Bitcoin – Ranging Along All-Time-Highs

Summary: The past couple weeks were euphoric, we broke new highs on Bitcoin, altcoins were running hot! But once again we find ourselves under the previous high.

Is the bull market over? The short answer – highly highly unlikely its over. Lets talk about whats next-

Bitcoin has never stopped climbing once it reached a previous all-time high (ATH), and with the ETF momentum, there is no reason to expect that now.

But as noted last week, we always look for confirmation on the monthly. Until we secure a monthly close, price is subject to more speculation, volatility and lower timeframe influences. In earlier cycles it took nearly two months to escape the previous ATH range. If you are confident we go higher (as I am), this is an excellent opportunity to stack more or rotate a little into high performers. Consider tax implications if you rotate.

If you are a LOW RISK spot holder, as noted last week, you should be starting to exit. Its likely we oscillate here between $50k and $70k for the near term, even in a worst case scenario where this is the top. You can average into sales, just as you do with buying. Something like X% per day/week/month. Timing and duration is based on your personal goals and risk tolerance.

If you are still buying spot (as I am), keep in mind that the risk/reward of buying skews less favorably once Bitcoin enters price exploration above $70,000. Maintain tigher stoploss or invalidations on short-term trades (ie. lower your risk profile where you can). With price oscillating in this range near ATH, it may be the last opportunity for decent entries before price exploration and mania take over.

| Note that throughout the bull market, different narratives will run as subcycles, for example- memecoins are currently popular, but that will rotate to something else eventually. Potential narratives: elections, artificial intelligence, DeFi, layer 1, layer 2, gaming, art, memes, ETFs. |

And if you are a day trader, simply respect the overall market bias is to the upside for the foreseeable future, potentially into 2025. There will be corrections but I recommend trading with the market, not against it. Even on corrections like we saw over the weekend, the overall bias remains to the upside and easier money will be found longing (smartly) than risking it on shorts.

Bitcoin Dominance

Bitcoin dominance is another way of saying “Bitcoin market share,” or how much of the total crypto market is Bitcoin. While not the clearest indicator, on lower timeframes, you can use Bitcoin Dominance to guage when altcoin markets may rally. This is also described as an “alt season.”

Altcoin rallies often follow a local or major top on Bitcoin dominance and can last for several weeks while Bitcoin consolidates for the next move. And as many of you know, memecoins have been running hot for a couple weeks, coinciding with a rejection along the 8 year diagonal resistance on Bitcoin Dominance.

In fact, since late 2023, Bitcoin remains stuck under 54%. Its very possible Dominance will break out later this year, but until then we are likely to see altcoin narratives rotating through the market.

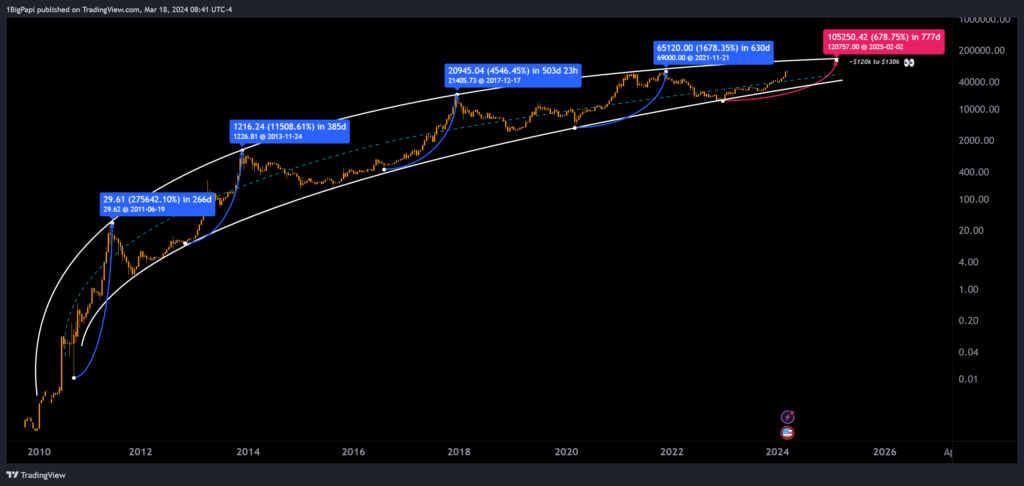

Long Term Cycle Forecast

When discussing cycle tops, you’ll get a range of answers. This writer is targeting a modest Q4-2024 to Q1-2025 target between $100,000 and $130,000, based on historic trends. While I suspect it can go much higher, especially if Bitcoin ETF flows remain elevated through 2024, in keeping with my personal risk management strategy, $130k is my current target and will adjust if market conditions significantly shift.

