You probably see a lot of influencers doomposting today, I don’t do that. I try my best to share objective perspectives on markets.

I’ll review recent news, fud and technicals, and you can decide how bearish or bullish you feel afterwards (or skip to the end if you are in a rush):

Mt. Gox Distribution:

Mt. Gox distribution has been making headlines for 7 years. Conveniently this (often) appears on social media at key Bitcoin support levels. Why?

When price drops, human psychology drives us to seek a narrative or reason for it. Yes at some point Mt. Gox Bitcoin will enter markets and we are getting closer to that moment. But distribution takes time, most of it is with small holders with a few hundred to a few thousand dollars worth.

Even if/when they sell, its not as if the entirety is selling in a single market order. It will be months of trickling sales, and many will just HODL. But the absolute worst case scenario? This is where the top holders dump as fast as they can- I estimate we land back around $52k, the bottom of a majorly bullish value range extending from $59k down to $52k.

Germany Distribution:

Germany was in possession of over 40,000 BTC. They are starting to sell. No public statement was made regarding timing or amounts, so we are assuming worst-case scenario that all of it will come to market.

At around $3 billion dollars worth, that would only equal 12% of Bitcoin’s daily volume. But for now they only sold a little over $300 million. If they continue with that pace, it will have almost no impact on price, aside from semantics, which compounded with other fud like Mt. Gox, can spook some investors to sell.

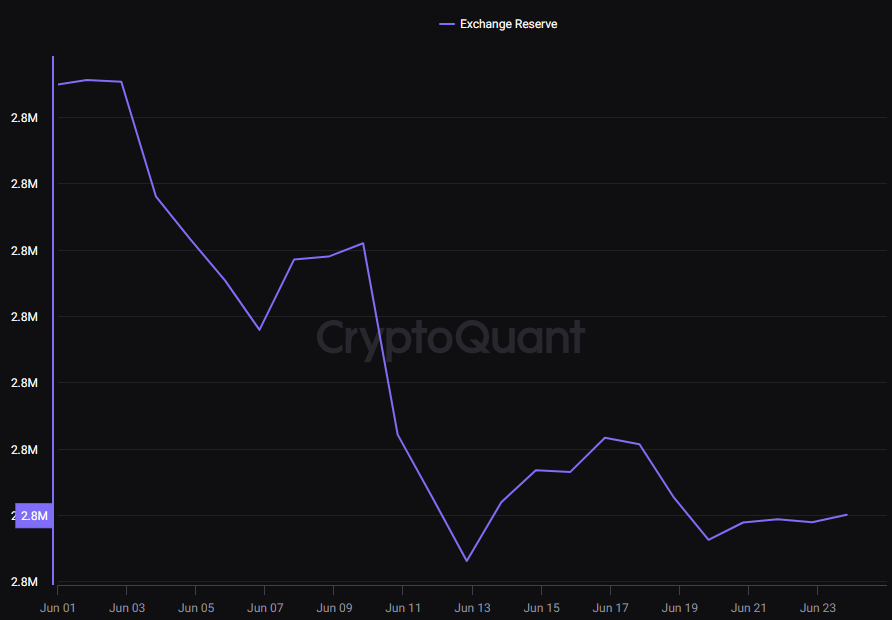

Supply on Exchanges:

When you look at current supply trends, while we are seeing some heavier flows into exchanges, the net result is still a decline for the month of June, and its not even close. A total of around 35,000 Bitcoin left exchanges this month [bullish].

That said, flows change and depending on whether the Mt. Gox news is true this time, we may see rising supply in July. But with the addition of ETF flows and increasing adoption from retail, on higher timeframes I don’t expect Mt. Gox or Germany to influence the continued decline in supply on higher timeframes –

We may see lower timeframe volatility and rising supply intraweek or intramonth, but across the year of 2024, Bitcoin will continue to march towards an inevitable supply crunch this decade, maybe much sooner, where there simply isn’t Bitcoin remaining on exchanges for everyone that wants it.

Note that while I discuss Bitcoin here, we see similar trends for Ethereum, which has an additional benefit of having deflationary economics over a certain level of utilization.

