Crypto & Economic Calendar

The events listed below inform governments, corporations, traders and investors on the health of the economy. I only list events noted by industry as “high volatility expected” in related markets.

- Monday

- 2200 ET: [CNY] Gross Domestic Product (GDP)

- 2200 ET: [CNY] Industrial Production

- Tuesday

- All Day: Japan Holiday

- All Day: Hong Kong Holiday

- Wednesday

- 0830 ET: [USD] Retail Sales

- Thursday

- 0200 ET: [GBP] Consumer Price Index (CPI)

- 0500 ET: [EUR] CPI

- 0830 ET: [USD] Building Permits

- Friday

- 0830 ET: [USD] Initial Jobless Claims

- 0830 ET: [USD] Philadelphia Federal Manufacturing Index

- 1000 ET: [USD] Existing Home Sales

Bitcoin $30k Respected into 4th Weekly Close

Summary: Bitcoin continues with a measure of uncertainty, ranging tightly between $29.5k and $31k intraweek, but respecting $30,000 as the local support into weekly closes. The market flipped bullish on BlackRock and other ETF news, and is awaiting updates on ETFs, or regulatory clarity from the SEC or CFTC.

The recent win by Ripple in the XRP suit may hint at what’s to come- it prompted many businesses and teams to reconsider their former aversion to US web3 markets. Macroeconomic events remain significant, and with the US Dollar Index (DXY) on track to lose 101 as a monthly support, we are potentially poised to see more money return to risk assets. This also depends on the US inflation rate continuing to trend down.

Bitcoin Levels: $30k marked the most important support level in 2021’s bull market. $30k withstood several retests, until the Luna meltdown in mid 2022. Afterwards, Bitcoin didn’t touch $30k again until April 2023, when it began to range between $25,000 and $30,000. This continued until the BlackRock news broke the indecision, sending price back towards $30k. Current levels to monitor:

- Immediate resistance: $30,500 to $30,600

- Immediate support: ~$30,000

- Current value range: $29,000-$30,700 [historically bearish range due to the massive distribution during the Luna meltdown; optimistically flipping to accumulation range now]

- Support levels: $28,900-$29,000; $27,700; $26,300, $25,500

- Resistance levels: $31,300-$32,000; $34,000-$36,500; $37,500; $40,000

Bull Perspective: BlackRock’s request for a Bitcoin Spot ETF and Ripple’s victory in the XRP suit remain the catalyst for increasing bullish sentiment, but macroeconomic factors matter too. While they are marginally improving, a bad month will stifle upward momentum. A month of weekly closes over $30k shows sufficient demand in this range; with intraweek retests of key levels (below $30k) likely and healthy.

- 23.6% fibonacci retracement at $29,000

- 38.2% retracement at $28,300

- 50% at $27,500; this is where the “bull market support” moving averages (20w & 21w) are currently

- Under $27,000 is unlikely given the current sentiment

Bear Perspective: Despite the recent bit of clarity derived from the Ripple win, there is still no clear playbook for crypto in the U.S. The much touted ETF requests are not guaranteed and if they are rejected, may see a strong selloff locally. Additionally, big players like BlackRock isn’t all good news – many have a reputation for manipulating markets.

Example- JP Morgan was recently fined nearly $1 billion dollars for manipulating commodity markets. For good reason we should be cautiously optimistic over the ETF news, and also hope that the SEC and CFTC (US regulators) don’t try to crush traditional crypto players to make room for their friends in traditional financial markets.

Looking at price action, the diagonal support extending from mid 2022 appears to be the trend mean, with price oscillating around it since after the Luna meltdown. If bulls can’t escape the sell pressure over $31k, another swing low into the upper $20s could enter the picture through August.

US Dollar Index (DXY)

SPICY NEWS!

Note: The DXY chart above is set to 12 month candles, to present the general decline of the US Dollar over the past 50 years.

For those who follow this newsletter regularly, you know we’ve been calling a larger selloff on the US Dollar. Specifically we are waiting for the US Dollar Index (DXY) to lose 101 support on the monthly, because historically that leads to prolonged downtrends.

Intramonth, the DXY dropped to the lowest level since April 2022. If you observe the red horizontal level at 101, at least 5 times in the past 50 years, losing that led to several years of the US Dollar trending down. If it remains there into July’s close, the probability of a prolonged downtrend on the US Dollar increases significantly.

