There are numerous alleged “top signals” for Bitcoin and cryptocurrencies, each with varying degrees of reliability. As markets evolve with each cycle, it’s unrealistic to rely on one indicator. This current cycle is particularly unique, marked by participation from sovereign funds, institutional investors, and boomers.

This means our approach seeks to find confluence—agreement among several top signals. Keep reading to learn more about some common signals that traders monitor.

Also note that we focus on BTC top signals because it drives the market, but altcoins typically run hot in the final quarter of the cycle, as money cycles out of Bitcoin and into big caps like Ethereum, Solana and eventually smaller altcoins.

Market Structure

We can look simply at the structure of the market and key levels. For example, if Bitcoin rejected from the same resistance in 2017 and 2021, it stands to reason it may do the same in 2024.

That said, the market is rarely this simple and the trend angle and momentum changes over time, so a diagonal level from last cycle may not work in this one.

1. Historic Resistance Level: one possibility is BTC rejects from the same diagonal range we saw in 2017 and 2021. This puts a potential top signal in when price approaches the range between $120k and $140k.

2. Historic logarithmic resistance level: Another great way to display data that spans many orders of magnitude is to use a log scale. The top of this logarithmic channel is between $105k and 120k, suggesting a top signal when price approaches that level.

We are approaching this range, so from a structure perspective, it becomes a question of whether this trend continues as-is and we reject, or we form a new trend and BTC rises above that $109-120k range.

On-Chain Signals

On-chain data for Bitcoin provides a transparent record of all transaction activities on its blockchain, which analysts use to gauge network health, user behavior, and potential market trends. Below are popular data points that can indicate a cycle top is in range.

Note: a glossary of each item is at the end of the article.

3. Supply of Bitcoin on Exchanges: look for significantly rising supply to signal a potential cycle top. Rising supply indicates there are more sellers than buyers.

Typically the selling begins early, as much as a couple months prior to the top coming into play. This is because smart money (often large holders) slowly exit positions on the way up.

Example below: in 2021, the inflows began to increase steadily ~3 months before the top. In total supply increased 20% during this time.

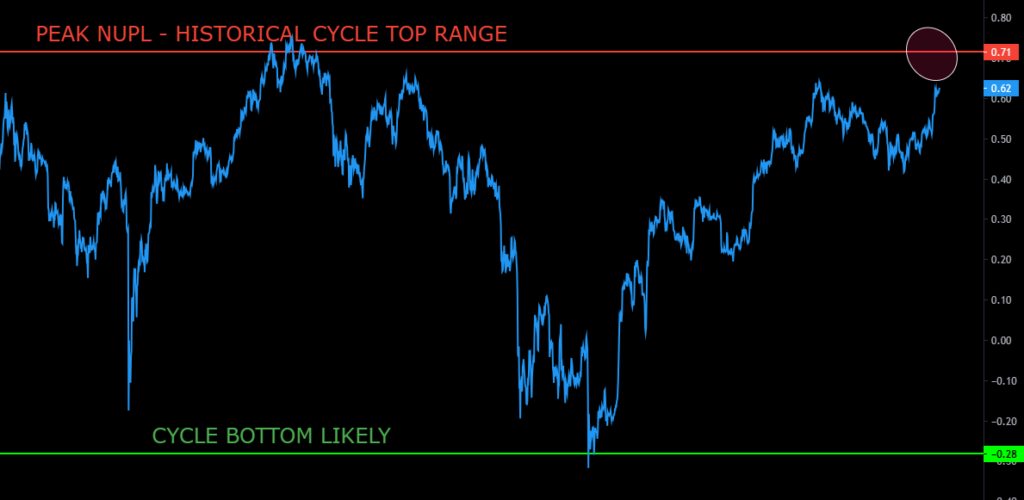

4. Net Unrealized Profit and Loss (NUPL): NUPL is often used as a top signal for Bitcoin, monitor when the value rises above 0.71 to 0.75, indicating the market may be in a state of euphoria and close to a peak. This level often signals that a large portion of holders are in profit, which historically aligns with potential market tops and subsequent corrections.

We approached that level in Q1 but as the market turned down, so did the NUPL before it could reach the top signal territory. We are climbing again and currently around 0.61, suggesting more room to run.

