By Maugie Solana-Drops: G8baFXXs1hvrFRi4Ms1iwjgBktm9Azg7Rz4Vj2f9mbwE 💖

–> Maugie on Twitter

Click for Audio Read!

Understanding the Recent Disruptions at Juno Finance and Evolve Bank & Trust

Personal Experience

On May 12, 2024, my daughter and I went out for lunch at a local Mexican restaurant to celebrate Mother’s Day. Unfortunately, my Juno Finance card was declined multiple times from two separate card readers. This was particularly frustrating because I had a positive five-digit balance in my account. I don’t typically carry cash, and my watch, which I usually use for payments, was at home charging. In a pinch, I managed to manually enter my husband’s card information, which is linked to a different bank, to complete the transaction. I had switched from traditional banks to crypto institutions like Juno to avoid such issues, as Juno claims to eliminate mandatory holding periods for crypto withdrawals, promoting self-custody.

About Juno Finance

Juno Finance is a fintech company that integrates traditional banking services with cryptocurrency capabilities. Juno provides users with the ability to manage both fiat and crypto assets seamlessly. They offer quick access to over 20 blockchains through various means such as ACH, Wire, and Cash App. Juno promotes the idea of financial freedom through self-custody, distinguishing itself from many U.S. crypto exchanges by eliminating mandatory holding periods for crypto withdrawals. They aim to blend the ease of traditional banking with the innovative possibilities of cryptocurrency.