Some joke about cycles never being different, but this cycle is very different due to institutional buyers and boomers entering the market. Thats why its difficult to rely on earlier trends, so we should look for confluence across several data points when forecasting this cycle. We are in uncharted territory from now on.

On-Chain Data

Given that we are approaching price exploration in a new cycle, traders should begin evaluating different data that might suggest a minor or major top. Never take a singular indicator as gospel, and look for confluence across multiple data points. Below are a few popular ones.

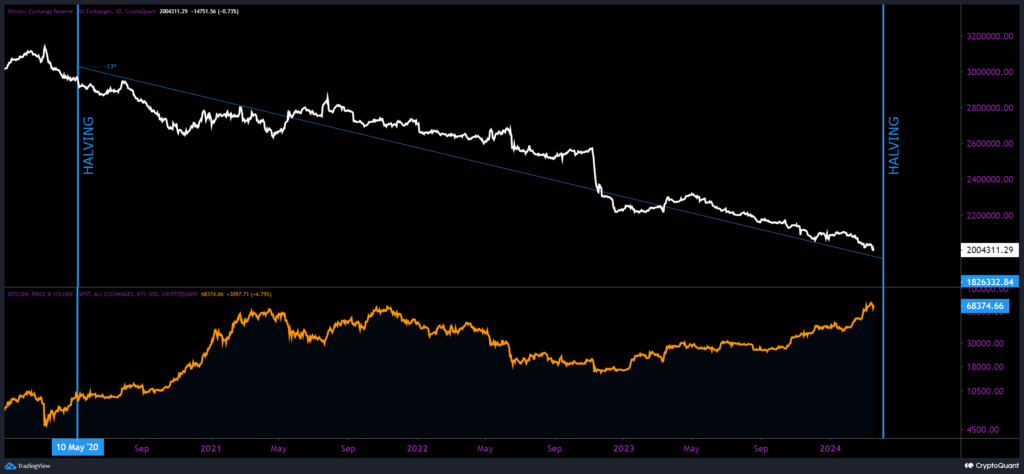

Supply of Bitcoin on Exchanges

Supply trends are simple- rising supply on exchanges implies bearish pressure, because it’s there to be sold, and the opposite true when supply drops.

More Bitcoin is being bought and HODL’d than is being mined, and this has been the prevailing trend since 2020. As we know with commodities, scarcity boosts perceived value. With a 40% drain on total supply since 2020, we are trending towards scarcity faster than ever.

Towards the end of a cycle, you typically see heavy inflows of Bitcoin as whales average out of positions, but since the end of last cycle, it -has- been different. Instead of a selloff at the end of 2021 into early 2022, we instead saw continued drop in supply. This may have been anticipation of the ETFs, but also a reflection of growing interest and trust in Bitcoin and cryptocurrency.

While you consider your position for this cycle, its also a good time to consider your long term investment over the next decade, especially for leading cryptocurrencies like Bitcoin and Ethereum.

Bitcoin Supply on Exchanges Since 2020

Nearly 40% drop in 4 years, and no signs of slowing into 2024 Halving

Net Unrealized Profit and Loss (NUPL)

NUPL indicates the total amount of profit/loss in all Bitcoins, represented as a ratio. You can see why that makes for a handy data point, because as more of the market is in-profit, the risk of a retracement rises.

Currently NUPL is trending into the greedy range of “belief,” where traders are mostly in-profit, but holding and expect more upside.

NUPL indicates a potential minor or major top when it rises over 0.75. Another way to think of this is as a greed tracker. The higher the NUPL, the greedier the market is, and eventually greed will turn to fear, as profit-taking cascades towards the end of a cycle or subcycle.