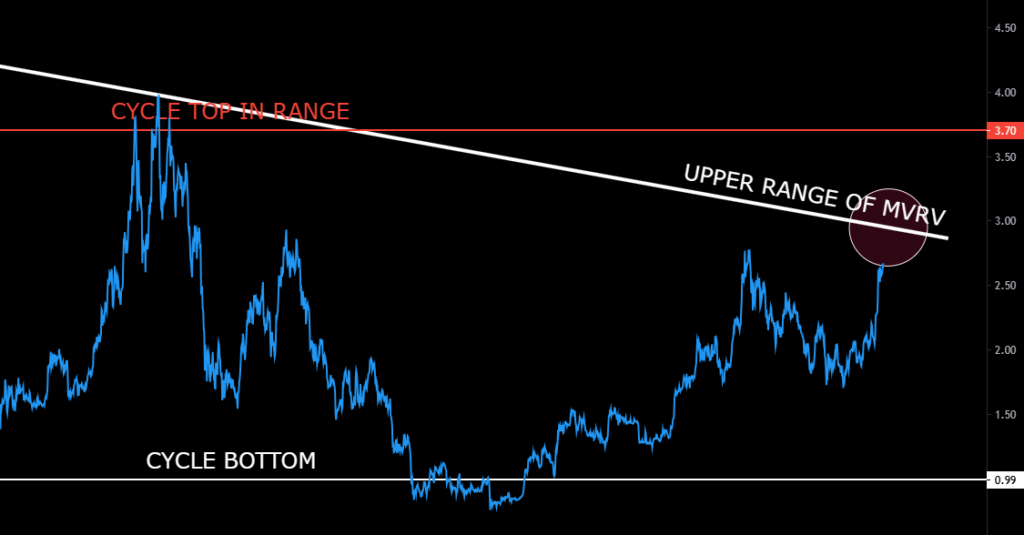

5. Market Cap to its Realized Cap (MVRV): MVRV is another popular top signal for Bitcoin. When the ratio exceeds its historical upper threshold, over 3.5, but if you follow the overall trend of MVRV, its weaker each cycle, suggesting a potential MVRV top signal this time over 2.9. The higher the number, the more the market is potentially overvalued, and this often precedes cycle tops.

6. Miner Position Index (MPI): MPI indicates whether miners are selling at higher levels than usual. As their business relies on selling BTC optimally, they often sell early into a cycle. Watch for spikes in the index, their selling usually rises the closer we get to the cycle top.

We currently see rising MPI but not to levels that historically saw steep selloffs, suggesting we have room to run higher.

7. Bitcoin Netflow (All Exchanges): Netflow indicates the net result of daily flows to exchanges, where people buy or sell Bitcoin. To use Netflow as a top signal, monitor for significant positive inflows (green candles) to exchanges, indicating a large influx of Bitcoin being prepared for sale.

This can often precede downward pressure on prices as it suggests increased selling activity that could lead to a market top or correction. Bulls want to continue seeing red candles, or outflows, suggesting people buying and moving BTC off exchanges where its unlikely to be sold.

