Bitcoin – Current Trend

Your mission right now: Don’t be shaken out! Don’t lost it all gambling on leverage or memes! But also mentally prepare for volatility and (potentially) more downside.

Summary: There are no on-chain or sentiment indicators of a cycle top, but many indications of a mid-cycle consolidation range below all-time high. Volatility and indecision will present at times, due to ongoing macroeconomic and geopolitical tensions, specifically this week: the Yen weakness, inflation concerns and Federal Open Market Committee (FOMC), and Hong Kong (Chinese) Bitcoin ETFs. More downside is very possible in the coming weeks, key supports at $61-62k, $52k, mid $40s.

Key Levels: I noted local [major] horizontal supports on the chart above, ranging from $40 lows (worst case) to $60s. Price is currently supported in the lower $60k range, but has yet to post a higher low and could trend lower depending on how Japan contends with their currency issues, and how the Fed responds at the FOMC Wednesday.

Ideally we close the month over $61k, to avoid a bearish engulfing candle for April.

Bull Case: Historically the ~10 months post-halving grow increasingly bullish; ETF interest growing as Hong Kong approvals open the door to Chinese investors; semantics around the overall crypto market and Bitcoin are vastly improved from past cycles; on higher-timeframes most on-chain and sentiment data indicates a bullish market, but not excessively greedy or overbought yet; Coinbase app isn’t near the top of app ranking.

Bear Case: The US Fed may not taper rates as early as markets anticipate, especially in light of recent jobs data and other external risks like Japanese selling of US bonds; the US election could introduce divisive political and regulatory dialogue around cryptocurrency; geopolitical tensions in the Middle East and Ukraine; the US Dollar is benefiting from weakness in competing currencies and some inflationary economic data like jobs, leading the Dollar Index (DXY) to rise.

What you do from here depends on your risk appetite, and won’t change until we leave this range:

- If you are still buying spot (as I am), use this time to rotate out weak performers, and double-down on strong performers. Don’t ape and lose it all on memecoin rugs. Be aware of tax implications as you do this and set aside some stables or cash for that.

- If you are a LOW RISK spot holder, you should already be exiting positions. Sell and don’t look back, or FOMO might pull you back in. Remember tax implications when selling, which makes it risky to re-enter the market after exiting.

- If you are a day trader, this is a challenging range full of chop due to indecisions in macro, geopolitical and locally in cryptocurrency markets. I don’t recommend day trading at this time, but if you do, try to identify the prevailing high-timeframe trend and trade in that direction.

Promising Narratives: If you are looking to rotate into something new, these may offer respectable risk/reward, but do your own research:

- Utility expansion on Bitcoin, like ordinals, Stacks, Runestone

- Ethereum L2s and L3s, especially those built around BASE, which Coinbase will drive new traders to

- OG projects like DOGE or LTC that might see institutional interest

- Emerging L1s like SEI that have VC investors & interest, VCs find ways to pump their bags

- Memecoins with utility, for example if Elon adopts DOGE for Twitter

- GameFi or NFTs related to gaming

- Web3 and crypto digital art. Cryptopunks, XCOPY, Beeple, and many others.

- Solana’s maturing DeFi ecosystem and memecoins (when its not broken)

Long Term Cycle Forecasts

The market is rarely this simple, but one possibility is for the top to arrive along the same diagonal range we saw in 2017 and 2021, which would land around $140k if it lands between Q4 2024 and Q1 2025.

Below is the totality of Bitcoin’s logarithmic growth, another great way to display data that spans many orders of magnitude. This shows Bitcoin reaching the lower $100k range by early 2025. When considering the current cycle’s growth trajectory, that could arrive earlier, and go higher.

Changes in the macroeconomic, regulatory or geopolitical climates can impact this timeline. For example, if inflation starts to steeply rise again and the Fed raises interest rates, we would expect crypto to respond negatively.

This cycle is different, due to institutional buyers and the economic climate. This makes it difficult to rely on historical trends, so we look for confluence across several data points when forecasting this cycle.

Market Health – Is Cycle Top Near? Read On..

Below is a list of popular data points that can INDICATE whether a cycle top is in range. Never take a singular piece of data as gospel, there is no single and guaranteed way to predict a cycle top.

Note: a glossary of each item is at the end of the article.

Supply of Bitcoin on Exchanges

- Performance 7d: Netural

- Performance YTD: Bullish

- Top Signal: No, supply continues to trend bullishly

40% drop in exchange supply of Bitcoin since 2020. 7.5% year-to-date, No notable change past week, despite selloff. Bitcoin price will experience a supply crunch in the coming year(s) if demand remains constant or grows.

