Preface: With sentiment we are using public data available via app store rankings, search trends, social media, and data to gauge public sentiment around crypto.

A bullish market is a greedy market, and should correlate to positive sentiment. And some of the best top signals are sentiment-based, such as the Coinbase app reaching the top of charts.

Overall Score

App Rankings

Coinbase:

Moderately bearish: As most know, Coinbase rising to the top of the app charts is a consistent top signals. Its current ranking dropped nearly 100 ranks globally in the past week, likely due to sticky macroeconomic jobs data. Coinbase is currently at #264 globally but remains steady at #14 among finance apps for the second week.

At these levels its elevated but not to the levels we see at peak mania, most retail investors aren’t stacking at these levels- typically a good time for crypto believers to stack.

Other Exchange Apps:

- Down 2 positions to #34 Crypto.com

- Down 2 positions to #40 Binance

- Down 15 positions to #71 Bybit

- Up 15 positions to #70 OKX

- Up big time 57 positions to #65 Kraken

Wallet Ranks: Phantom at the top follows the memecoin cycle we saw through late Q1 into Q2, mostly on Solana.

- Dropped significantly 49 positions to #54 Phantom

- Up significantly 27 positions to #50 Trust

- Up 1 position to #58 Coinbase Wallet

- Up 45 positions to #41 Metamask

Search Trends

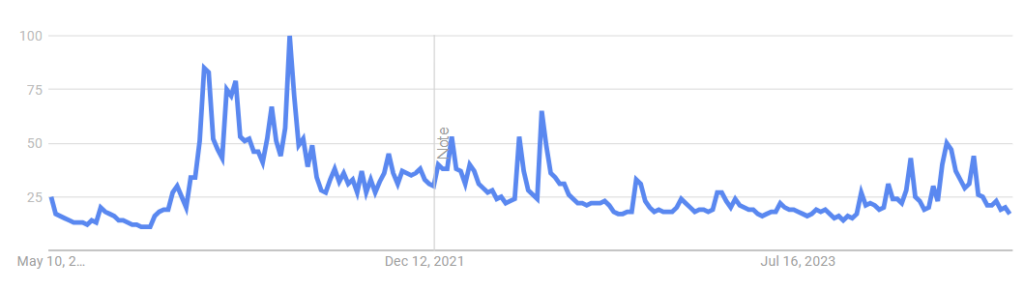

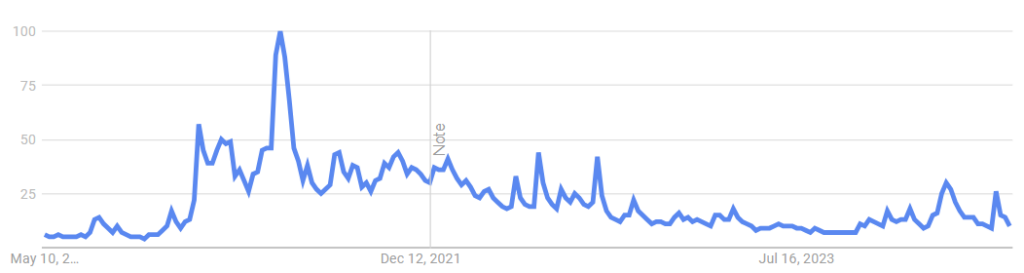

Bitcoin:

Neutral: Searches for Bitcoin slid into moderately bearish levels as interest wanes from March highs. The past 6 weeks of mid-cycle chop and indecision did a great job of resetting sentiment and interest among retail.

Note that institutional investors are not the driver of Google searches, retail is. And while institutions are buying in this range, retail is largely sidelined or HODLing.

