Crypto & Economic Calendar

The events below inform governments, corporations, traders and investors on the health of the economy. I only list events noted as “high volatility expected” in related markets.

- Monday

- Nothing

- Tuesday

- Nothing

- Wednesday

- 0200 ET: [GBP] Gross Domestic Product (GDP)

- 0800 ET: [USD] Consumer Price Index (CPI)

- 1030 ET: [USD] Crude Oil Inventories

- Thursday

- 0815 ET: [EUR] European Central Bank (ECB) Interest Rate Decision

- 0830 ET: [USD] Retail Sales

- 0830 ET: [USD] Initial Jobless Claims

- 0830 ET: [USD] Producer Price Index (PPI)

- 0845 ET: [EUR] ECB Press Conference

- Friday

- Nothing

Bitcoin Indecision Prevails

Summary: It feels like we’ve been here before, and we have – Bitcoin is unlikely to give a definitive direction this year, unless the regulatory climate is clarified, or the macro outlook improves. While we are likely near peak US interest rates, there is room to climb a little higher, which would squeeze the dollar higher and crypto markets lower.

As noted over the past month, and more likely given current data: downside continuation could lead Bitcoin to the range between the 50% and 62% fibonnaci retracement, or $20k to $22k. While it may spook some participants, this is a technically healthy retracement.

Bitcoin Levels: $30k marked the most important support level in 2021’s bull market, and is the most important resistance to overcome in 2023. Several rejections from $30k since Q2 2023 add to the importance of $30k. Looking at the weekly chart:

- Immediate resistance: $25,600

- Immediate support: ~$24,757

- Current value range: $24,400 to $25,000

- Support levels:

- $25,000

- $24,450

- Resistance levels:

- $25,600

- $25,900

- $26,300

- $27,200 (21w EMA)

- $29,044

- $30,600

- $31,300-$32,000

- $34,000-$36,500

- $37,500

- $40,000

Bull Perspective: This breakdown is an opportunity for momentum and sentiment reset. Bulls were exhausted at $30k, its clear they need additional “firepower” to break through resistance. This can be achieved when price retreats to a key support that brings in more buyers and interest. This means a consolidation in this range can reverse into a new rally. The right news may also spark a reversal of sentiment and subsequent rally, such as a Bitcoin ETF approval, or additional regulatory clarity from the US Government.

Bear Perspective: A bullish reversal over the next month cannot be ruled out, but this writer’s bias continues to be weakly bearish. We had a weak uptrend but the shallow retracement just under the 23.6 fib doesn’t align to sentiment. Momentum indicators on the weekly, such as TSI or RSI, also reflect a bearish momentum that hasn’t quite bottomed. $20k to $22k remain probable, but is only marginally lower than current prices and will offer a great dollar-cost-average (DCA) opportunity for patient traders.

US Dollar Index (DXY)

The Dollar Index showed some short term strength, due to an indecisive but decidedly more hawkish US Fed, coupled with a struggling Euro. This is moving money away from risk assets like crypto, as investors attempt to navigate this messy macro and economic climate.

The DXY nearly lost it’s most important support level between 100 and 101, but is recently recovered to resistance around 105, before settling into support on 103. Overlaying a Schiff Pitchfork, the DXY is barely clinging to the top channel, and any loss of the key support around 100 to 101 will correspond with a movement to the next lower channel, likely signaling a more prolonged downtrend.

From a technical perspective, the DXY is flirting with downside continuation; but entering the final stage of the current hiking cycle, we may see a prolonged “dead cat bounce” for the Dollar as the US Fed tries to thread the needle in squeezing demand but avoiding a recession. Historically over the past 50 years, losing support along 101 led to multi-month to multi-year downtrends.

Why do we care about the DXY?

The Dollar Index is a complex financial data point, a lot of external factors impact its value. But in the simplest terms, you can look at the relationship between DXY and risk assets like Bitcoin simply – they usually move inverse to each other. When DXY is up, BTC is down; and the opposite is true.

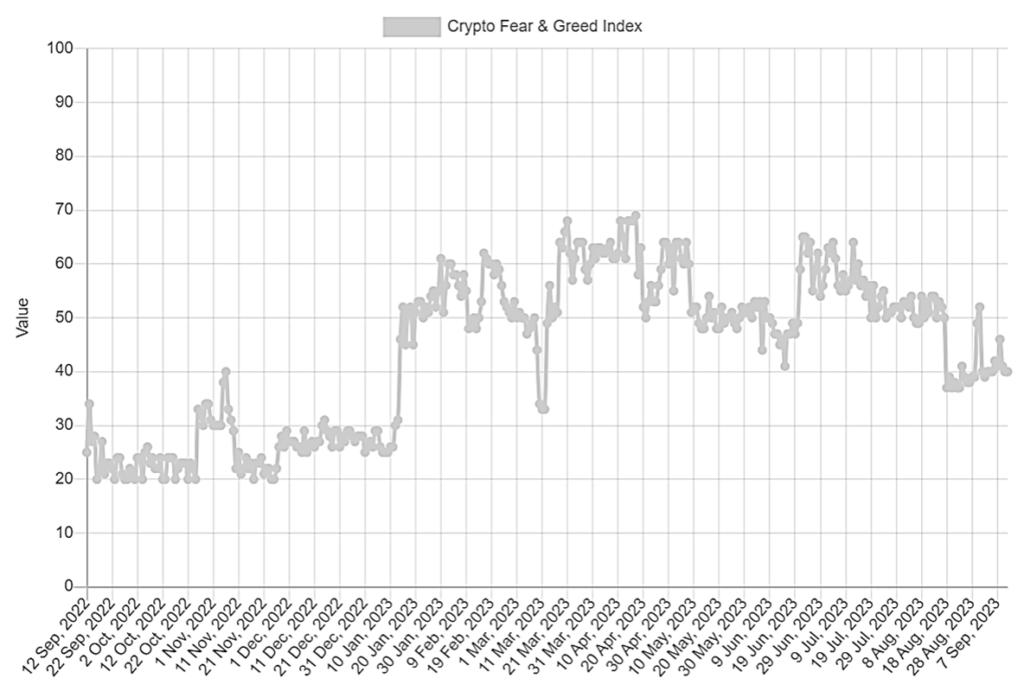

Market Sentiment

While things look up from late last year, there remains a pronounced uncertainty in the macroeconomic forecast, and regulatory climate. This is reflected in the past month’s drop below 50, to weakly bearish around 40.

An ETF approval likely lead to improved sentiment and greed across Bitcoin and crypto markets. Further boosts to market sentiment will follow if the US Fed declares a pause on rates, peak rates, or if a recession is confirmed avoided.

Trading Tips

Eat healthy.

A strong mind and body is important – trading speculative assets is one of the most mentally and emotionally draining activities you will take part in.

——————————————————————————-

If you enjoyed this article and want more hot takes and interesting posts about the economy, web3, crypto, decentralized finance, NFTS and more – you can follow Papi on Twitter/X at https://twitter.com/1MrPapi.

Disclaimer: Nothing found on this website, or any sources linked to this website includes financial advice of any sort. We are not certified financial advisors, use our content at your discretion as entertainment, and as an educational resource. Do your own research.