Net Unrealized Profit and Loss

At ~.6 reflects increasing greed & unrealized profit, but room to run

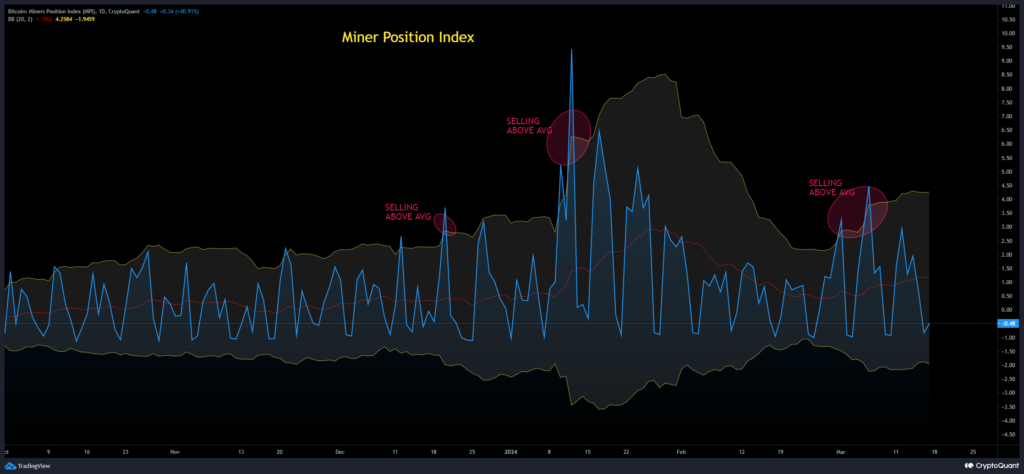

Miner Position Index (MPI)

Miners are among the smartest traders in crypto. For obvious reasons they need to optimize their selling to fund operations. Miners sell to fund operations, but will HODL supply when conditions permit, and sell heavily in the early to middle bull market.

MPI is the ratio of miner selling against the yearly average. If its rising strongly above the average, it suggests miners are worried about a top approaching expedite their selling. They do not try to land the top of the market, so they often sell in advance, which is helpful to traders trying to also time their exits.

Miner Position Index

Miner selling pressure is low over the past two weeks.

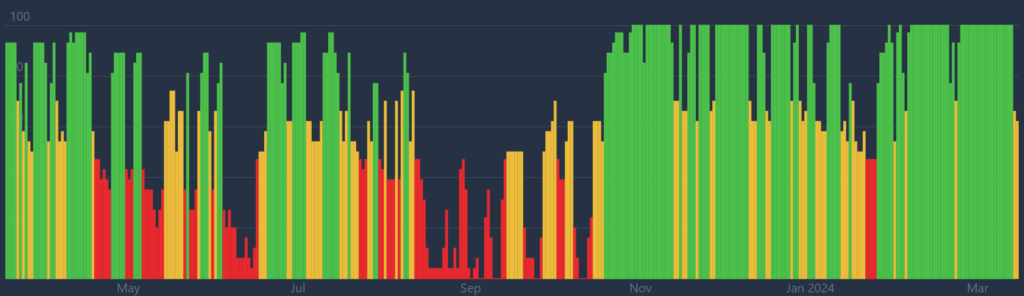

Bitcoin Netflow (All Exchanges)

Another fun data point is netflow. This shows the net result of a day’s inflows (moving Bitcoin to an exchange) and outflows (moving Bitcoin off an exchange).

The implication is that Bitcoin moved off exchanges is unlikely to sell. And as we approach tops, the netflows skew towards increasingly heavier inflows (moving to exchanges to sell).

Green on the chart below represents the inflow of Bitcoin to exchanges. Red is outflows, likely from someone buying Bitcoin and moving it to cold storage. Predominantly red or larger red bars represent a prevailing bullish sentiment in the market.

Exchange Netflows

The past 6 months reflect predominantly outflows/buying.