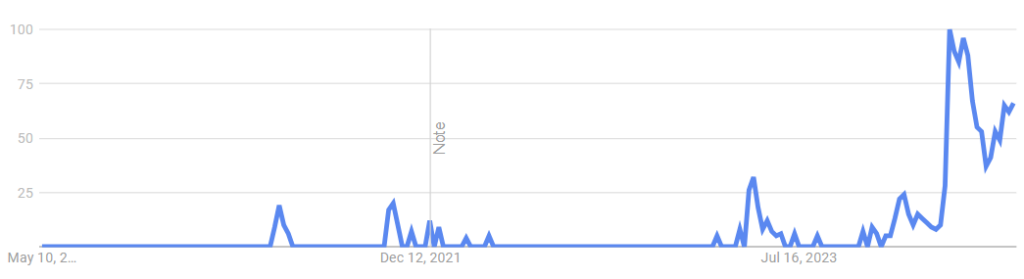

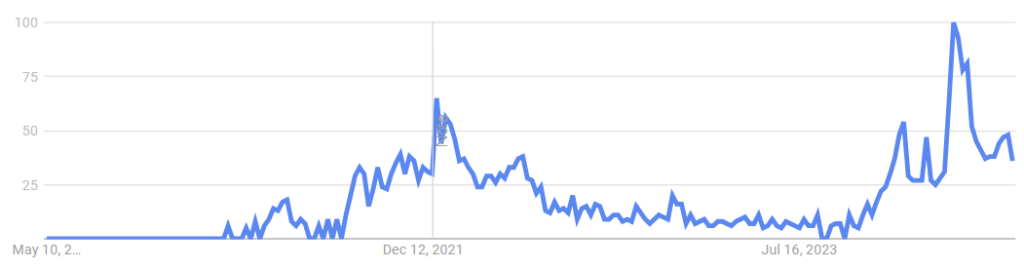

Memecoins:

Neutral: Searches for Memecoins continue to slide from March highs, but did log a small bounce recently. It remains to be seen if this continues up or if memecoins are rotating out for the next cycle hype event.

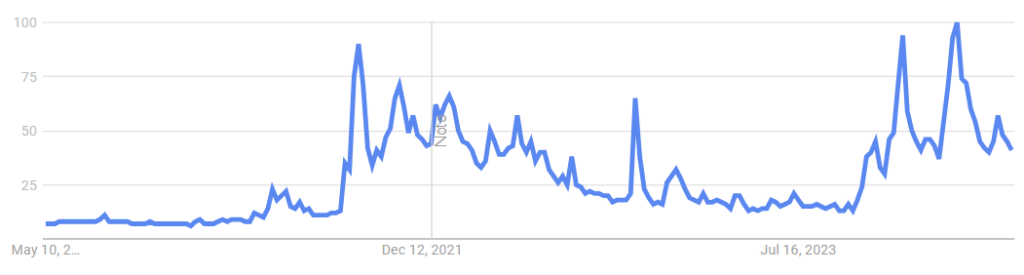

Solana:

Neutral: Searches for Solana are elevated but currently trending down since March, strongly correlated to memecoins. Like memecoins, searches for Solana logged a recent bounce. However it remains to be seen if this is just a small bounce before moving lower.

Ethereum:

Neutral: Ethereum appears similar to Bitcoin. Again, Google trends are driven by retail searches, not institutions, so they can be misleading. But its clear that the small population of retail traders active in the market are focused on memecoins and farming, which is primarily on Solana.

Large caps like Ethereum are likely to cycle in later in the cycle on the back of a growing L2 ecosystem like Blast and Base.

NFTs:

Neutral: NFTs at this stage in the cycle were replaced by memecoins for most traders. There remains an active digital art community and some pfp collections continue somewhere between thrive and survive. But in general terms, the attention economy is still coming off memecoin highs.

Its likely NFTs cycle in later, due to the ease of access for normies.

Sol Wallet:

Bullish: Searches for Sol wallet correlate to the memecoin cycle and logged a very similar trend. As with Solana and memecoins, it remains to be seen if these continue up with the same trajectory as the cycle progresses.

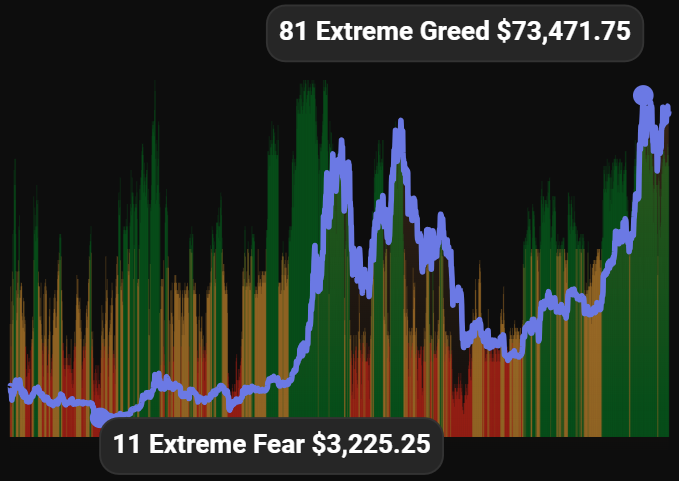

Fear and Greed

Currently Bitcoin F&G is in the top 30% of the index at 72, suggesting elevated but not peak greed.