As an intermediate trader in cryptocurrency, you’ve likely held a Losing Crypto Trade. You know this nerve-wracking situation: a trade has turned sour, and you’re stuck in a losing position.

You’re not alone. Even seasoned traders find themselves in this scenario. But fear not – there are practical ways to navigate these choppy waters. Drawing on the wisdom of years of crypto trading, this guide is here to help.

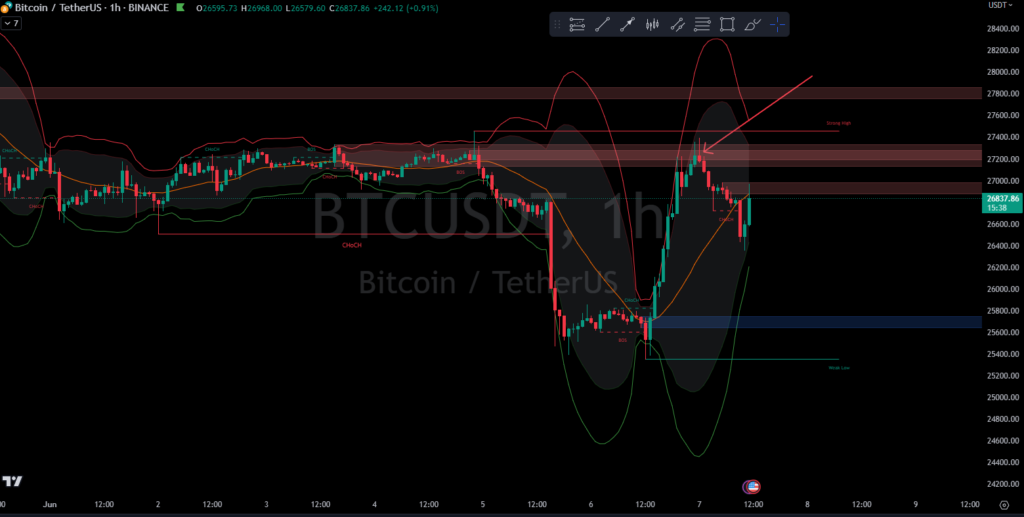

Understanding the Trend

First, let’s acknowledge the current market situation. As recent reports have indicated, many altcoins are in a bearish trend, and several have even moved into a full exit status.

Recognizing the market’s direction is crucial because it informs your decision-making process. Ignoring these signals may lead to overtrading or misuse of leverage, two common pitfalls that can exacerbate losses.

Navigating Losses with a Robust System

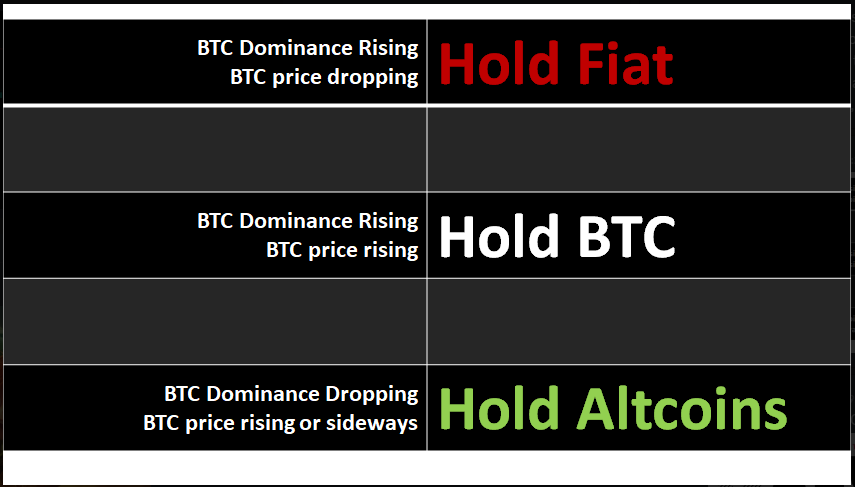

One way to effectively handle a losing trade is to rely on a robust trading system. With an objective money management approach, a good system helps traders manage their positions during market fluctuations.