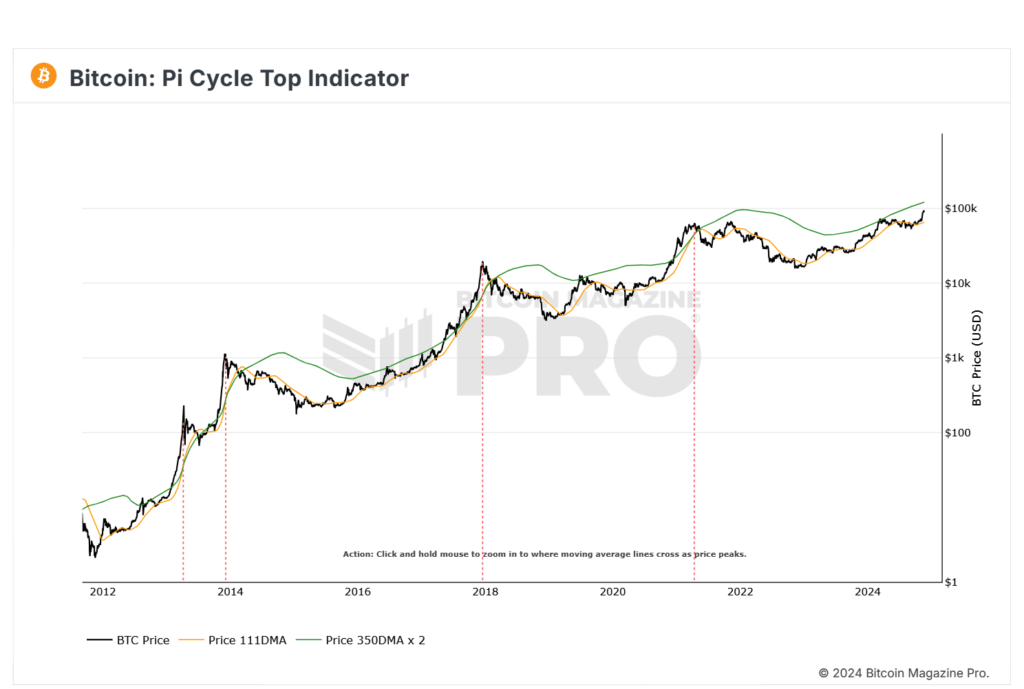

8. Pi Cycle Indicator: Pi Cycle is considered a meme in come circles, it wasn’t created until 2020, but it did accurately predict the 2021 cycle top, and it also retroactively fits perfectly over earlier cycles too.

To use the Pi Cycle, monitor when the 111-day moving average (yellow line) crosses above the 350-day moving average multiplied by 2 (green line). This crossover signals the market is at it’s peak.

Currently the Pi Cycle is not remotely close, suggesting this cycle has room to continue higher.

Sentiment Data

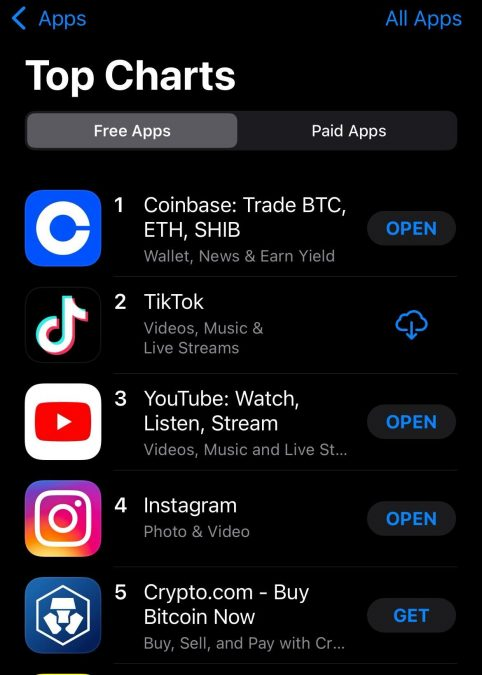

9. Coinbase / Phantom / Metamask App Ranking: when these popular apps rise to the top of Android and Apple app stores, this signals the influx of non-crypto “normies” entering the space.

From this point on, the market usually has a few months, maximum, before the top is in. It represents a bullish mania that eventually cascades into fear, as Bitcoin approaches the end of it’s cycle and begins to fall, pulling the larger market with it.

Disclaimer: Nothing found on this website, or any sources linked to this website includes financial advice of any sort. We are not certified financial advisors, use our content at your discretion as entertainment, and as an educational resource. Do your own research.

If you enjoyed this article and want more hot takes and interesting posts about the economy, web3, crypto, decentralized finance, NFTS and more – follow Papi on Twitter/X at https://twitter.com/1mrpapi

On-chain data sourced from Cryptoquant.com; you can sign up using my referral link: https://cryptoquant.com/sign-up?my-friend=gmpqkdsc

Glossary of Terms

Below is an explanation of each indicator and data point I discuss above.

Bitcoin Dominance:

Bitcoin dominance is another way of saying “Bitcoin market share,” or how much of the total crypto market is Bitcoin. While not the clearest indicator, on lower timeframes, you can use this information to speculate when altcoins may rally. This is also described as an “alt season.”

Altcoin rallies often follow a local or major top on Bitcoin dominance and can last for several weeks or longer, while Bitcoin consolidates for the next move. The recent memecoin cycle is a form of altcoin cycle.