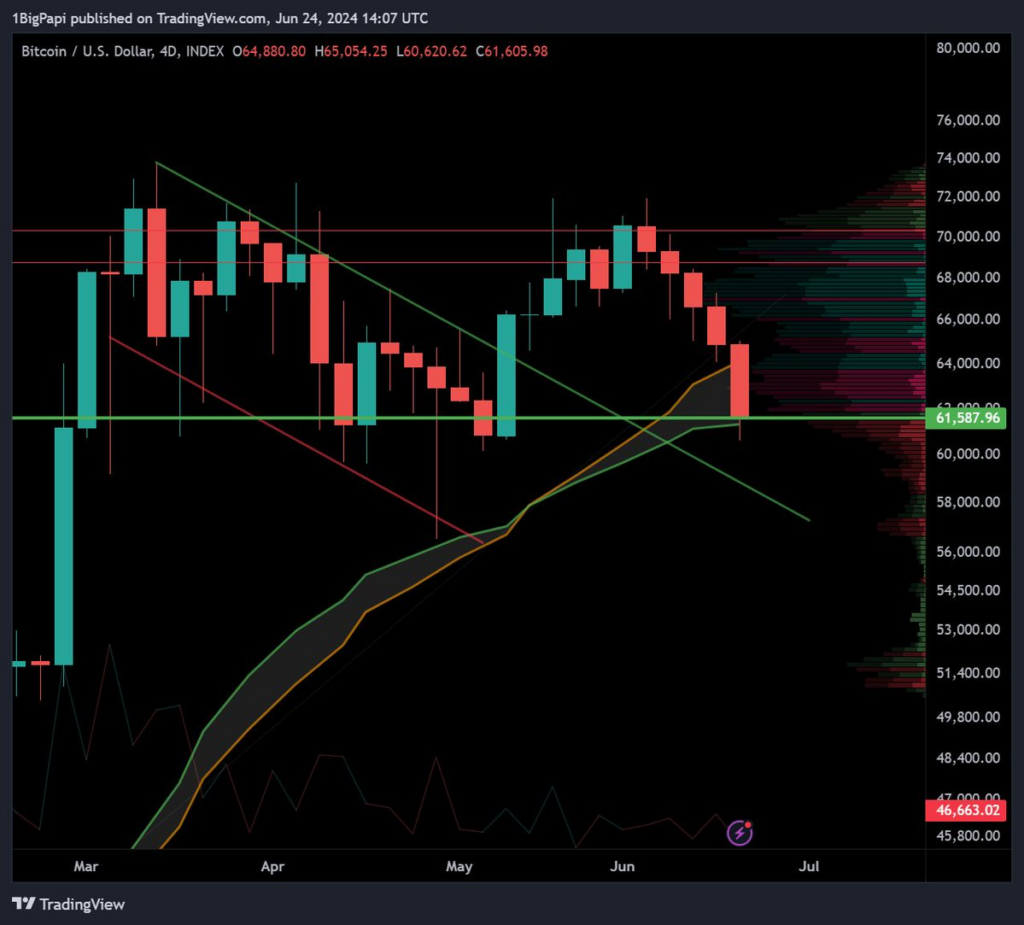

Bitcoin Market Structure:

So this is where it starts to get interesting. Bitcoin penetrated the 20w SMA and 21w EMA, collectively known as the “bull market support band.” These are historically the supporting moving averages that Bitcoin rides to the top of a bull market.

Its not unheard of that price can pierce that support intraweek, but the important thing is that we close the weekly in or over that band.

We are currently testing the 21w EMA, that also aligns with the last bullish value range before $58.3k. If there was going to be a bounce, this is where it will happen.

Macroeconomic:

You’ve probably seen commentary about the Japanese versus Dollar, and how the Yen is struggling against the Dollar, potentially leading to a collapse of the Japanese Yen.

There is absolutely a scenario where that could cascade to larger macro instability, and I’m not qualified to comment on it in-depth.

But one possibility and worth acknowledging – the US Dollar is at the end of a rate cycle, with the US Dollar Index (DXY) showing clear signs of decline on higher timeframes. It logged several rejections as it falls closer to losing the key support along 101.5.

If the DXY continues it decline, that alleviates pressure on the JPY, which could avoid a larger economic disaster, with the added bonus of boosting crypto and speculative markets. And Japan is not unique, even the US is suffering with a stronger dollar in light of a rising sovereign debt.

