Cryptocurrency markets are notorious for their volatility, and the massive crypto market crash overnight is sending waves of panic through the trading community.

Were There Warning Signs?

Yes, for those who follow the AltSeason Copilot spreadsheet, the crash didn’t come as a total surprise. The tool had been signaling warnings of an impending market move for quite some time.

In this article, we examine how the AltSeason Copilot managed to provide early warnings and what traders should keep in mind for future market trends.

A Brief Overview of the Crypto Market Crash

The cryptocurrency market is now experiencing one of the most significant crashes in recent memory. Bitcoin, along with numerous altcoins, plummeted overnight, wiping out billions of dollars in market capitalization. The causes behind this sharp decline are varied, including regulatory pressures and market sentiment shifts. But for those using the AltSeason Copilot spreadsheet, there were signs that such a move was on the horizon.

Alt Season Copilot: A Beacon Amidst The Storm

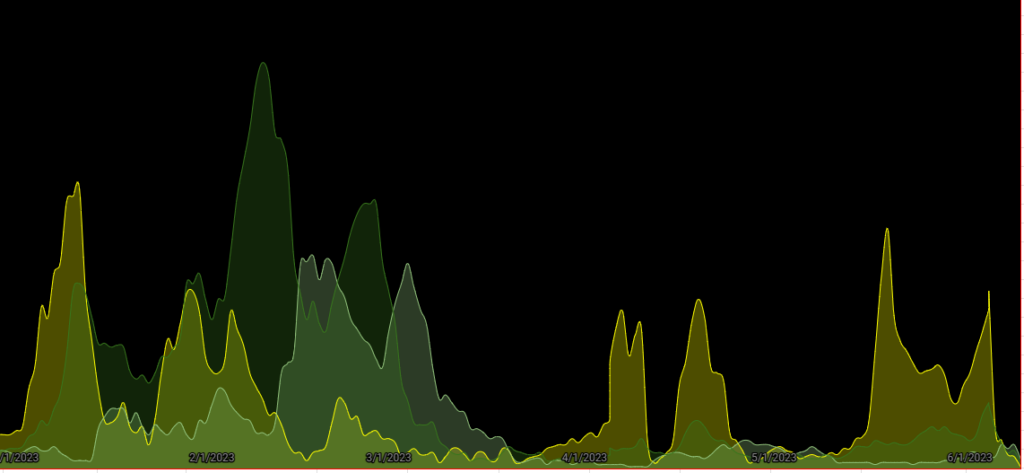

The AltSeason Copilot spreadsheet is a tool designed to analyze Bitcoin dominance and altcoin averages over time. Through meticulously tracking these data points, the spreadsheet aids traders in comprehending the direction and momentum of cryptocurrency prices.

Warning Signs

As the market was approaching its tipping point, the AltSeason Copilot was already setting off alarms. The spreadsheet, through its data analytics, was indicating that the market was nearing exit ranges. For those who paid attention, this was a clear indication to prepare for market shifts.

The Importance of a Data-driven Approach

The recent crash highlighted the importance of employing a data-driven approach in cryptocurrency trading. While nobody can predict the future with absolute certainty, tools like the AltSeason Copilot spreadsheet offer traders invaluable insights.

Being Prepared

Being forewarned allowed traders to take various measures, such as setting stop losses or reallocating assets to hedge against the impending crash. Those who heeded the warnings of the AltSeason Copilot potentially minimized their losses compared to those who were caught unawares.

Learning for the Future

Understanding the importance of risk control is crucial for future trading. While the markets have already taken a hit, they will eventually stabilize and start moving again. Being prepared and employing data-driven tools can be the difference between making a profit or suffering losses the next time the markets make a significant move.

Key Takeaways

The overnight crypto market crash is a stark reminder of the inherent volatility in this space. However, simple tools can prove to be invaluable for traders seeking to navigate these choppy waters. While no one can predict the future, being able to see warning signs and prepare accordingly is an asset in any trader’s arsenal. In an ever-evolving market, staying informed and adaptable is key to success.