Net Unrealized Profit and Loss (NUPL)

- Performance 7d: Neutral

- Performance YTD: Bullish

- Top Signal: No, but ~20% away from historical top signal

No major change in the past week. At ~.56 reflects persistent greed & unrealized profit, but room to run before historical peak between 0.7 and 0.8. NUPL is near the top of it’s historical range, typically mid bull market territory.

Miner Position Index (MPI).

- Performance 7d: Bullish

- Performance YTD: Bullish

- Top Signal: None at the moment

Miner selling has been trending down since March. Miners are not adding significantly to sell pressure on higher timeframes, with only occasional minor profit taking, once or twice a week.

Note: as a general trend, miner selling pressure is lowest on weekends.

Bitcoin Netflow (All Exchanges)

- Performance 7d: Weakly Bullish

- Performance YTD: Bullish

- Top Signal: No

Netflows remain elevated through much of April, setting higher lows and with the second largest selloff in April occurring last week. This is likely the result of less buying pressure, in light of recent macroeconomic news and new geopolitical uncertainty in the Middle East. Moderate bullish strength remains however, most days saw predominantly net outflows (mostly buyers).

Going into the next week and next month, we continue monitoring to look for netflows to return to lows observed thru March. We want to see a lower low, or this might be an indicator of rising bearish sentiment where inflows outpace demand.

Pi Cycle Indicator

- Performance 7d: Neutral

- Performance YTD: Bullish

- Top Signal: No

The Pi Cycle’s moving averages are trending bullishly, moving towards each other but not at risk of crossing yet. The 111 DMA isn’t forecast to cross above the 350 DMA x2 before Q4 2024.

Market Cap to its Realized Cap (MVRV)

- Performance 7d: Neutral

- Performance YTD: Bullish

- Top Signal: No, but within 30% of historical top signal

In recent weeks, MVRV continues it’s consolidation 20% to 30% below key rejection levels, suggesting room for the bull market to continue. What analysts may be questioning at this point, is whether this rally on MVRV is more similar to early stage bull market, or like the 2019 bull trap.

MODERATELY BEARISH PAST 7D: US Dollar Index (DXY).

The dollar demonstrated moderate strength over the past month on the back of several high profile news items:

The April jobs report was troubling for the US Fed, because it showed employers adding a significant number of workers to their payroll, more than expected. This was followed by the Consumer Price Index (CPI), a popular inflation metric, showing inflation stickier than expected.

If inflation remains stubborn, it will lead to high rates for longer, or a small chance they raise rates further. Both would be short term bearish for crypto.

Note: even if they go this route, the Fed is still near the end of a hiking cycle, and for several reasons, particularly the US deficit, they can’t continue this course without serious repercussions. This is why markets are long-term bullish, even if the near-term is dicey.

If this happens, expect Bitcoin to continue sideways with a moderate bearish bias, with retests of key supports starting around $61k (most bullish), $50s (moderately bullish), and as low as mid $40s (weakly bullish).

Market Sentiment

BULLISH & NO TOP SIGNAL: Coinbase App Ranking. Rank is up around 8% globally to 234 in the past week, and up 16% to rank 11 among finance apps. Its trending bullishly, but not high enough to suggest a cycle top.

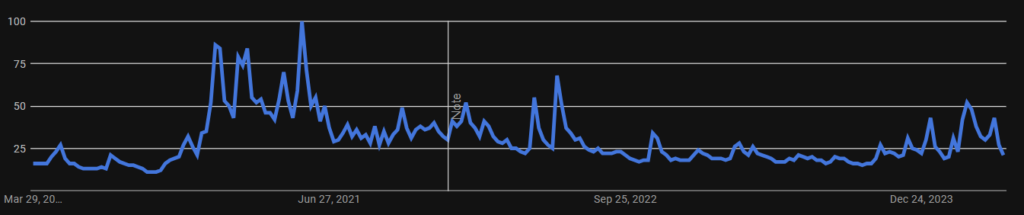

BULLISH: Google Trends. Bitcoin set a lower low, dipping into bear market range as interest continues to wane from March highs. April has done a lot to reset sentiment and interest in crypto.