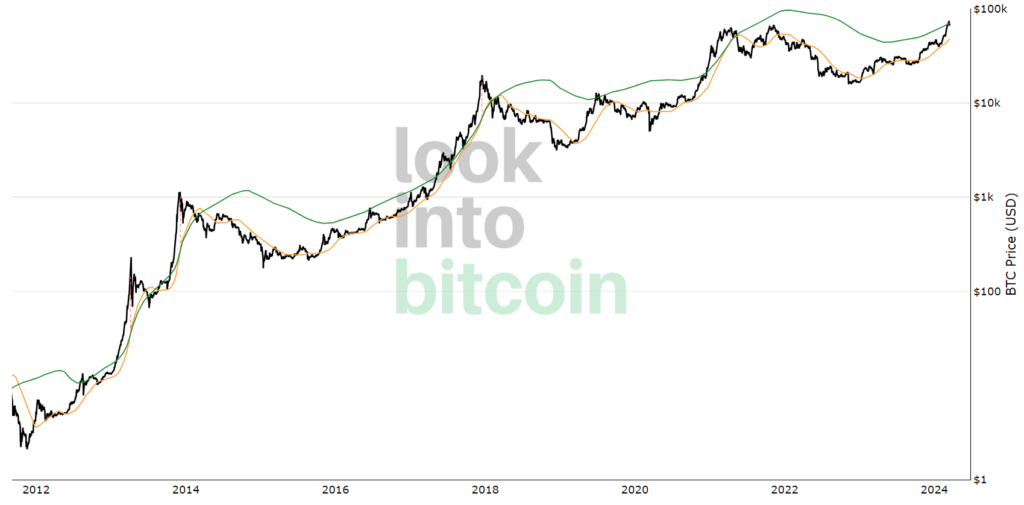

Pi Cycle Indicator

The Pi Cycle indicator is something many traders joke about, but there is no doubting it’s effectiveness.

It uses the crossing of two key moving averages (MA) to predict cycle tops: 111 DMA and 350DMA x2. It accurately called earlier cycle tops within a few days. The top signal is when the 111 DMA crosses above the 350 DMA x2.

Whether you believe these two MAs can predict cycle tops, its worth keeping an eye on it. As you can see, we still have time before the MAs converge.

Pi Cycle

Forecast a potential bearish cross between Q4-24 ~ Q1-25

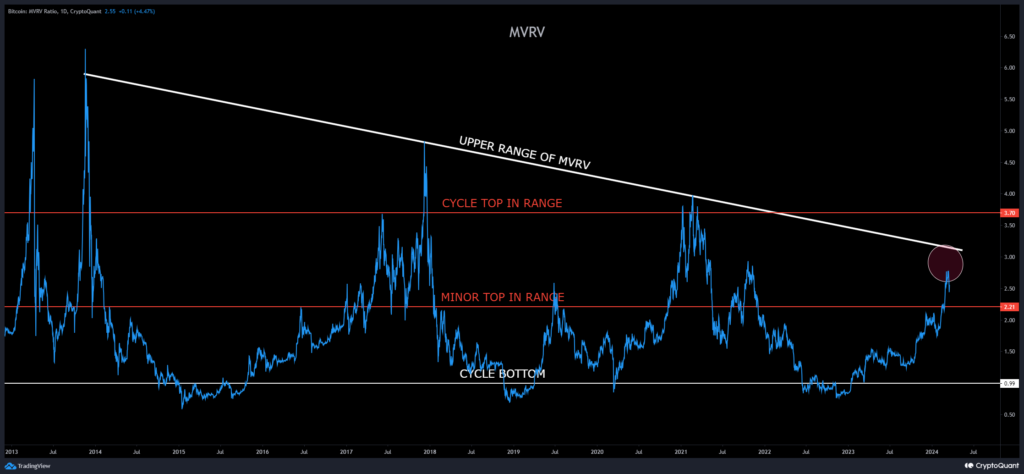

Market Cap to its Realized Cap (MVRV)

MVRV is used to understand when the exchange traded price is below “fair value” by looking at the ratio between market cap and realized cap (approximates the value paid for all coins in existence).

This gives an idea of whether the market is fairly priced and can be used to identify potential tops and bottoms in the market. As with any indicator, don’t use it in isolation; look for confluence with other data.

A new component this cycle is the orange line, the top of the MVRV range, which reflects an increasingly smaller ratio over time. For the first time this cycle, the longer term diagonal resistance is lower than the generally acccepted upper range of 3.7 for cycle tops, so traders should monitor both.

MVRV

Cooled off past week, with small reject along 2.8 minor resistance

US Dollar Index (DXY)

The US Dollar Index (DXY) is an index that measures the strength of the US Dollar. We’ve discussed the inverse relationship between the the DXY and speculative markets like crypto and equities. In general, when the DXY is up, crypto is down. The opposite is also true.

Of particular importance, the ~101 level, arguably the most significant for the DXY. Almost every time in the past 50 years, when DXY rejected from, or closed under the 101 range, it led to a prolonged period of weakening dollar.

If the fed drops rates in 2024, thats a strong signal that the DXY will continue to drop, and rates will inevitably decrease, its just a question of timing and whether they will start in 2024 or 2025. For rate decreases to occur in a year along with the Bitcoin halving would be particularly bullish.

Market Sentiment

Economic events, political discourse, or general price action are all events that can impact sentiment. The market is currently overwhelmingly bullish, and has been since October 2023.

