Unveiling This Week’s Dramatic Shifts in Precious Metals Markets

By Maugie Solana-Drops: G8baFXXs1hvrFRi4Ms1iwjgBktm9Azg7Rz4Vj2f9mbwE 💖

–> Maugie on Twitter

Click for Audio Read!

——————————————————————-

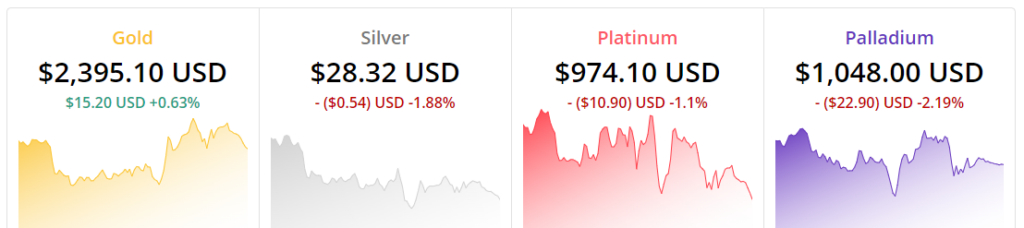

Gold’s Steady Climb Reflects Market Jitters

Spot Price: $2,393.60 USD/oz | Weekly Change: +$29.10 USD (+1.23%)

Bid/Ask Price: $2,379.80 USD / $2,394.80 USD | Ask Price Fluctuation: +$14.90 USD (+0.62%)

In a world brimming with uncertainties, gold continues to shine as a beacon of safety. This week, the venerable yellow metal has seen its price swell by over 1.2%, a clear signal that investors are flocking to traditional safe havens amidst geopolitical shake-ups. The modest but steady increase in the ask price also underscores a solid buying interest likely spurred by sustained defensive asset allocations by major institutional players.

——————————————————————-

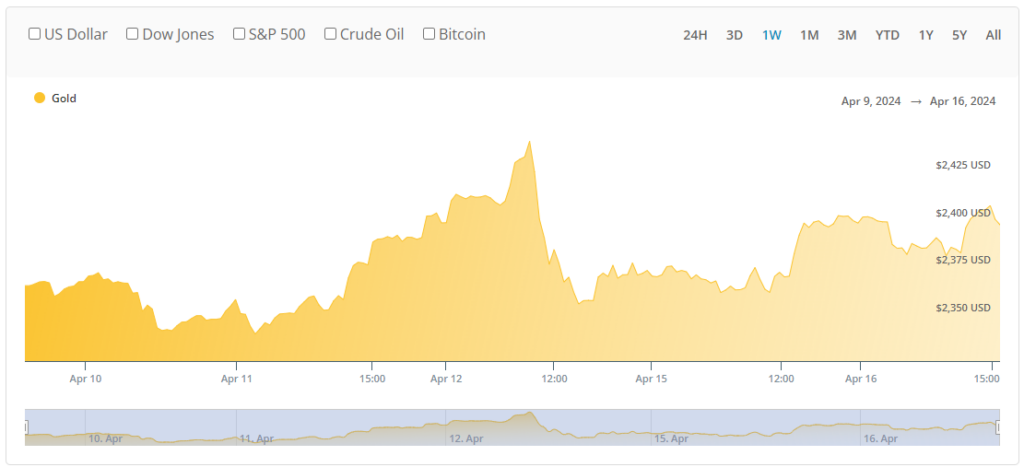

Silver’s Subtle Dip: A Glimmer of Volatility

Spot Price: $28.32 USD/oz | Weekly Change: -$0.04 USD (-0.14%)

Bid/Ask Price: $28.02 USD / $28.32 USD | Ask Price Fluctuation: -$0.54 USD (-1.88%)

Silver, ever the gold’s capricious cousin, tells a different tale. The minor retreat in its spot price this week paints a picture of cautious investor sentiment. With a tight bid-ask spread, the market for silver shows less volatility, suggesting that while the investors are wary, they aren’t fleeing just yet. This slight negative drift might catch the eye of bargain hunters betting on future industrial demand sparking a rally.

——————————————————————-

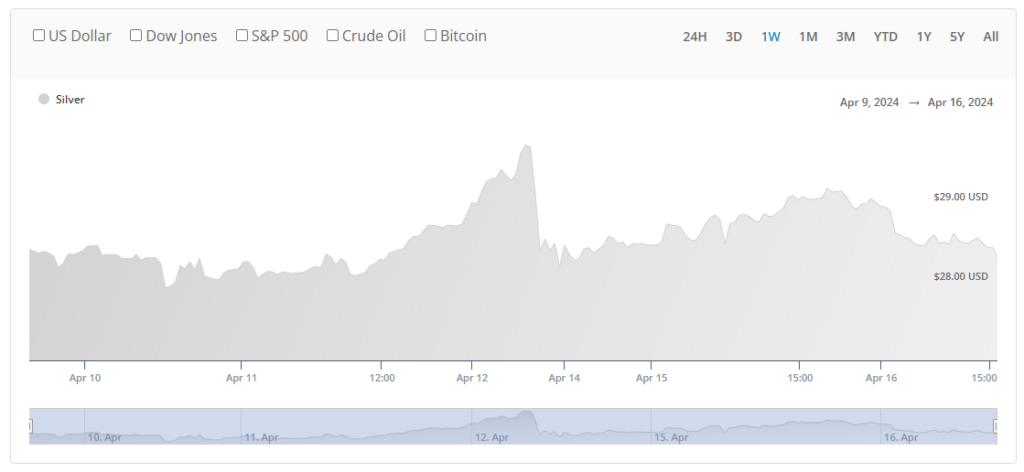

Platinum’s Plight: Caught in the Crosswinds

Spot Price: $974.40 USD/oz | Weekly Change: -$21.30 USD (-2.14%)