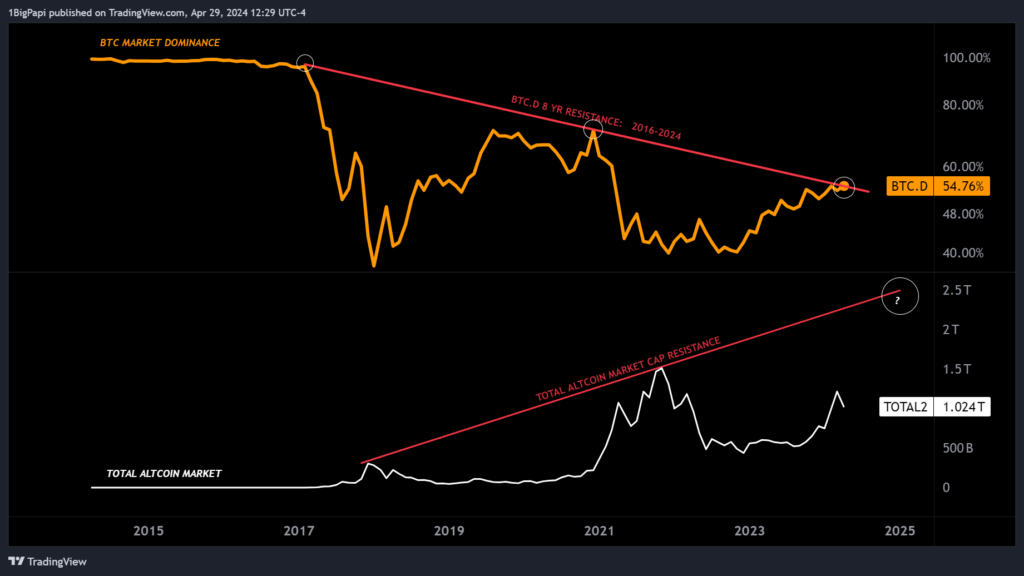

Bitcoin Dominance

In early April Bitcoin dominance rallied above the 8 year resistance, on the back of the Israel and Iran news! In the weeks since, it firmly retraced below the resistance.

Bitcoin Dominance continues to struggle with a decade old resistance for months. Falling Bitcoin Dominance typically precedes altcoin cycles, where the altcoin market outperforms Bitcoin.

Total alt market is rising. Historic trends suggest it topping out at 2 to 2.5 tril, a 2.5x from here.

Its likely that most of that continues to be Ethereum, which suggest a 2x to 2.5x from here, minimum, between $7,000 and $8,000 per ETH.

Note: all of this predicated on the assumption that Bitcoin Dominance falters here. That could change with US and soon Hong Kong ETFs online ro if the Japanese markets drag global markets down with it.

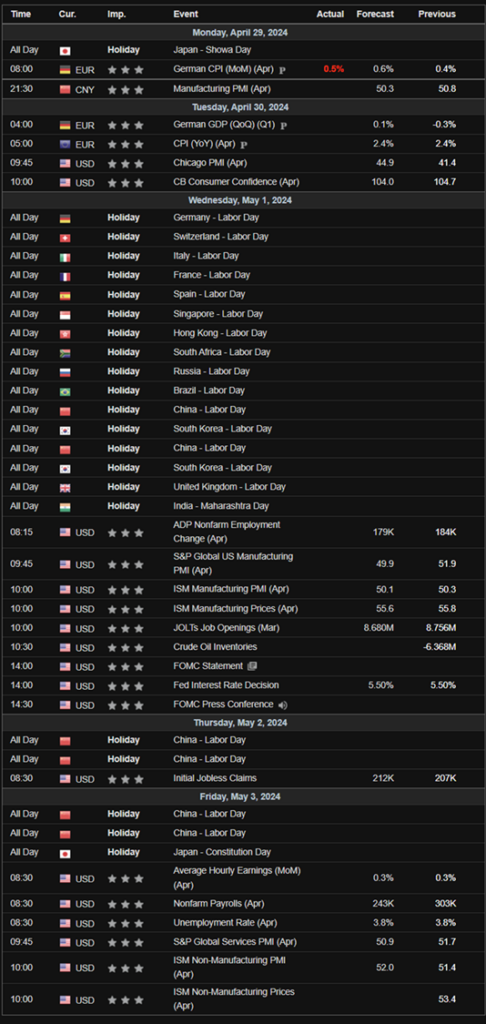

Crypto & Economic Calendar

The events below inform governments, corporations, traders and investors on the health of the economy. I only list events noted as “high volatility expected” in related markets.

Of particular importance this week:

- FOMC on Wednesday

- Holiday on Wednesday for much of EU and Asian markets

- Hong Kong (Chinese) Bitcoin ETF goes live April 30th

Disclaimer: Nothing found on this website, or any sources linked to this website includes financial advice of any sort. We are not certified financial advisors, use our content at your discretion as entertainment, and as an educational resource. Do your own research.

If you enjoyed this article and want more hot takes and interesting posts about the economy, web3, crypto, decentralized finance, NFTS and more – follow Papi on Twitter/X at https://twitter.com/thectpapi

Glossary of Terms

Below is an explanation of each indicator and data point I discuss above.