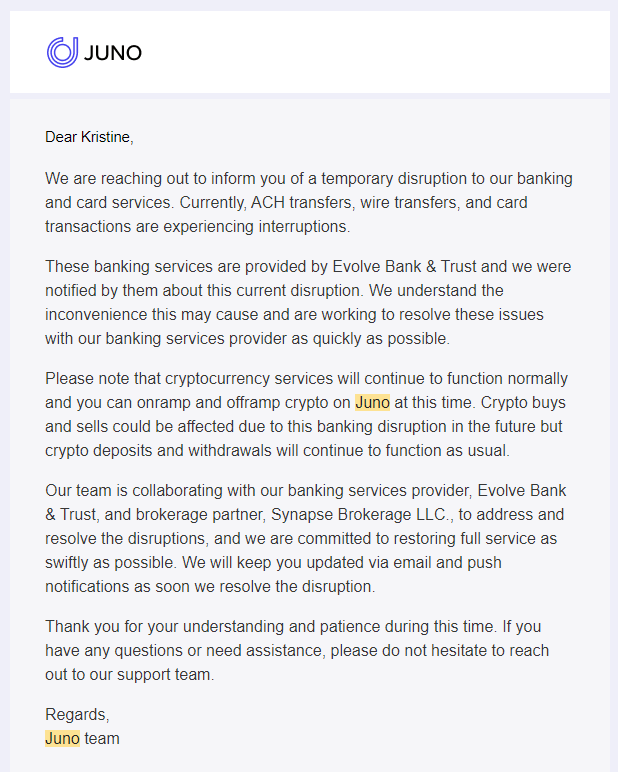

Notifications from Juno Finance

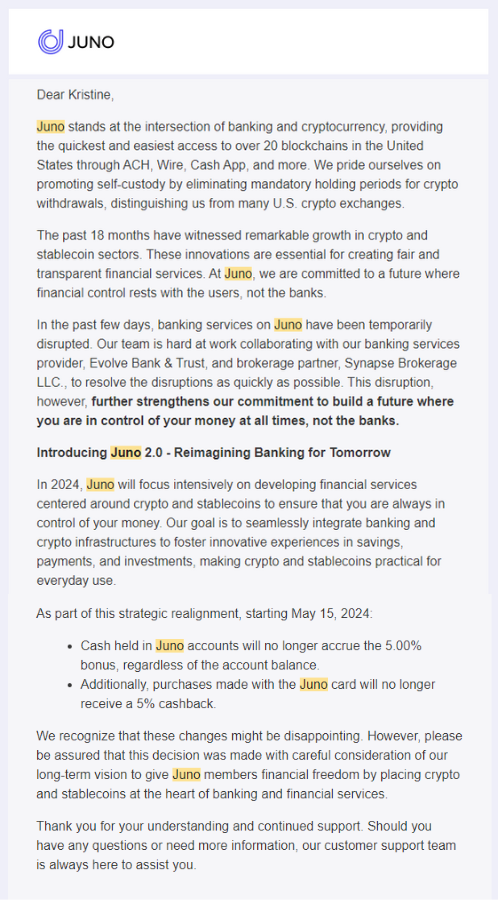

Shortly after the incident at the restaurant, I received an email from Juno Finance explaining the situation. On May 12, 2024, Juno informed customers of a temporary disruption to their banking and card services, including ACH transfers, wire transfers, and card transactions, attributing these issues to their banking partner, Evolve Bank & Trust. Despite these interruptions, cryptocurrency services continued to function normally. The email assured users that Juno was working closely with Evolve Bank & Trust and Synapse Brokerage LLC. to resolve the issues and would provide updates via email and push notifications.

The following day, on May 13, 2024, Juno sent another email announcing significant changes to their bonus and cashback programs. Effective May 15, 2024, cash held in Juno accounts would no longer accrue a 5.00% bonus, and purchases made with the Juno card would no longer receive 5% cashback. This shift is part of Juno 2.0, focusing on developing financial services centered around cryptocurrency and stablecoins to ensure users have full control over their finances.

Customer Service Interactions

Frustrated by the ongoing issues, I reached out to Juno’s customer service. The representative, Pallavi, explained that the disruptions were due to issues with Evolve Bank & Trust and emphasized that Juno was not responsible for these disruptions. She reassured me that Juno was collaborating with Evolve Bank & Trust and Synapse Brokerage LLC. to resolve the issue as quickly as possible. Pallavi also provided a link for real-time status updates on the services.

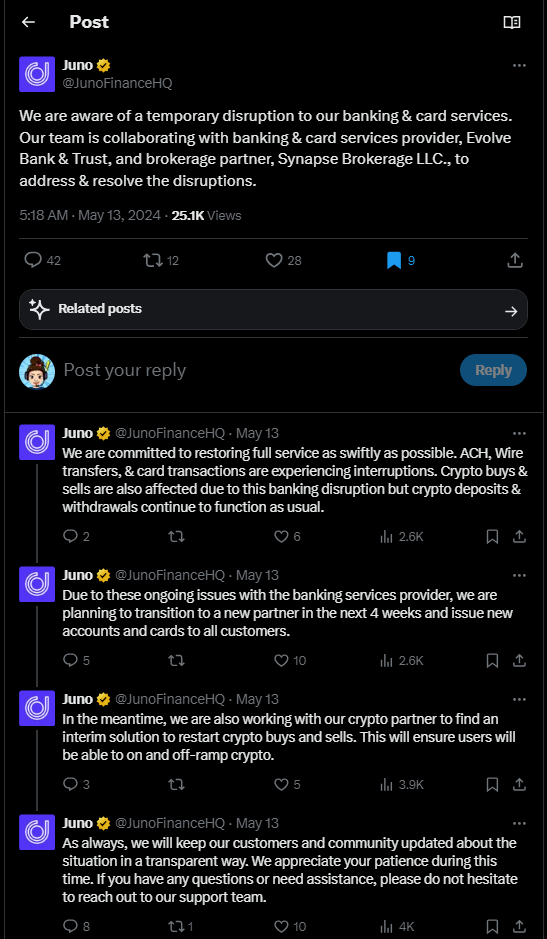

Juno’s Social Media Updates

Juno Finance actively addressed the situation on their Twitter account. On May 13, 2024, they acknowledged the temporary disruption to their banking and card services and outlined their efforts to resolve the issue. They mentioned that ACH transfers, wire transfers, and card transactions were experiencing interruptions. They also announced plans to transition to a new banking partner within four weeks and issue new accounts and cards to all customers. Additionally, Juno is working with their crypto partner to restart crypto buys and sells to ensure users can still on-ramp and off-ramp crypto. Juno emphasized their commitment to transparency and keeping their customers informed during this period.