Why do we care about the DXY?

The Dollar Index is a complex financial data point, a lot of external factors impact its value. But in the simplest terms, you can look at the relationship between DXY and risk assets like Bitcoin simply – they usually move inverse to each other. When DXY is up, BTC is down; and the opposite is true.

DXY’s bearish sentiment, coupled with a hawkish outlook for the Euro (a key economic competitor), Bitcoin’s rising sentiment on the back of ETF news and Ripples win, and next year’s Bitcoin halving – things are shaping up for a potentially bullish 2024.

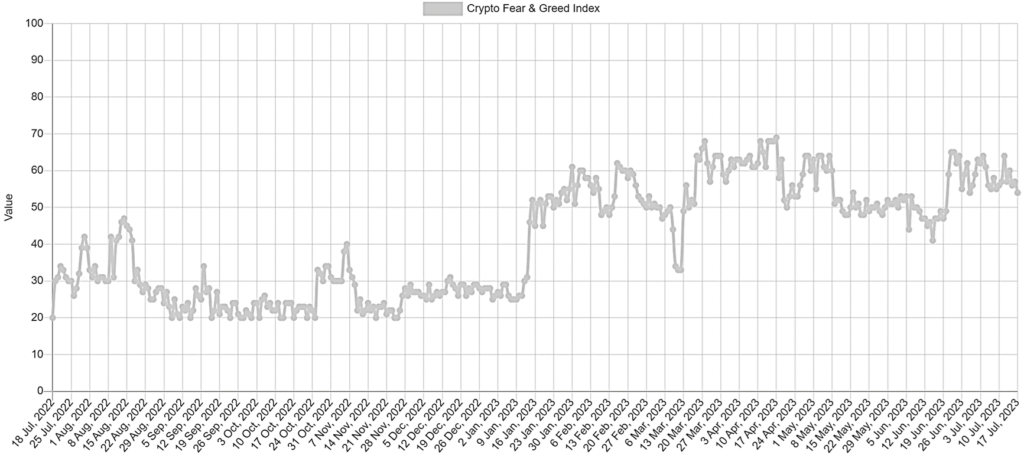

Market Sentiment

The Cryptocurrency Fear and Greed Index peaked at 69 in April, after two months of recovering price and consumer confidence. A series of SEC actions at that time shook investors, bring it down as low as 41 in June. Sentiment quickly recovered on the back of the BlackRock ETF news.

The overall risk appetite, including that of crypto markets, appears to be growing. But continued appetite will be dictated more by the macroeconomic climate than crypto regulators, so monitoring of the US Fed and European Central Bank (ECB) as leading sentiment indicators is important.

Trading Tips

Here are a few general tips for traders to consider, especially if you are new or recent to the crypto space:

- Diversify your Portfolio: Just as with traditional investing, it’s important to diversify your holdings. Don’t put all your money into a single cryptocurrency, no matter how promising it may seem. There are numerous cryptocurrencies available, each with their own potential for growth and risk of loss.

- Understand What You’re Investing in: Cryptocurrencies can be complex, and their value can depend on a range of factors. Before investing, make sure you understand how the cryptocurrency works, what it’s used for, and what factors might impact its value. Additionally, you should research the team behind the crypto – their background, past accomplishments, and vision for the project.

- Don’t Invest More Than You Can Afford to Lose: This is a golden rule for any form of investing, and it’s particularly important for cryptocurrencies, which can be highly volatile. You should only invest money that you can afford to lose without it affecting your standard of living.

- Set Clear Goals and Stick to Them: This involves defining your investment goals and setting the parameters for when you will sell. It could be a specific price point, a percentage increase, or a date. Having clear goals can help you avoid making impulsive decisions based on market fluctuations or emotions.

- Use Security Measures: Cryptocurrencies are digital assets, and as such, they are vulnerable to hacking. Make sure to use a secure wallet, enable two-factor authentication, and be careful about the information you share online. Also, consider keeping your larger holdings in “cold storage” (offline) to protect against potential cyber threats.

If you enjoyed this article and want more hot takes and interesting posts about the economy, web3, crypto, decentralized finance, NFTS and more – you can follow Papi on Twitter at https://twitter.com/1MrPapi.

Disclaimer: Nothing found on this website, or any sources linked to this website includes financial advice of any sort. We are not certified financial advisors, use our content at your discretion as entertainment, and as an educational resource. Do your own research.