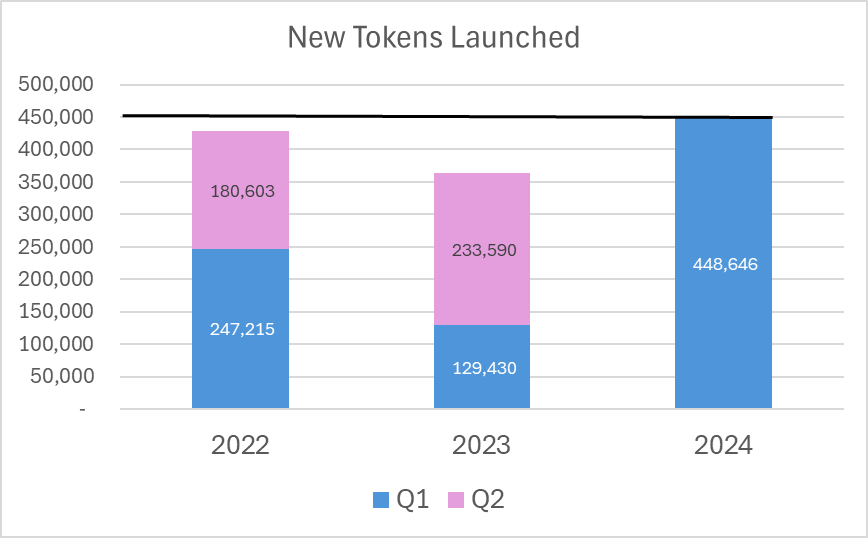

The pace of new token creation (including memecoins) is at record highs. According to CoinGecko, the first quarter of 2024 (Jan-Mar) saw 3.5x more tokens launched than during the same time last year. In fact, Q1 2024 saw more tokens launched than the FIRST HALF of the past two years

New Tokens Launched, H1 of 2022 and 2023, Q1 of 2024

Why the Popularity?

This part is easy. We have lower friction (better technology) and improved market sentiment.

It started with Solana, which I’ve long called this cycle’s Binance Smart Chain (BSC). Last cycle BSC was the chain of choice for memecoins and other low effort altcoins we affectionately call shitcoins, because it was cheaper, faster than Ethereum.

Solana is going down the same path, being cheaper and faster than Ethereum Layer-1. And with SOL’s rally from $8 lows, to nearly $200 this cycle, sentiment around their ecosystem was very high.

Solana’s success led to major hype for projects launching during this time, like the memecoins WIF or BONK, setting a precedent for memes on Solana.

But that’s not enough. Anyone can use a cheap chain to trade, but most traders cannot create smart contracts or navigate liquidity pools.

Enter the next generation of memecoin builders-

Pump dot Fun is a super cool dAPP that lets anyone create a memecoin. Simply upload a logo, choose a ticker, write a description, and click create. If enough people like it, the token launches fairly. While there are ways to game the system, this is the basic premise.

Pump (and similar tools) deserve a lot of credit for removing a major barrier to launching memecoins. This opens up the world of memecoin projects to the general public, removing our reliance on the influencer cartel pump and dumps.

Who is Launching & Trading Memes?

The average trader active in low-effort memes are those with few resources, shorter attention span, and likely less money. Not all, but certainly most. Thats not an insult, its simply the economic baseline for many in crypto. Memecoins are generally designed to be cheap, accessible, and marketing focused on positive messaging, which appeals to the demographic with few resources.

But this introduces an issue – the same problem that plagues NFTs: people want to profit, and they want it quickly. With NFTs, they will mint and rush to immediately flip for a profit. This can sour sentiment around a problem as long term investors see price dropping immediately after launch.

With low market cap memecoins the same thing happens: a couple early sales can crush an uptrend. Other investors see the red candle, fear rises and price cascades down as everyone rushes to sell.

Additionally, low-effort memecoins give investors no reason to expect something meaningful will be built (no marketing, no utility, no project), so they exit at the first sign of weakness.

Virtually all of these low-effort memecoin projects lack fundamental “hooks” to mitigate some of the early sell pressure, like staking or vesting.. and forget about more advanced gamification and utility, its not there.

While crypto makes a very small number of people extremely rich, it makes most other traders extremely poor (we’ll save the ‘why’ for another article).