Bitcoin Dominance:

Bitcoin dominance is another way of saying “Bitcoin market share,” or how much of the total crypto market is Bitcoin. While not the clearest indicator, on lower timeframes, you can use this information to speculate when altcoins may rally. This is also described as an “alt season.”

Altcoin rallies often follow a local or major top on Bitcoin dominance and can last for several weeks or longer, while Bitcoin consolidates for the next move. The recent memecoin cycle is a form of altcoin cycle.

Bitcoin Supply:

Supply trends are simple- rising supply on exchanges implies bearish pressure, because it’s there to be sold, and the opposite true when supply drops.

More Bitcoin is being bought and HODL’d than is being mined, and this has been the prevailing trend since 2020. As we know with commodities, scarcity boosts perceived value. With a 40% drain on total supply since 2020, we are trending towards scarcity faster than ever.

While general supply trends can signal sentiment, did you know you can also account for localization? For example, in the last cycle, as we approached the top, Asian and international exchanges logged notable increases in supply, while America was net decline. Effectively this meant Asians left many Americans holding bags near the top.

Net Unrealized Profit and Loss (NUPL):

NUPL indicates the total amount of profit/loss in all Bitcoins, represented as a ratio. You can see why that makes for a handy data point, because as more of the market is in-profit, the risk of a retracement rises.

NUPL indicates a potential minor or major top when it rises over 0.75. Another way to think of this is as a greed tracker. The higher the NUPL, the greedier the market is, and eventually greed will turn to fear, as profit-taking cascades towards the end of a cycle or subcycle.

Miner Position Index:

Miners are among the smartest traders in crypto. For obvious reasons they need to optimize their selling to fund operations. Miners sell to fund operations, but will HODL supply when conditions permit, and sell heavily in the early to middle bull market.

MPI is the ratio of miner selling against the yearly average. If its rising strongly above the average, it suggests miners are worried about a top approaching expedite their selling. They do not try to land the top of the market, so they often sell in advance, which is helpful to traders trying to also time their exits.

Bitcoin Netflow:

Another fun data point is netflow. This shows the net result of a day’s inflows (moving Bitcoin to an exchange) and outflows (moving Bitcoin off an exchange).

The implication is that Bitcoin moved off exchanges is unlikely to sell. And as we approach tops, the netflows skew towards increasingly heavier inflows (moving to exchanges to sell).

Pi Cycle:

The Pi Cycle indicator is something many traders joke about, but there is no doubting it’s effectiveness.

It uses the crossing of two key moving averages (MA) to predict cycle tops: 111 DMA and 350DMA x2. It accurately called earlier cycle tops within a few days. The top signal is when the 111 DMA crosses above the 350 DMA x2.

Whether you believe these two MAs can predict cycle tops, its worth keeping an eye on it. As you can see, we still have time before the MAs converge.

Market Cap to its Realized Cap (MVRV)

MVRV is used to understand when the exchange traded price is below “fair value” by looking at the ratio between market cap and realized cap (approximates the value paid for all coins in existence).

This gives an idea of whether the market is fairly priced and can be used to identify potential tops and bottoms in the market. As with any indicator, don’t use it in isolation; look for confluence with other data.

A new component this cycle is the orange line, the top of the MVRV range, which reflects an increasingly smaller ratio over time. For the first time this cycle, the longer term diagonal resistance is lower than the generally acccepted upper range of 3.7 for cycle tops, so traders should monitor both.

US Dollar Index (DXY):

The US Dollar Index (DXY) is an index that measures the strength of the US Dollar. There is an inverse relationship between the DXY and speculative markets like crypto and equities. In general, when the DXY is up, crypto is down. The opposite is also true.

Of particular importance, the ~101 level, arguably the most significant for the DXY. Almost every time in the past 50 years, when DXY rejected from, or closed under the 101 range, it led to a prolonged period of weakening dollar.

If the fed drops rates in 2024, thats a strong signal that the DXY will continue to drop, and rates will inevitably decrease, its just a question of timing and whether they will start in 2024 or 2025. For rate decreases to occur in a year along with the Bitcoin halving would be particularly bullish.

Market Sentiment:

Economic events, political discourse, or general price action are all events that can impact sentiment. The market remains predominantly bullish since October 2023.

Sometimes market sentiment needs to cool off, otherwise bull markets can burn out too early. The market moves in waves of fear and greed, and too much of either can lead to pronounced moves in the opposite direction, which can further cascade due to leverage in the market.

Going into the election cycle, we can expect some volatility to accompany the crypto narrative, with players like Senator Warren building an anti-crypto coalition. It remains to be seen if this will have a bigger impact on sentiment than the increasingly accomodating macro.