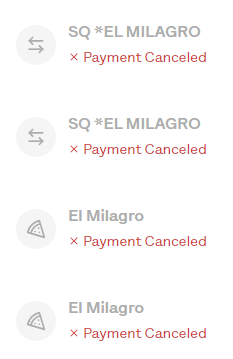

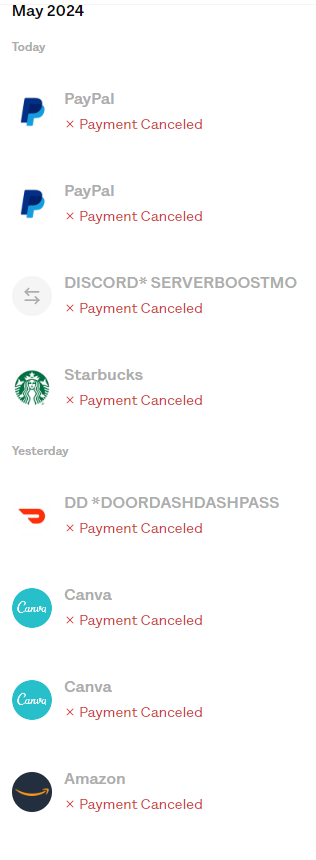

Declined Transactions

The disruptions have led to multiple declined transactions for many users, including myself. Payments to services such as PayPal, Discord, Starbucks, DoorDash, Canva, Amazon, and a local Mexican restaurant (El Milagro) were all marked as “Payment Canceled.” This issue was consistent across several days in May 2024, highlighting the widespread impact of the disruptions.

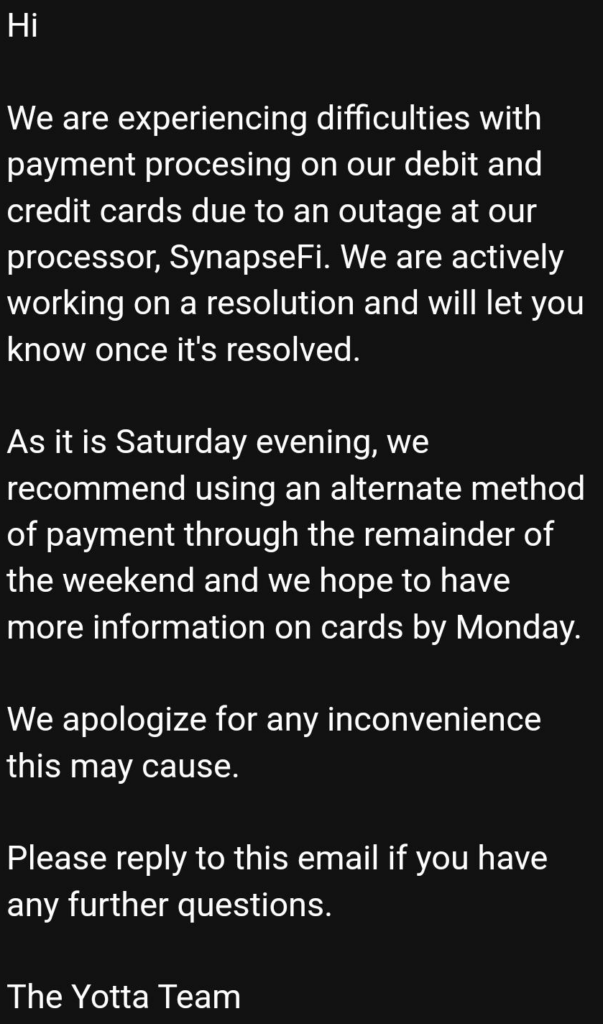

Investigating Further: SynapseFi Outage

In my search for more information, I came across an article highlighting that the issues might be related to SynapseFi, a third-party financial institution that went bankrupt in October 2023. This article, titled “SynapseFi Outage Causing Problems With Yotta, Juno & More,” indicated that SynapseFi’s bankruptcy and subsequent operational issues have affected many fintech companies, including Juno Finance and Yotta Savings. Yotta had sent out an email explaining difficulties with payment processing on debit and credit cards due to an outage at SynapseFi.

