By Maugie

–> Maugie on Twitter

–> Hire for Freelance!

Click for Audio Read!

Daily Market Analysis: March 21, 2024 – Spotlight on Micron Technology Inc.

Introduction:

Today’s stock market analysis zooms in on Micron Technology Inc. (MU), which has emerged as the top mover in today’s trading session. With an impressive surge, Micron Technology’s stock performance offers a unique lens through which to examine market trends, investment opportunities, and significant sector impacts.

Market Overview:

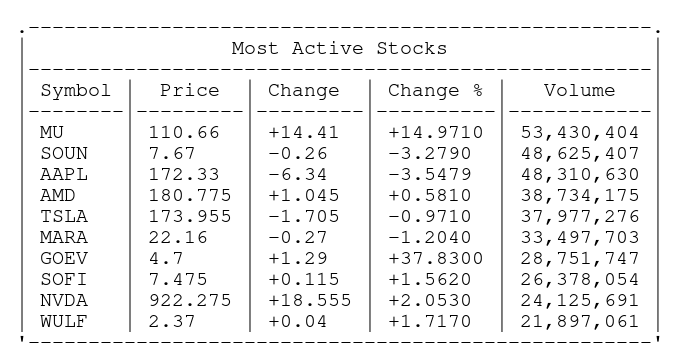

Micron Technology Inc. (NASDAQ: MU) captured investor attention with a remarkable 15.25% increase in its stock price, closing at $110.93 from the previous close of $96.25. This significant movement is underscored by a trading volume of 54.82M, substantially higher than its 65-day average of 16.46M, indicating heightened investor interest.

Featured Analysis: Micron Technology Inc.

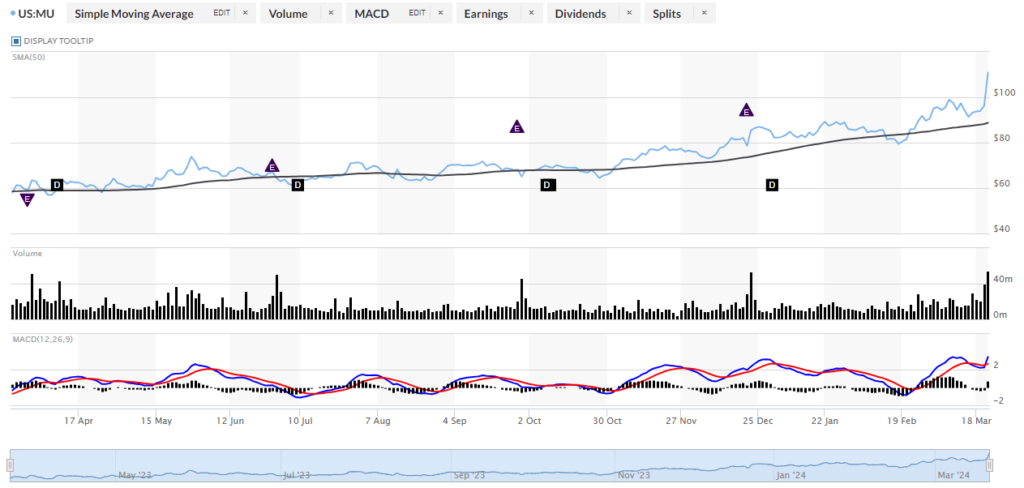

- Technical Analysis: The day’s trading saw MU’s stock price fluctuate between $108.78 and $113.50, ultimately pushing its 52-week range to $56.01 – $113.50. This volatility reflects the stock’s responsiveness to both market trends and internal company developments.

- Market Trends: Micron’s performance today is part of a broader positive trend, showcasing a year-to-date increase of 29.99%, with an impressive 80.84% rise over the past year. Analyst ratings currently position MU as “Overweight,” with an average target price of $119.21, suggesting potential room for growth.

- News Impact: This surge can be attributed to a mix of factors including, but not limited to, strategic company decisions, market sentiment, and recent upgrades or analyst recommendations. Notably, the semiconductor industry, where Micron operates, has been at the forefront of technological advancements, further fueling investor interest.

Investment Opportunities:

Given the current market conditions and Micron’s performance trajectory, investors may consider MU a viable option for both short-term gains and long-term investment. However, it’s crucial to note the volatility inherent in the tech sector, especially amidst ongoing global supply chain challenges and economic uncertainties.

Disclaimer:

This content is for informational purposes only and should not be considered financial advice. Please consult with a financial advisor before making any investment decisions.