In recent weeks we spoke of potential volatility due to it being the end of a rate cycle and some potential inflows from Mt. Gox and Germany (yes- the government of Germany).

Indecision and volatility is not unusual at this point in the crypto cycle, but its being amplified by these additional flows and the semantics around them.

Germany and Mt. Gox

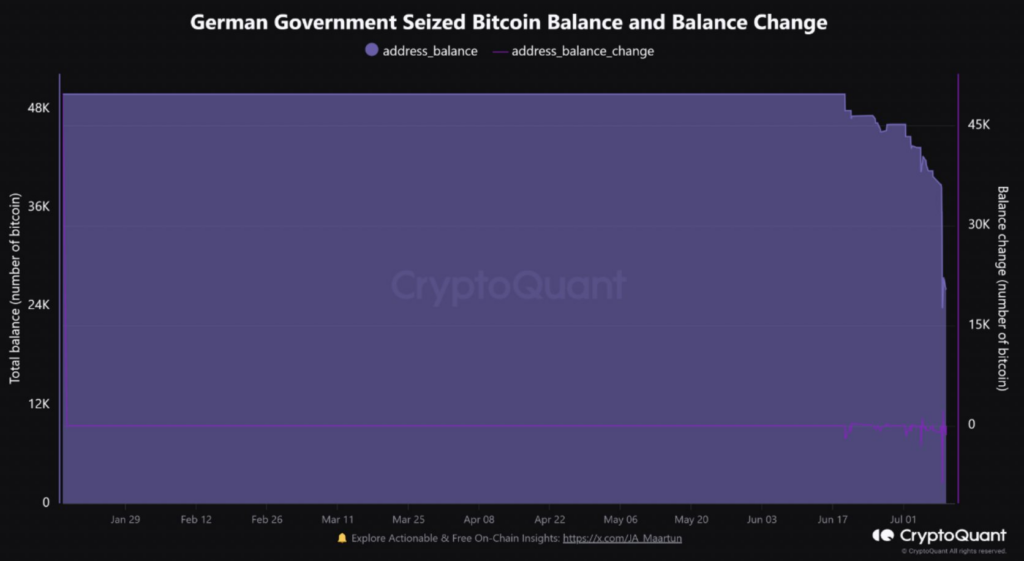

In the past two weeks, Germany began selling Bitcoin that they’ve confiscated. They started with ~50,000 BTC. They are currently at around 22,000 BTC.

In recent weeks Mt. Gox also began their distribution of BTC to holders from a decade ago. They started with over ~140,000 BTC and removed around 30% of that to begin distributing to holders.

Price Action and Forecast for Bitcoin

Indecision with a moderate bearish bias is the prevailing trend. We don’t see clear signs of strength yet, and as we’ve said for a while now- a sideways summer was highly likely, and so far thats what we have.

The recent bounce off of ~$53k is the first zone we may possibly set a floor for price, that served as a floor during peak bull market last cycle. But that depends heavily on the volume of selling by Mt. Gox holders and Germany, and the ability of the market to absorb that, either on open market or via OTC.

If we close under $52k, additional levels might be tested, including psychological $50k, ~$48-49k that correlates to the 38.2% fib, $42-43k that correlates to the 50% fib, and worst-case (in my opinion) $38k which correlates to the 61.8% fib.

Personally I have limit buy orders stacked the whole way down to $38k via Coinbase, and similar orders on ETH and SOL. I highly recommend stacking limit orders on the way down versus trying to identify the bottom and going all-in. Its much easier to average into positions while price swings range lows, than gambling that you can identify the very bottom (hint: you almost certainly can’t).

Mt. Gox Data

While Germany is actively moving funds to sell, it’s holdings are considerably smaller than Mt. Gox. I put together a helpful set of charts and data to monitor Gox activity. If you have a CryptoQuant account, you can view it HERE. If you don’t have an account, below is a snapshot.

Its important to remember that while Mt. Gox owned ~140,000 BTC, those belong to individuals, and that means 1.) it will take time to distribute and they plan for it to take until October 2024; and 2.) not everyone will sell. There is no reason to panic, even in a worst-case scenario where most sell as soon as they receive it, is still a short-lived event (three months for distribution) in a multi-decade parabolic uptrend for Bitcoin.

But looking at hard numbers- the market is currently unable to absorb significant BTC inflows without an impact to price. If large-scale deposits occur from large holders, or heavy selling coincides with a large inflow from Germany, prices could drop into the $40,000 range (next lowest key support is around $48k), but in an unlikely but worst-case scenario, price could wick to $38k intramonth.

Small sales, say a few hundred more BTC daily, won’t have a significant impact on price. OTC deals could also influence the trend but we won’t have much insight into that.

To close out the price action and forecast- it really does boil down to flows. It could take months for the large holding to unwind, and for market sentiment to recover. With improvements in inflation, its growing likelier we’ll see a Fed rate pivot by Q4, and that would be sufficient time for crypto markets to recover.

If you enjoyed this, you can follow me on my shitposting account on X/twitter: @1mrpapi or my crypto-only account @thectpapi.