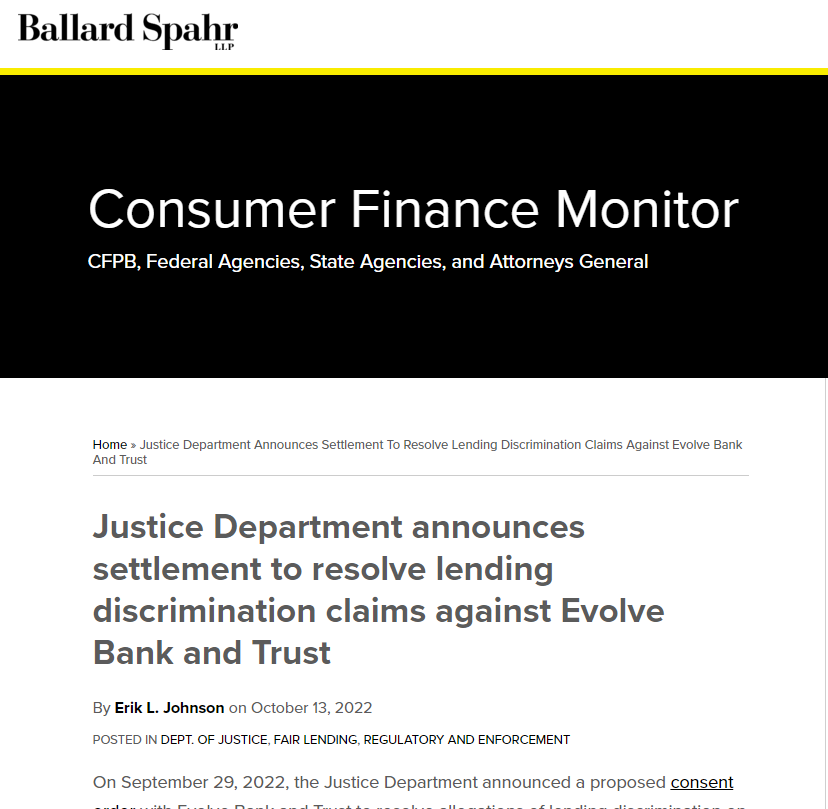

Legal Issues with Evolve Bank & Trust

Evolve Bank & Trust has been under legal scrutiny for discriminatory lending practices. In September 2022, the Department of Justice (DOJ) announced a settlement with Evolve Bank & Trust to resolve allegations of discriminatory lending. From 2014 to 2019, Evolve’s loan pricing practices resulted in Black, Hispanic, and female borrowers paying more in discretionary pricing components of home loans compared to white or male borrowers. The settlement included a $1.3 million fund to compensate affected borrowers and a $50,000 civil penalty. Evolve was required to revise its policies to reduce loan officer discretion, hire a fair lending officer, and provide fair lending training to its personnel.

These legal and operational challenges, combined with the recent service disruptions, likely influenced Juno Finance’s decision to transition to a new banking partner if that is what they are doing (there is still a lack of transparency there) to ensure more reliable and compliant services for their users.

Conclusion

The recent disruptions at Juno Finance underscore the challenges fintech companies face when relying on third-party financial institutions. While Juno works to resolve these issues and transition to a new banking partner, users are encouraged to stay informed through official updates and service status notifications. The legal and operational challenges faced by Evolve Bank & Trust highlight the importance of compliance and reliability in financial services. I sincerely hope that this situation gets sorted out quickly, as not everyone has the means to manage these disruptions. It’s been a stressful experience, and I am eagerly awaiting more updates soon.

Sources

- Justice Department Announcement: https://www.justice.gov/opa/pr/justice-department-announces-actions-resolve-lending-discrimination-claims-against-evolve-bank-and-trust

- Consumer Finance Monitor: https://www.consumerfinancemonitor.com/2022/10/13/justice-department-announces-settlement-to-resolve-lending-discrimination-claims-against-evolve-bank-and-trust

- SynapseFi Outage Articles: https://www.doctorofcredit.com/synapsefi-outage-causing-problems-with-yotta-juno-more/

https://www.americanbanker.com/news/what-synapses-bankruptcy-means-for-the-baas-model

Affiliate Link 💖

Disclaimer: This article is for informational and entertainment purposes only. It is not intended to be financial advice. The views expressed are those of the author and do not necessarily reflect the official policy or position of any agency or company. Cryptocurrency investments are volatile and high risk in nature. Don’t invest more than what you can afford to lose. Before making any financial decisions, consult with a qualified professional.