This is a reflection of increasingly positive sentiment around cryptocurrencies. Various factors can affect sentiment, which in turn can lead to a selloff.

Going into the election cycle, we can expect some volatility to accompany the crypto narrative, with players like Senator Warren building an anti-crypto coalition. It remains to be seen if this will have a bigger impact on sentiment than the increasingly accomodating macro.

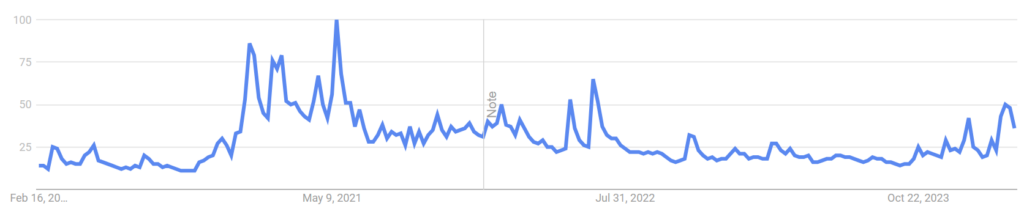

Other Sentiment Data

Coinbase App Ranking: Historically when Coinbase rises to the top of the app charts, a major top is approaching. Dropped nearly 70 ranks globally to 219, and 14 among finance apps.

Google Trends: Google Trends reflect what people are searching for on Google and also present a clear sentiment indicator when they rise towards 100. This week saw Bitcoin cooling off, after a breakout to it’s third highest level in 3 years.

Note: Remember Bitcoin, Ethereum, cryptocurrency is apolitical; its designed by and for the people. Governments, banks, funds, they are tourists here.

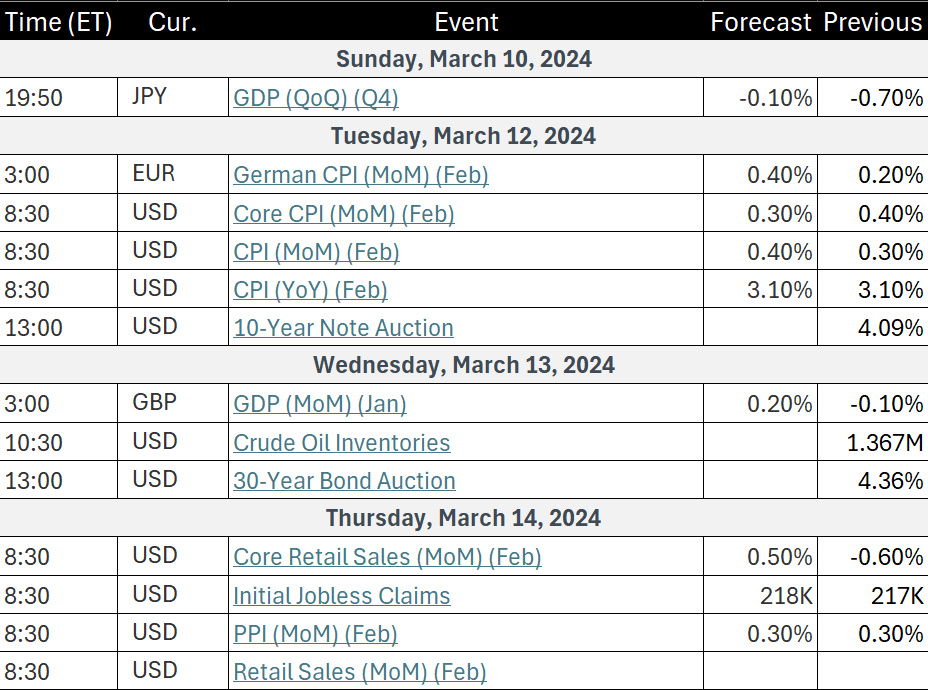

Crypto & Economic Calendar

Disclaimer: Nothing found on this website, or any sources linked to this website includes financial advice of any sort. We are not certified financial advisors, use our content at your discretion as entertainment, and as an educational resource. Do your own research.

The events below inform governments, corporations, traders and investors on the health of the economy. I only list events noted as “high volatility expected” in related markets.

——————————————————————————-

If you enjoyed this article and want more hot takes and interesting posts about the economy, web3, crypto, decentralized finance, NFTS and more – follow Papi on Twitter/X at https://twitter.com/1MrPapi.