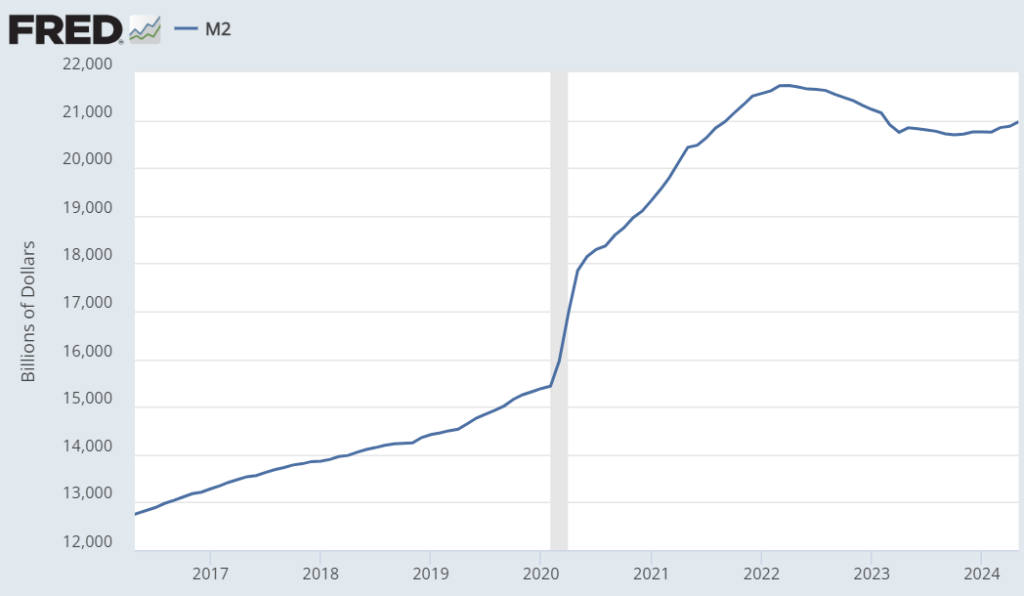

Lets start off by talking about money supply. Its one of those sexy economic terms we rarely discuss, but heavily impacts our investments. Basically its the amount of money readily available to Americans. It includes:

- Physical currency and coins

- Checking accounts

- Savings accounts

- Small time deposits

- Retail money market funds

Little known trick for chartists: you can apply a formula to your charts that shows BTC’s value adjusted for the supply of money in the US. As you see below, the increase in money supply post-COVID is not insignificant.

This drives things like inflation, and also skews the valuations on assets like Bitcoin.

The standard BTC chart shows it UNDER 2021’s top, as resistance, in 2024:

BUT the Bitcoin chart adjusted for money supply (M2SL) shows us OVER 2021’s top as support:

The M2SL adjusted chart was more accurate through bear. Which do you believe?

Personally I lean towards the M2 adjusted chart, I think it paints a more accurate picture, removing the noise from an evolving monetary climate.

On the M2SL adjusted chart, major support levels during the bear market very cleanly correlated to earlier cycles on that chart.

July’s close should help us determine direction from here. More specific – let’s see how July’s Nope Zone plays out. I’m very confident in resuming a proper bull by Q4-24 to Q1-25; but timing isn’t certain. We have the possibility for another leg down first.

And beyond July’s Nope Zone, we have to overcome the 2024 Nope Zone. Closing a monthly over $67.5k would be a good start. Closing over $71.5k would be bullish spicy.

With 9 days remaining in July, we might log the highest close since March, first time in the 2024 Nope Zone.

If we reject again, its okay- we continue sideways summer and stack more.

By now you notice some alts perform better than others this year. As a general rule: if your alt performed worse than 50% YTD, rotate it out. Any alt that can’t beat the big 3 are not worth the risk.

What I’m watching:

- Fed and the rate cycle

- Election

- ETF flows

- Semantics around Gox flows

- On-chain

My DCAs continue. I also keep my limit orders open, in case we drop again. Be patient, stack and enjoy your summer.

If you enjoyed this, you can follow me for more hot takes, shitposting and other perspectives on Twitter/X: https://x.com/1MrPapi