of your life – and even your health.

Best Crypto Price Predictions for 2023

Technical Analysis is not about making predictions about future price movements, though the clickbait headlines on youtube may lure you into that horoscope-method-of-trading.

While predicting price movement for the promising altcoin charts is important part of the trading process, price movement is ultimately not within a trader’s control.

The primary job of a trader is managing the two sides of risk

mitigating the potential for loss.

maximizing the potential for gains.

A crypto traders primary job involves identifying and analyzing potential risks, developing strategies to mitigate exposure to those risks, and implementing those strategies effectively. Their secondary job is to increase exposure to risk when the trade is going in our favor.

By understanding the principles of risk control technical analysis, you can gain a deeper understanding of the real job that is required for successfully trading the promising altcoin charts of 2023

About the author

Doug is a full time crypto trader and the creator of the Altseason CoPilot. He is a strong believer in the small trader. He shares his biggest trading mistakes so you might avoid them, and evangelizes the strategy of making your money work for you while you do other things!

Follow Doug on Twitter. Connect on Linkedin. Watch on YouTube.