Recently, the AltSeason CoPilot guided its users into a full cash position, a move that might feel counterintuitive but serves as an essential risk management strategy.

The Altseason Tradingview Indicator just flashed full exit on #bitcoin pic.twitter.com/wWi4qqvDbZ

— DigitalCurrencyTraders (@introtocryptos) May 10, 2023

Resisting Overtrading and Misuse of Leverage

It’s tempting, especially during a downturn, to chase after a bottom and anticipate a bull run, hoping to recover losses quickly. Yet, as many seasoned traders will tell you, this strategy often does more harm than good.

Overtrading can not only drain your resources but also your emotional well-being. Similarly, misuse of leverage can amplify losses. It’s essential to be patient and not let short time frame signals or market noise dictate your decisions.

Leveraging a Trading Community

Nobody should navigate a losing trade alone. A supportive trading community is an invaluable asset during challenging times. This group of like-minded individuals can offer a fresh perspective, share experiences, provide emotional support, and suggest potential strategies you might not have considered.

Facing the Future with Caution and Confidence

Even as the short-term forecast for the altcoin market appears bearish, the long-term future remains uncertain. Yet, don’t let this uncertainty rattle you. You’re in the driver’s seat of your trading journey. Recognize that the market’s unpredictability is part of the game – and sometimes, it’s okay to take a step back.

When is it REALLY Altcoin Season?

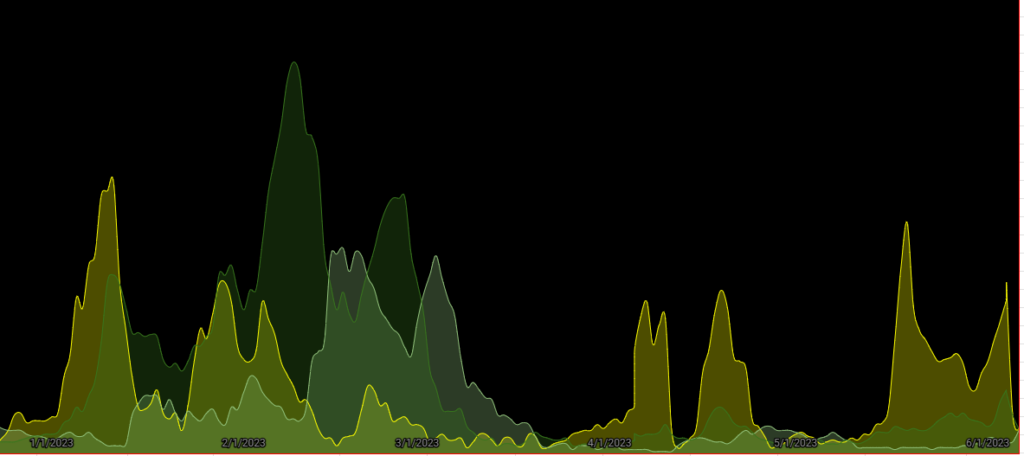

It’s also extremely satisfying to dodge the bullet and stay outside of the noise rather than jumping in on the short time frame signals that were flashing before the continuation of the downtrend. The best way to Handle a Losing Crypto Trade, of course, is to plan for it in advance.

Here we can see the yellow is ALERT (get ready). This system held us out of the mini-pumps and filtered out the noise successfully.

Capital preservation.

Remember, a losing trade does not define your overall trading skill or potential. Consider it a learning experience, an opportunity to refine your strategy, enhance your risk management, and deepen your understanding of the market’s complexities.

In conclusion, handling a losing crypto trade involves recognizing market trends, leveraging a robust trading system, resisting overtrading and misuse of leverage, and engaging with a supportive trading community.

With these strategies, you can navigate losing trades with greater confidence and poise, ready to face whatever the market throws at you next.