Altcoins, or alternative cryptocurrencies, are digital currencies that emerged after the success of Bitcoin. They are based on similar principles and/or use similar technology.

In this article we look at altcoins that occupied the 2013 top ten list for crypto, as measured by market cap. These are among the earliest altcoins, and historically significant as a test bed for ideas and technologies still used today, like Proof of Stake (PoS) consensus algorithms.

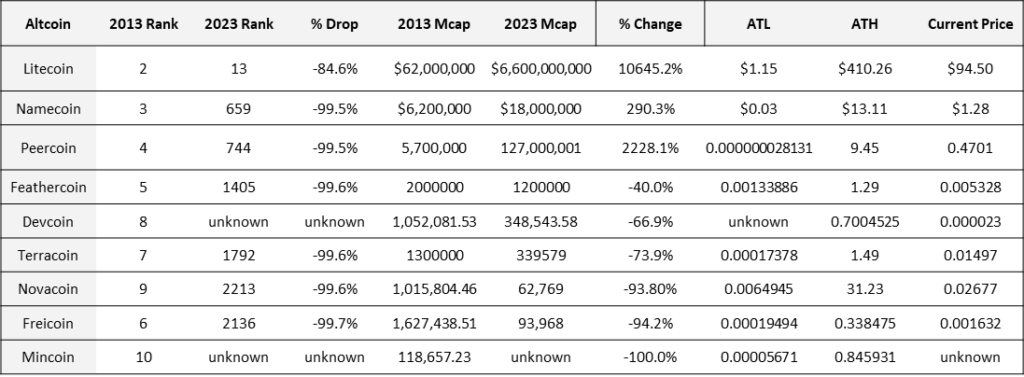

We will also compare their values and performance from 2013 to 2023. To put things into perspective, Bitcoin’s market cap (total value of all coins or tokens in circulation) was $1.2 billion in May of 2013, and is $449 billion in 2023, at the time of writing.

General Observations:

- Many early altcoins were more fairly launched than those in later cycles.

- Early altcoins were experiments, particularly with consensus algorithms and emissions paid to miners. For example, they introduced new algorithms, like PoS, or hybrid models that use aspects of Proof of Work (PoW) that Bitcoin uses, and PoS.

- Most early altcoin projects are in a deprecated to abandoned state. Some are ghost chains, meaning no real use or investors and minimal mining or staking activity. 70% of the top ten altcoins from 2013 are effectively at or approaching zero users, investors and/or activity in 2023.

- Litecoin is the most successful early altcoin, but Namecoin, Feathercoin and Peercoin remain somewhat active and in-use still.

Namecoin (NMC):

- Ranked #3 in May 2013, it dropped to #659 in 2023. Despite the drop, its market cap grew by nearly 300%.

- Namecoin was launched in 2011 as a fork to Bitcoin, becoming the first altcoin in existence. The Namecoin codebase consists of the Bitcoin codebase with relatively minor changes (~400 lines) focused on a naming system versus Bitcoin’s focus on serving as a currency.

- Namecoin’s primary purpose was to provide users with an alternative way of protecting their online identities. They did this by providing domain names within the .bit domain namespace which are not subject to censorship or interference from authorities.

- The inspiration for Namecoin likely came from Satoshi, the creator of Bitcoin. Satoshi suggested the idea of awarding domain names to miners, “While you are generating bitcoins, why not also get free domain names for the same work? If you currently generate 50 BTC per week, now you could get 50 BTC and some domain names too.”

Litecoin (LTC):

- Ranked #2 in May 2013, it dropped to #13 in 2023. During that time it’s market cap grew over 10,000%, the best performer on this list.

- Litecoin was launched in 2011 by Charlie Lee, a former Google employee, intending to improve on Bitcoin’s scalability and transaction speed issues, envisioning a “lite” version of Bitcoin.

- Litecoin transactions are processed four times faster than Bitcoin’s, with cheaper fees, and have a total cap of 84 million coins compared to 21 million for Bitcoin.

- In December of 2017, Lee sold his entire holding of Litecoins saying he wanted “to avoid any conflict of interest between me and Litecoin.” This remains a divisive moment for the community as Charlie sold near the top of the cycle and the the market dropped significantly in the months that followed.