Bitcoin Supply:

Supply trends are simple- rising supply on exchanges implies bearish pressure, because it’s there to be sold, and the opposite true when supply drops.

More Bitcoin is being bought and HODL’d than is being mined, and this has been the prevailing trend since 2020. As we know with commodities, scarcity boosts perceived value. With a 40% drain on total supply since 2020, we are trending towards scarcity faster than ever.

While general supply trends can signal sentiment, did you know you can also account for localization? For example, in the last cycle, as we approached the top, Asian and international exchanges logged notable increases in supply, while America was net decline. Effectively this meant Asians left many Americans holding bags near the top.

Net Unrealized Profit and Loss (NUPL):

NUPL indicates the total amount of profit/loss in all Bitcoins, represented as a ratio. You can see why that makes for a handy data point, because as more of the market is in-profit, the risk of a retracement rises.

NUPL indicates a potential minor or major top when it rises over 0.75. Another way to think of this is as a greed tracker. The higher the NUPL, the greedier the market is, and eventually greed will turn to fear, as profit-taking cascades towards the end of a cycle or subcycle.

Miner Position Index:

Miners are among the smartest traders in crypto. For obvious reasons they need to optimize their selling to fund operations. Miners sell to fund operations, but will HODL supply when conditions permit, and sell heavily in the early to middle bull market.

MPI is the ratio of miner selling against the yearly average. If its rising strongly above the average, it suggests miners are worried about a top approaching expedite their selling. They do not try to land the top of the market, so they often sell in advance, which is helpful to traders trying to also time their exits.

Bitcoin Netflow:

Another fun data point is netflow. This shows the net result of a day’s inflows (moving Bitcoin to an exchange) and outflows (moving Bitcoin off an exchange).

The implication is that Bitcoin moved off exchanges is unlikely to sell. And as we approach tops, the netflows skew towards increasingly heavier inflows (moving to exchanges to sell).

Pi Cycle:

The Pi Cycle indicator is something many traders joke about, but there is no doubting it’s effectiveness.

It uses the crossing of two key moving averages (MA) to predict cycle tops: 111 DMA and 350DMA x2. It accurately called earlier cycle tops within a few days. The top signal is when the 111 DMA crosses above the 350 DMA x2.

Whether you believe these two MAs can predict cycle tops, its worth keeping an eye on it. As you can see, we still have time before the MAs converge.

Market Cap to its Realized Cap (MVRV)

MVRV is used to understand when the exchange traded price is below “fair value” by looking at the ratio between market cap and realized cap (approximates the value paid for all coins in existence).

This gives an idea of whether the market is fairly priced and can be used to identify potential tops and bottoms in the market. As with any indicator, don’t use it in isolation; look for confluence with other data.

A new component this cycle is the orange line, the top of the MVRV range, which reflects an increasingly smaller ratio over time. For the first time this cycle, the longer term diagonal resistance is lower than the generally acccepted upper range of 3.7 for cycle tops, so traders should monitor both.

US Dollar Index (DXY):

The US Dollar Index (DXY) is an index that measures the strength of the US Dollar. There is an inverse relationship between the DXY and speculative markets like crypto and equities. In general, when the DXY is up, crypto is down. The opposite is also true.

Of particular importance, the ~101 level, arguably the most significant for the DXY. Almost every time in the past 50 years, when DXY rejected from, or closed under the 101 range, it led to a prolonged period of weakening dollar.

If the fed drops rates in 2024, thats a strong signal that the DXY will continue to drop, and rates will inevitably decrease, its just a question of timing and whether they will start in 2024 or 2025. For rate decreases to occur in a year along with the Bitcoin halving would be particularly bullish.

Market Sentiment:

Economic events, political discourse, or general price action are all events that can impact sentiment. The market remains predominantly bullish since October 2023.

Sometimes market sentiment needs to cool off, otherwise bull markets can burn out too early. The market moves in waves of fear and greed, and too much of either can lead to pronounced moves in the opposite direction, which can further cascade due to leverage in the market.

Going into the election cycle, we can expect some volatility to accompany the crypto narrative, with players like Senator Warren building an anti-crypto coalition. It remains to be seen if this will have a bigger impact on sentiment than the increasingly accomodating macro.