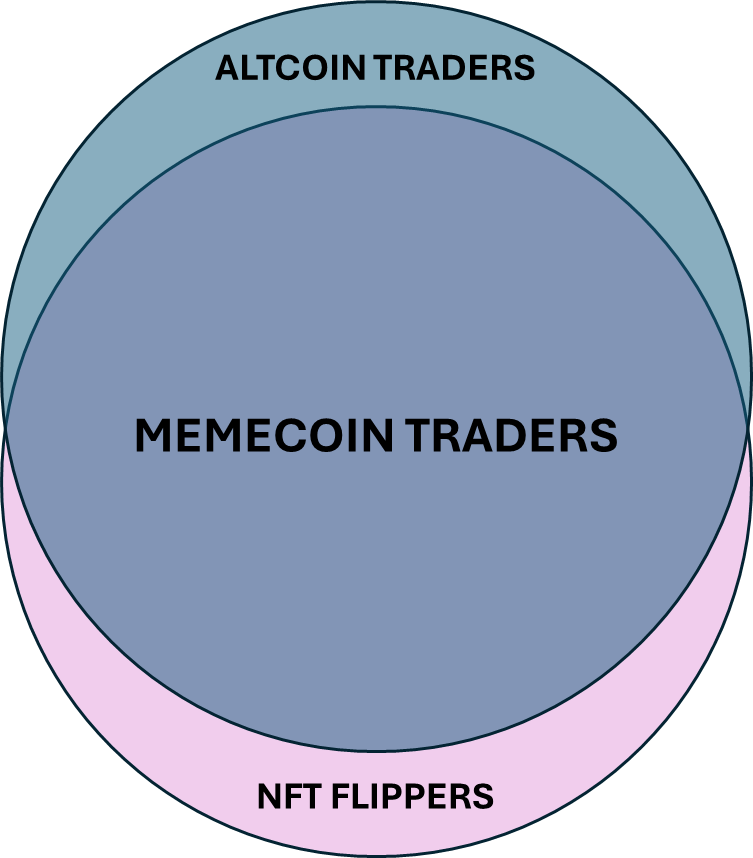

The venn diagram of NFT Flippers and Altcoin Traders Intersects Bigly at Memecoin Trading

Quality and Quantity

One of web3’s fundamental principles is increased accessibility to wealth and wealth generation.

To achieve this, we democratize, decentralize, and make accessible the tools to generate wealth. For example- I can get a DeFi loan without consulting a bank, or even a human.

But increasing accessibility also increases the amount of garbage entering these networks. With NFTs it led to thousands of low effort generative 10k pfp projects, now worth nothing. With altcoins/tokens, its leading to a deluge of low effort memes, mostly worth nothing.

Calling the current generation of memecoins “low effort” is a lie. Most of them are zero effort.

I’d wager that 99% of projects launching in Q1 have:

- No Twitter or website

- No team

- No webapp or utility

- No plan, strategy, roadmap

- No following or community

- Low effort memetics

- A small group of insiders ready to dump

This is when you realize you aren’t investing in crypto, you are gambling on memetics.

You are hoping that the memes for your token are so funny and relatable that people want to build a community around it long enough to turn a profit.

The Attention Economy

Attention economy is the idea that attention is a process that involves the selective concentration on a given item of information Iin this case memes). And the economic value of that time, or attention, can be quantified and compared to monetary expenditures.

This is why advertising and market is so important. Investors or buyers of your product need to 1.) know you exist and 2.) like what you are offering (better memes than the other guy).

Herein lies the biggest problem – an oversaturated market focused on low effort manufactured memetics.

Every single day of 2024 we are launching between 3,000 and 5,000 new tokens across all chains, almost all of them useless memecoins with no plan, no team.

Summary

In a world of endless token production against a finite amount of capital, who wins? Most of the time it isn’t us.

Despite my critical commentary on memecoins, I think they have a place in crypto. They are a crucial piece of the market and the easiest way to onboard someone. I hold some dog coins and PEPE. I’ve been active in other communities over the years like Bananos and DOGE.

But in my opinion, the current crop of memecoins launching daily are so low effort, and the market grossly oversaturated.

There is typically no incentive for the projects to live more than a day, and everyone knows it, so they dump first chance they get.

Bottom Line – The current low-effort generation of memes are well suited for gamblers, but not for me. If you are a memecoin trader, there are better memecoin projects on the horizon, offering real attempts at utility, gamification. Wealth can’t be rushed, and memecoins are already higher on the risk scale than your average crypto, so hedge your risk and look for real teams making an earnest effort to build something.

Disclaimer: Nothing found on this website, or any sources linked to this website includes financial advice of any sort. We are not certified financial advisors, use our content at your discretion as entertainment, and as an educational resource. Do your own research.

If you enjoyed this article and want more hot takes and interesting posts about the economy, web3, crypto, decentralized finance, NFTS and more – follow Papi on Twitter/X at https://twitter.com/1MrPapi.