Peercoin:

- Ranked #4 in May 2013, it dropped to 744 in 2023. During this time it’s market cap grew by 2,200%, the second best performer after Litecoin.

- Peercoin (PPC) was created in 2012 and is the first implementation of a proof-of-stake consensus (PoS). As a reminder, PoS is the consensus algorithm that Ethereum moved their chain to in 2022, viewed as more energy efficient compared to the PoW algorithm used by Bitcoin, but some argue its not as decentralized or secure.

- Peercoin is among the more active projects on this list alongside Litecoin and Namecoin, with a busy forum and ongoing development.

Feathercoin (FTC):

- Ranked #5 in May 2013, it dropped to #1405 in 2023. During that time it’s market cap dropped 40%, the smallest loss among losers on this list.

- Feathercoin was launched in 2013 as a fork of Litecoin and was intended to be an improved, more advanced version of Bitcoin. These days its advertised as a test bed for Litecoin and Bitcoin.

- Feathercoin uses NeoScrypt as its proof-of-work algorithm. It switched to NeoScrypt from Litecoin’s Scrypt after a 51% attack on their chain.

Terracoin (TRC):

- Ranked #7 in May 2013, it dropped to 1792 by 2023. During this time it’s market cap dropped 74%.

- Terracoin (TRC) was created in October of 2012 as a fork of the Bitcoin protocol, to address some of the scalability issues associated with Bitcoin.

- In 2020 the original foundation managing Terracoin resigned, and the community took ownership of the project.

- It appears the Terracoin community is still attempting to restructure and is not fully functional. At the time of writing, the author is awaiting a reply from the foundation with updates.

Devcoin:

- Ranked #8 in May 2013, Devcoin was delisted from major cryptocurrency tracking sites. While limited data is available, it appears over $300,000 in liquidity exists still, suggesting the market cap only dropped 67% since 2013.

- Devcoin is one of the oldest altcoins in existence, claiming to be the third altcoin created. It was envisioned as supporting Open Source programmers and writers, and eventually to support musicians, painters, graphic artists and filmmakers via the non-profit Software Freedom Conservancy.

- Devcoin, like Namecoin and some other early altcoins, were originally “merge mined,” meaning they could be mined at the same time as mining for Bitcoin.

- As of December 2022 Devcoin announced a rebranding/restructure of the project. At the time of writing, no further information was provided. The lack of price data suggests its no longer available for trade on exchanges.

Freicoin:

- Ranked #6 in May 2013, it dropped to #2136 by 2023. During that time it’s market cap dropped by 94%.

- Freicoin was created in December 2012. It was envisioned as an alternative to Bitcoin that implements a yearly tax on holders to discourage hording of the supply. To stabilize the value of the token, they minted new tokens at the same rate but awarded these to miners of FRC.

- This alternative economic theory appears unsuccessful, as Freicoin is likely a dead chain and project, and most of the content on it’s website is from 2013.

Novacoin:

- Ranked #9 in 2013, it dropped to #2213 by 2023. During that time it’s market cap dropped by 94%.

- Novacoin was created in February 2013 to be an improvement on Peercoin. It rewarded holders for the coins they already have, which is different from some other models we see forked and derivative of Bitcoin.

- In the early altcoin days, Novacoin was viewed favorably, with even Cointelegraph.com authoring a flattering commentary of it on their one year anniversary from launch.

- Novacoin has a very small but active community, and the chain is operational with little to no usage or trading. At the time of writing, it logged $6 of trading volume in 24 hours.

Mincoin:

- Formerly ranked #10 in 2013, it appears unlisted in 2023. No information was found regarding the price of Mincoin, and we rate it’s market cap to effectively be lost.

- Mincoin appears to be inactive. It was launched as a “minimalist” coin, using the same consensus algorithm as Litecoin.

- The project was on the low end of the top 10 in 2013, and now appears to be a ghost chain with little information available, and the last update in their forums from several years ago.

If you enjoyed this article and want more hot takes and interesting posts about web3, crypto, decentralized finance, NFTS and more – you can follow Papi on Twitter at https://twitter.com/1MrPapi.