Bid/Ask Price: $959.40 USD / $974.40 USD | Ask Price Fluctuation: -$10.60 USD (-1.07%)

Platinum’s week could be summed up in one word: challenged. Dropping over 2% in market price, it’s clear that the metal is feeling the heat from a cooldown in manufacturing sectors, particularly automotive, where it finds significant industrial use. The significant bid-ask spread indicates a market consensus leaning towards caution, with a potential oversupply possibly dampening prices further.

——————————————————————-

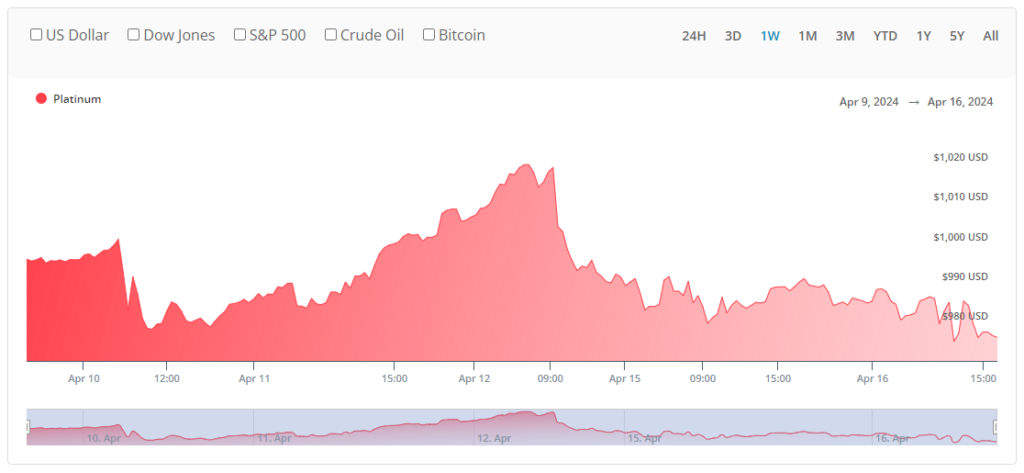

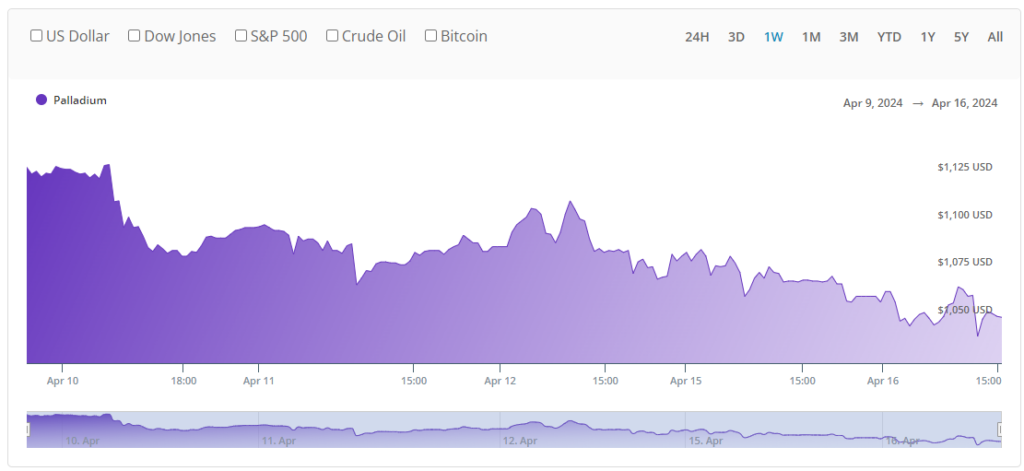

Palladium’s Precipitous Drop: A Warning Sign?

Spot Price: $1,048.50 USD/oz | Weekly Change: -$77.00 USD (-6.84%)

Bid/Ask Price: $959.40 USD / $974.40 USD | Ask Price Fluctuation: -$10.60 USD (-1.07%)

Palladium took the hardest hit, tumbling nearly 7% as demand from the automotive industry stuttered. The drop is a stark reminder of the metal’s high volatility, especially prone to swings from sector-specific shocks. Although the current low prices may tempt some to consider adding palladium to their portfolios, the market’s nerves suggest that caution should be the watchword.

——————————————————————-

Final Thoughts

Lego 1 oz .999 Silver Bar Hand Poured

Click Maugie’s Amazon Associates Link

https://amzn.to/445hAIK to Order

Navigating the precious metals market this week has been like reading a thriller – full of twists and turns but thoroughly riveting. Gold’s ascent is a strong narrative on market fear, silver’s stability a subplot of resilience, while platinum and palladium’s declines are cautionary tales on industrial dependence. As always, these metals offer not just the lure of returns but a test of the investor’s mettle.

——————————————————————-

Disclaimer: This content is for informational and entertainment purposes only and is not intended as financial advice. The views and opinions expressed are those of the author alone. Precious metals investments carry risks, including the loss of principal. Consult your financial advisor before making any investment decisions.