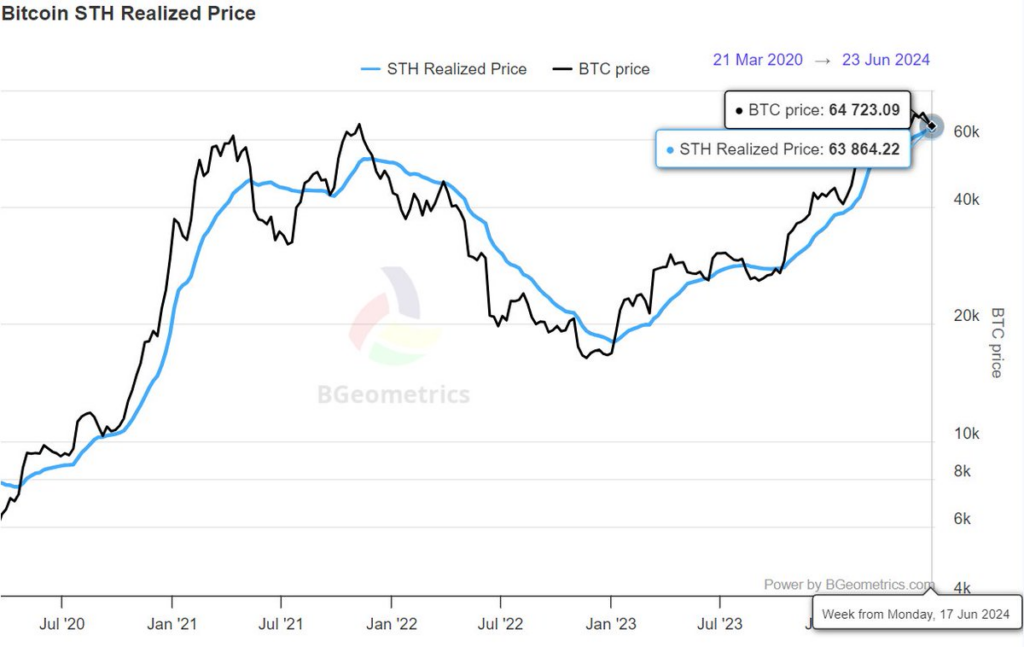

Short Term Holders:

One data point often used by analysts is the cost-basis (price investors bought at) for short-term holders. This often acts as a support, for obvious reasons-

If someone buys Bitcoin, as long price remains above that price they will feel good. If price drops below it, its increasingly likely they panic sell or positions get liquidated.

Bitcoin dipped below this STH realized price today, before bouncing back to around $1,000 over it. It’s not unheard of in a bull trend, but you ideally recover this level within a week or less.

You can easily find this chart online by searching for STH realized price.

So what’s next?

From a price perspective, accounting for all probabilities, you could see price anywhere between $50k and $70k, with a short term bias early this week of a little bounce.

For background: I’ve been DCA’ing into the market since 2022. My entire strategy is to stack spot until we approach the end game for the cycle, then cash out. In my opinion the end of cycle is still a ways out.

On days/weeks like today, I’ll log in and manually stack extra. Today I already made a few buys.

Possibilities for the remainder of 2024:

- [Most Likely] sideways summer; we see continued chop and shake out paperhands and overleveraged traders before the Fed pivots in Q4 (possibly).

- [Least Likely] sink notably lower in the near term; we see the macro instability in currencies like the JPY accelerate, bumping the DXY higher and sinking risk assets like crypto.

- [Moderately Likely] rally hard into summer; we see the macro stabilize, more good news on inflation comes, and markets try to front-run the Fed rate decision at end of summer by buying now.

Why do I choose sideways summer as most likely? Largely timing and sentiment. The end of the rate cycle also correlates to historic Bitcoin trend of lengthened cycles which call for a cycle top by Q1 2025. Additionally, searches for Bitcoin and crypto are largely in decline after peaking in March. Data shows a great deal of correlation with mid-cycle consolidation, and very little with the end of a cycle.

Keep in mind that once this cycle peaks, there is a good probability that the macro climate will destabilize and we fall into a recession or worse.

So timing this cycle’s exit is important, but everything until then is just noise imo.. and right now nothing indicates the end of the cycle here.

Enjoy this? You can follow me at my OG account on X/Twitter @1mrpapi or my crypto-only account at @thectpapi